Lululemon (NASDAQ:LULU) has had a successful day today on the stock market, closing up roughly 2%, after the athleisure company reported first quarter earnings yesterday after the closing bell. Lululemon was able to beat estimates of 71 cents a share by 3 cents a share, an earnings surprise of 4.23%. Revenues also surpassed our consensus estimate, and the company raised its full-year guidance as a result.

Lululemon has been on a tear lately, hitting a 52-week high today in the aftermath of their strong earnings report. In addition to a successful quarter, the company announced in a conference call with analysts it was planning on opening a new, 20,000-square-foot store in Chicago this July. Lululemon’s new outpost is said to have multiple yoga studios, areas for meditation, and a juice bar.

Lululemon has been making a lot of noise with their recent success. The company has been paving the way for other stocks to emerge from the recently troubled retail sector. Here are some other apparel stocks that can make solid additions to a portfolio.

Under Armour

Under Armour (NYSE:UAA) has also been making strides in the right direction this year. The company’s stock has surged 49% since January, which has been its best annual performance in five years. Analyst Michael Bapis of BK Asset Management believes the athleisure industry as a whole has tremendous growth potential. The versatility of athleisure products gives companies like Under Armour the opportunity to reshape the fashion industry landscape. Under Armour is a Zacks Rank #2 (Buy) with an expected earnings surprise prediction of 12.09%. Furthermore, the company also has an expected long-term growth rate of 24.45%. These high expectations of the company are accompanied by its strong performance over the past month relative to the apparel market.

Crocs

Crocs (NASDAQ:CROX) is one company that has been able to provide a sense of security for its shareholders during times of uncertainty with the trade war. Crocs stated that the company didn’t anticipate adverse impacts on its business from potential tariffs because of their globally diversified sourcing base. This relief assures current investors while attracting potential investors who are looking for secure stocks during times of volatility. Crocs is a Zacks Rank #1 (Strong Buy) with an estimated long-term growth rate of 15%. The company also has a beta of 0.96, demonstrating the stock’s ability to stay solid when the market isn’t. Crocs projected sales growth for the current fiscal year is 6.85%, which is higher than the industry average of 1.97%.

Columbia

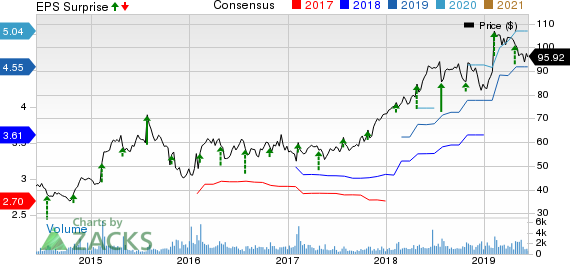

Columbia Sportswear Company (NASDAQ:COLM) is another athleisure company that can capitalize on the prediction analyst Michael Bapis stated. The company is a global leader in design, sourcing, marketing, and distributing active outdoor apparel and footwear. Columbia is currently a Zacks Rank #2 (Buy), and is another stock that can provide a portfolio with stability in the face of volatile market trends with a Beta of 0.69. Apart from the stock’s low risk nature, the company also has a projected EPS growth of 13.43% as well as a projected sales growth of 8.55% for the current fiscal year. Both of these company metrics are well above the industry’s average. Notably, Columbia’s EPS surprise has been positive the past five years, making the stock a strong addition to consider given its recent successes.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

lululemon athletica inc. (LULU): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

Columbia Sportswear Company (COLM): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

Original post

Zacks Investment Research