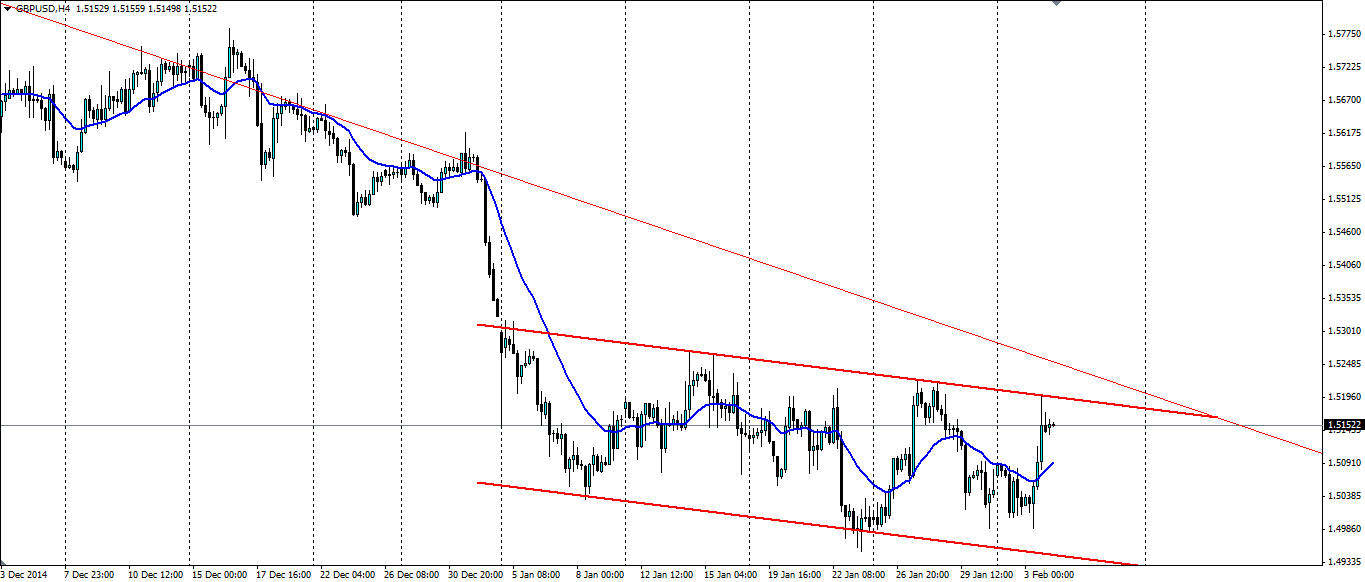

The British pound has been in somewhat of a bearish channel over the course of 2015. Another test of the top has held and the logical result is a rejection towards the recent lows.

There has been plenty of debate on the course of action the Bank of England will take over the coming months. Disappointing inflation figures and a move to a more neutral stance has pushed the pound lower. Some dollar weakness has ensured that it hasn’t been all one way traffic and hence we are stuck in a channel that is 240 pips wide.

The Bank of England had been eyeing up an interest rate increase sometime this year, however, inflation falling to just 0.5% y/y all but rules that out. The pound felt the full effect as the two members of the MPC calling for a rate rise moved back to neutral. BoE Governor Mark Carney said the ECB cannot eliminate stagnation on its own. This suggests the Bank may be looking at possible ways to stimulate the market to avoid falling into the same deflationary trap the EU is staring at.

News to watch out for this week is the Services PMI, which represents over 85% of the UK economy, with the market expecting a slight rise. Later in the week the BoE will meet to set interest rates. It is very unlikely we will see a rate change, however, any dovish talk will likely send the pound to the lower end of the channel. Finally on Friday we have the US Non-farm Payroll figures. This is the biggest event in the calendar so watch out for the volatility.

The last two times the upper level of the channel was tested, we saw the formation of strong double tops indicating a rejection was coming. If we see that pattern play out once again, this will be a strong signal to the market and the bears will take full advantage.

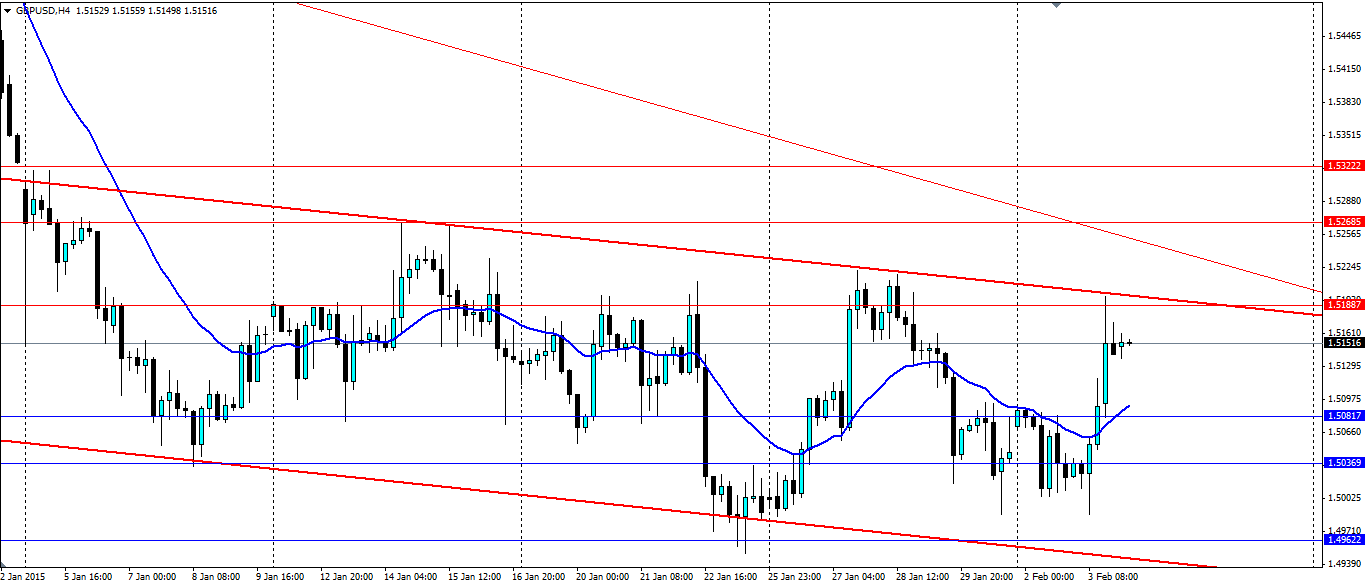

If we see a continuation of US Dollar weakness, this could lead to a bullish breakout of the channel. In this case look for resistance to be found at 1.5188, 1.5268 and 1.5322 with the bearish trend line coming back into play. If we see the channel hold and a movement back towards the recent lows, look for support to be found at 1.5081, 1.5037 and 1.4962.