- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pound May Pull Back As US Dollar Bounces On UK, US Inflation Data

Talking Points:

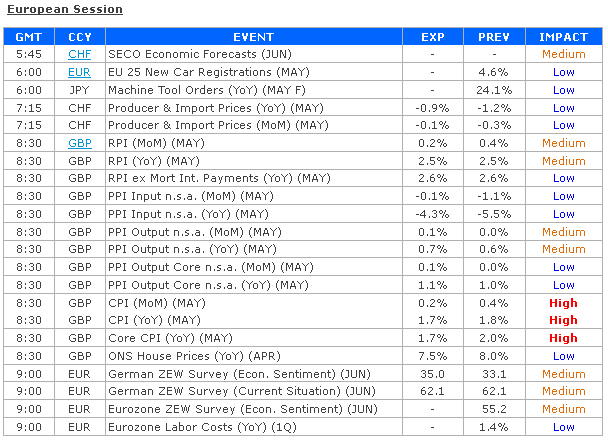

- British Pound May Give Back Some Recent Gains if CPI Data Disappoints

- Upbeat US Inflation Data May Help US Dollar Correct Higher Pre-FOMC

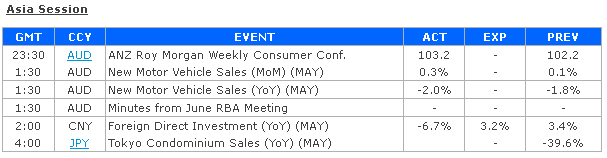

- Aussie Dollar Fell as Minutes from June RBA Meeting Struck Dovish Tone

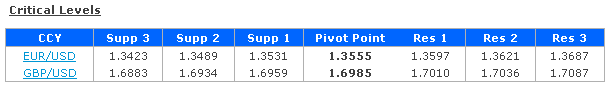

UK inflation data headlines the economic calendar in European hours. The headline year-on-year CPI growth rate is expected to tick lower to 1.7 percent in May. A print in line with expectations would fall in line with the three-month trend average, offering relatively little in terms of market-moving potential for the British Pound. However, it is noteworthy to mention that such UK price-growth data has tended to undershoot expectations over the past few months. If this trend continues, a soft result may encourage investors to dial back BOE tightening bets and send Sterling lower. Indeed, tentative signs of topping have emerged in GBPUSD.

Later in the day, the spotlight will turn to US CPI figures. Unlike the UK, inflation data from the North American giant has steadily improved relative to consensus forecasts since the beginning of the year. That hints analysts are underestimating cost pressures, opening the door for an upside surprise. Such an outcome help trigger a bounce in the US Dollar as markets move to a more neutral setting following last week’s selloff in the run-up to the upcoming FOMC policy meeting.

The Australian Dollar underperformed in overnight trade, sliding as much as 0.4 percent on average against its leading counterparts. The selloff was triggered by the release of minutes from June’s RBA policy meeting. As we suspected, the central bank sounded decidedly dovish in its rhetoric, saying accommodative policy is likely to remain appropriate for some time as economic growth registers below trend and inflation holds on-target.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.