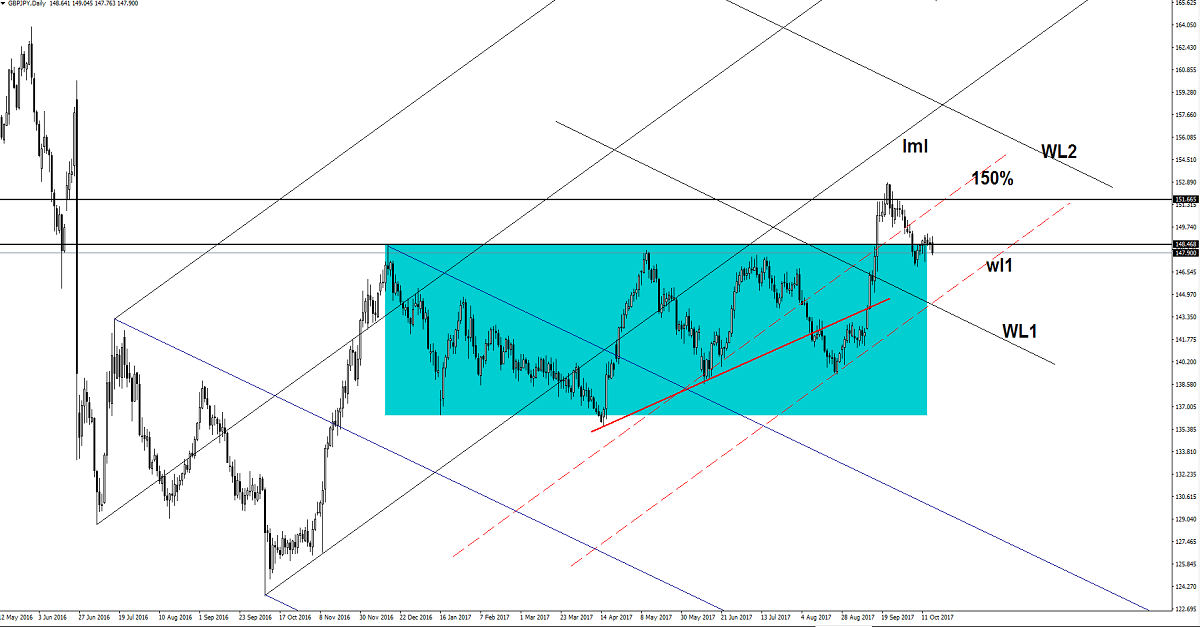

GBP/JPY Turned To The Downside

The currency pair dropped aggressively in the yesterday’s trading session and seems to heavy to be stopped at this moment. GBP/JPY is trading in the red even if the Nikkei stock index has managed to reach new highs. The JP225 increased as much as 21392 level, but failed to stay there and has retreated a little. The Nikkei maintains a bullish perspective on the daily chart, a further increase should force the Yen to drop, but the Japanese currency is not impressed by the index’s rally.

The Cable needs serious support from the UK’s data to be able to drag the rate higher again. The United Kingdom Unemployment Rate could remain steady at 4.3% in August, while the Claimant Count Change could be reported at 1.3K, versus the -2.8K in the former reading period. Moreover, the Average Earnings Index could increase by 2.1% again.

Price dropped and failed to stay above the 148.46 broken horizontal resistance, signaling that a further drop is favored. A retest of the mentioned upside obstacle will confirm a drop towards the first warning line (wl1) of the ascending pitchfork, where he may find support again. Technically, it should drop after the failure to stabilize above the 151.66 and after the failure to approach and reach the lower median line (lml) of the ascending pitchfork.

USD/CAD Losing Momentum

The USD/CAD rallied and climbed much above the 1.2557 Monday’s high, but failed to stay there. Price retreated as the USDX has slipped lower after the impressive rally. However, the perspective is bullish on the short term after the retest of the upper median line (uml) of the minor descending pitchfork and after the failure to close on the median line (ml) of the blue ascending pitchfork.

The next upside target will be at the ML of the major red descending pitchfork and at the 1.2678 static resistance.

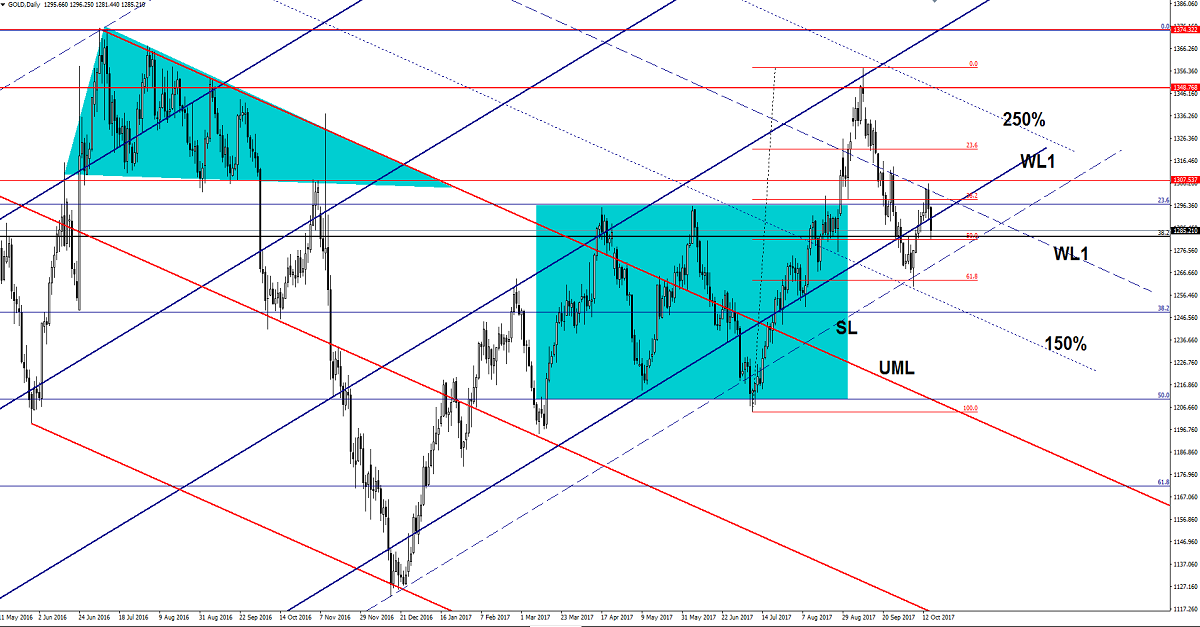

Gold Under Massive Pressure

The Gold plunged on Tuesday and touched the $1281.44 per ounce as the USDX has rallied. The bearish momentum was paused by the long term 38.2% retracement level and the 50% level. A retest of the WL1 will signal a drop at least till will reach the SL of the ascending pitchfork.

Risk Disclaimer: Trading, in general, is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this website.