Shares of Qualcomm (NASDAQ:QCOM) Inc., the San Diego, California-based chip-maker, have been on a tear since late-April, when the price touched $51.06. A little over a month later, the stock closed the last trading session at $58.58, representing a recovery of 14.7%. Many might see this rally as an invitation to grab shares in one of the largest semiconductors and telecommunications companies in the world.

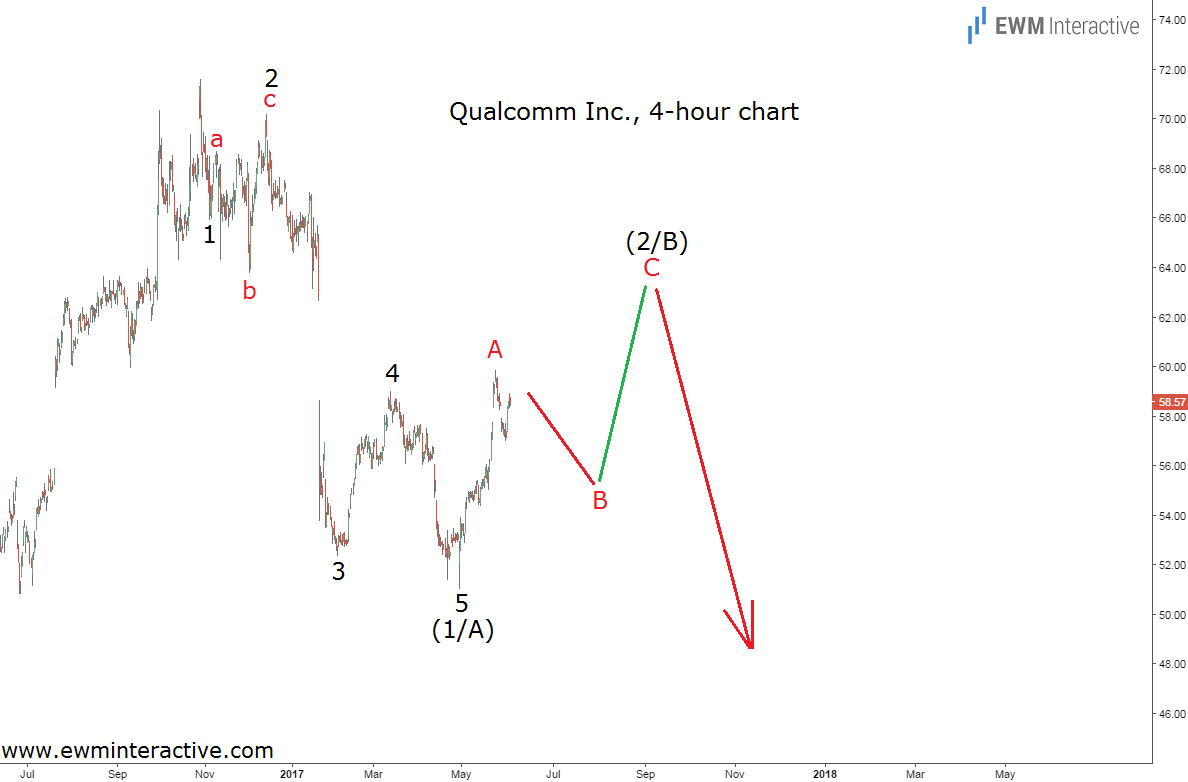

Elliott Wave analysts, on the other hand, need to examine the price action prior to the current jump and see how it fits into the bigger picture. The 4-hour chart of Qualcomm below will help us with this task.

The chart visualizes not only the current strength, but also the preceding decline between $71.61 and $51.06. It allows us to take a look at its structure and recognize a clear five-wave impulse. The rule of alternation has been taken into account, since wave 2 is a sideways correction in the form of an expanding flat, while wave 4 is very sharp. Every impulse is followed by a three-wave retracement in the other direction. The current recovery should be part of this retracement. If this is the correct count, we should expect waves B and C of (2/B) to develop.

Once the correction is over, the Elliott Wave Principle suggests the trend should resume in the direction of the impulsive sequence. The market does not like gaps, so I suspect wave (2/B) to exceed the $60 mark, in order to close the gap left by wave 3 of (1/A). Once it is closed, the bears should be expected to drag Qualcomm stock to a new multi-month low beneath $51 a share in wave (3/C) to the south. Even if the bulls breach $60, the negative outlook would remain valid as long as the starting point of wave (1/A) at $71.61 is intact.