Currencies

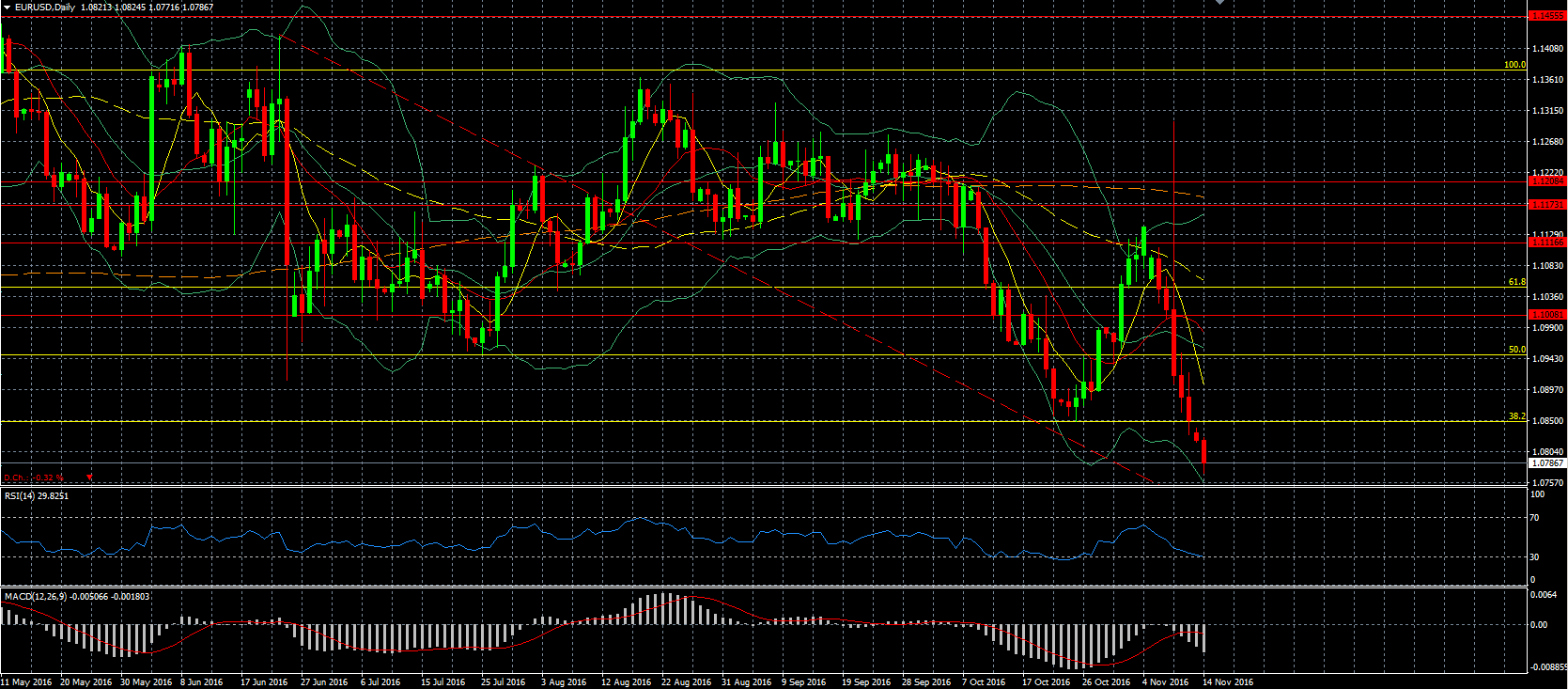

EUR/USD – is trading at the lowest level this year and since December 2015 and is on the longest losing streak since February. This week is packed with important data from the Eurozone as well as the US.

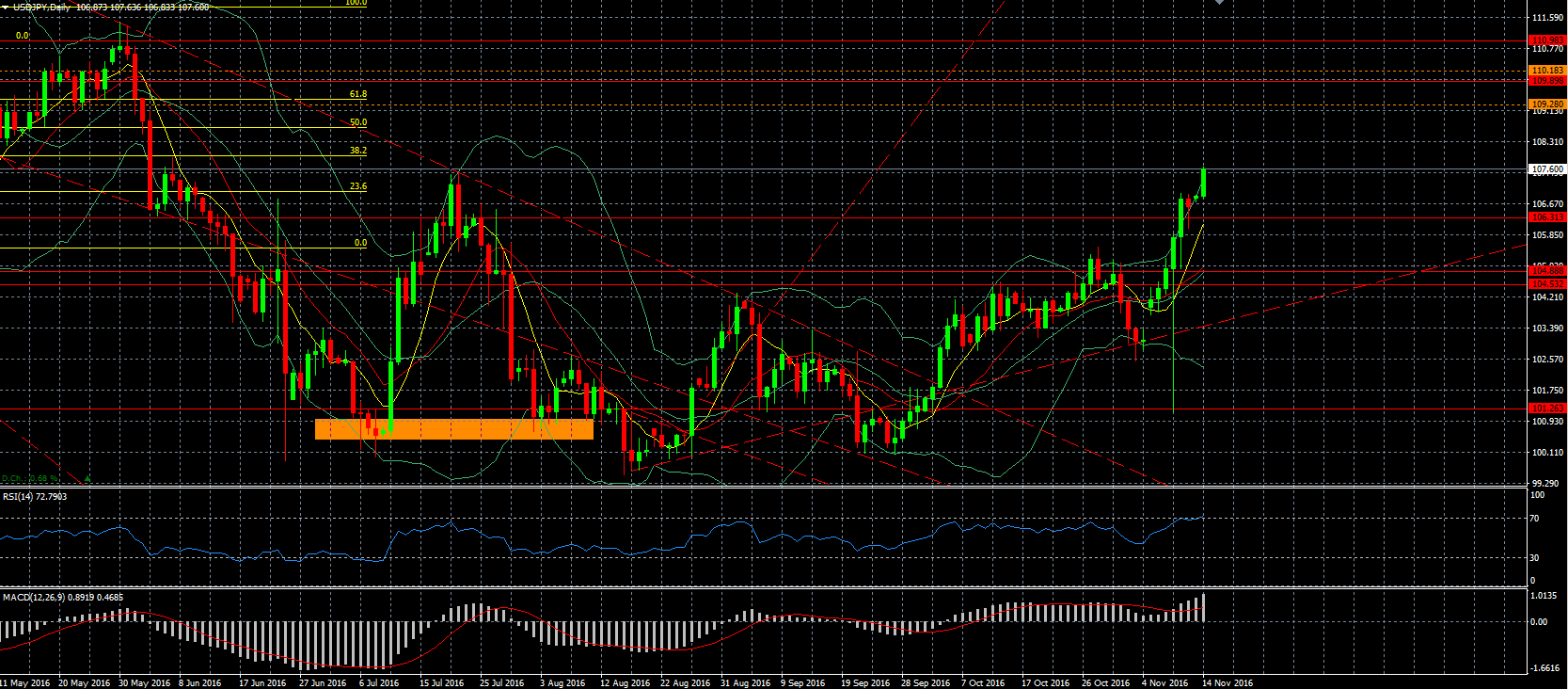

USD/JPY – the much better than expected GDP data was unable to cause a reversal and we are trading at the highest level since June. With the strong GDP data it becomes less likely that the BOJ will actually increase its stimulus measures, which should strengthen the JPY, but at the moment it looks like there is nothing stopping the USD.

GBP/USD – is trading more or less flat as this week will have some important data out of the UK except for today and Friday.

Indices

DJ 30 – is extending its gains further and reached a new record high.

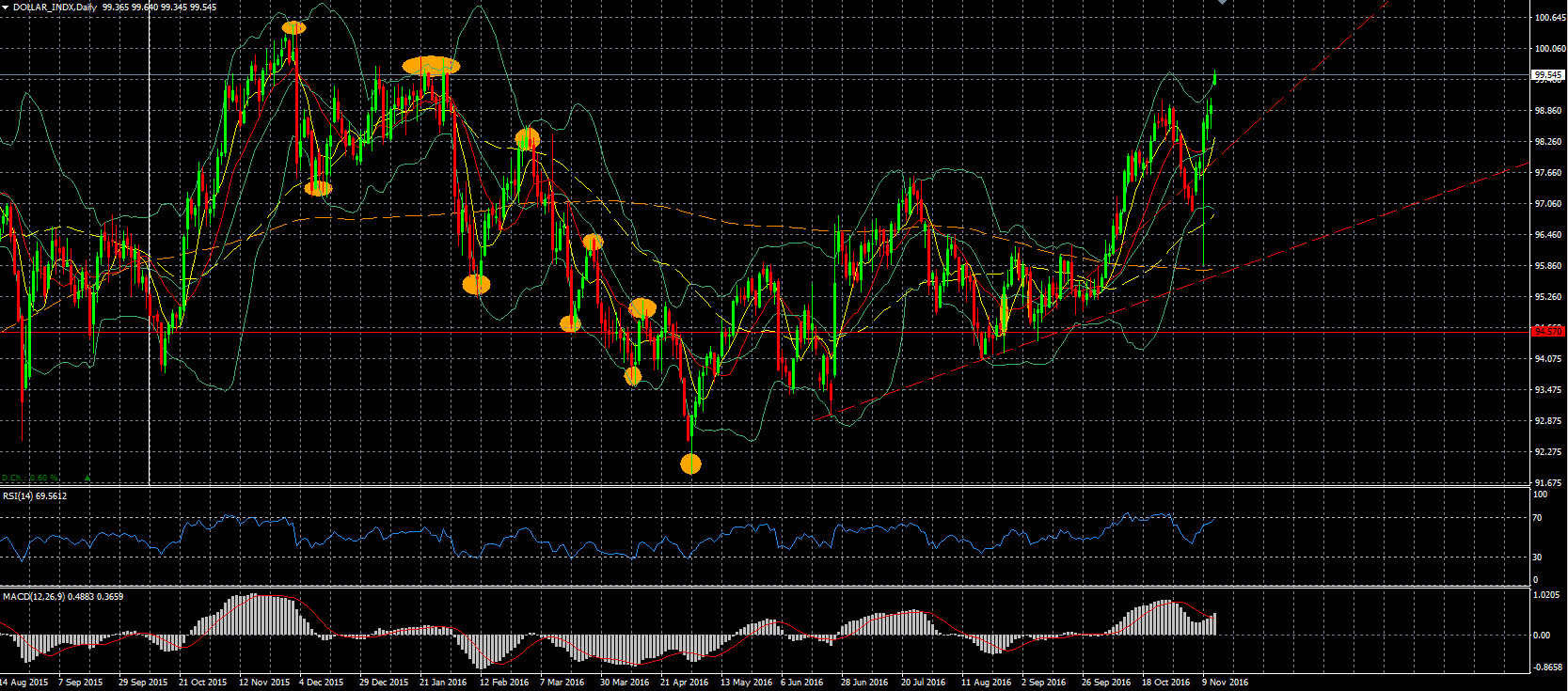

Dollar Index – is trading at the highest level since January, although it is now approaching some resistance. If we cross above the levels reached in March 2015, we are trading at the highest level in over 13 years! While the FED is expected to increase the interest rate, they might be a bit more hesitant to do so if the USD keeps on strengthening this much, although if they won’t they will have a serious credibility issue.

S&P 500 – closed right on the resistance level and is trying once again to break through this level this morning.

Commodities

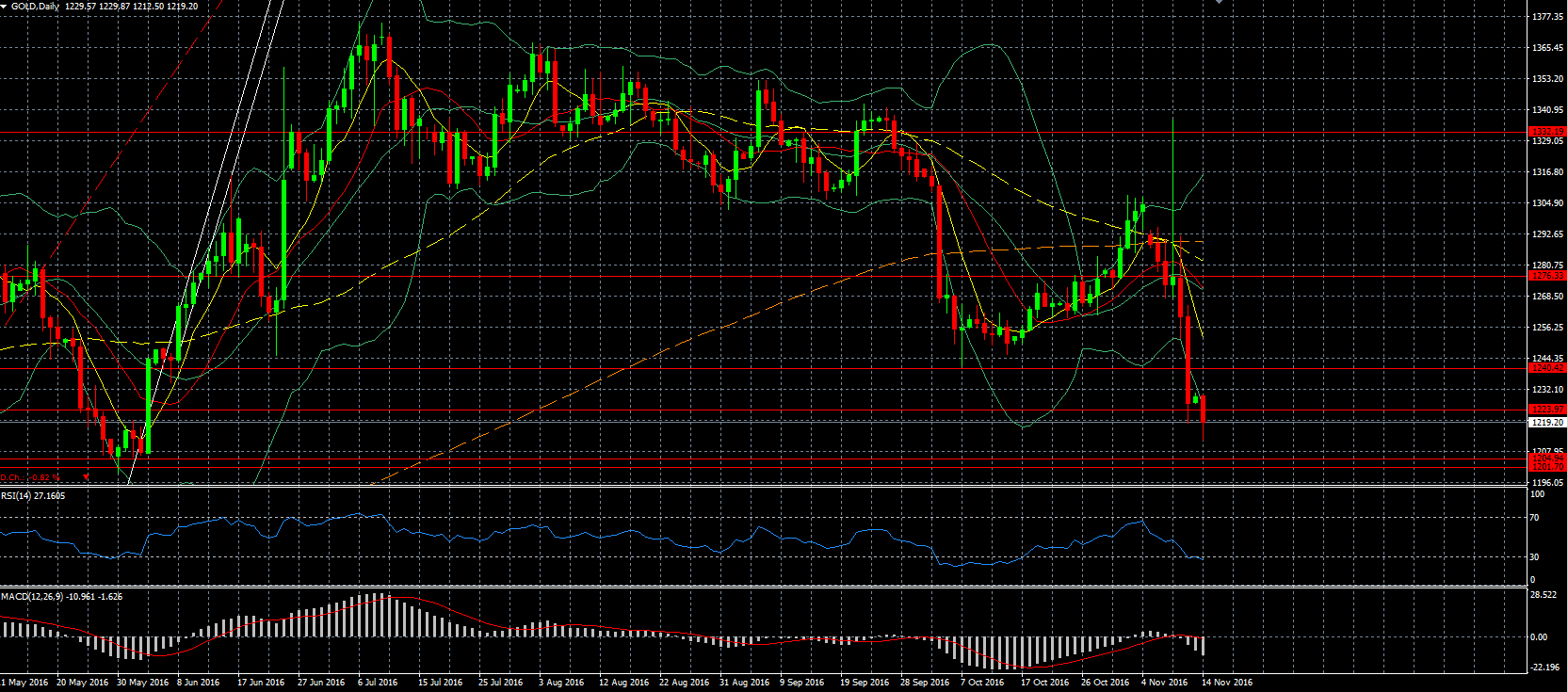

Gold – hasn’t traded this low since the start of June and is also getting closer now to the support around the 1200 level. The USD is trading at the highest level since the start of the year so from that point of view there is more downside for gold, especially since there are no major risk events on the calendar. The main outstanding event this year is the FED interest rate decision next month at which it is expected that they will raise the interest, further boosting the USD.

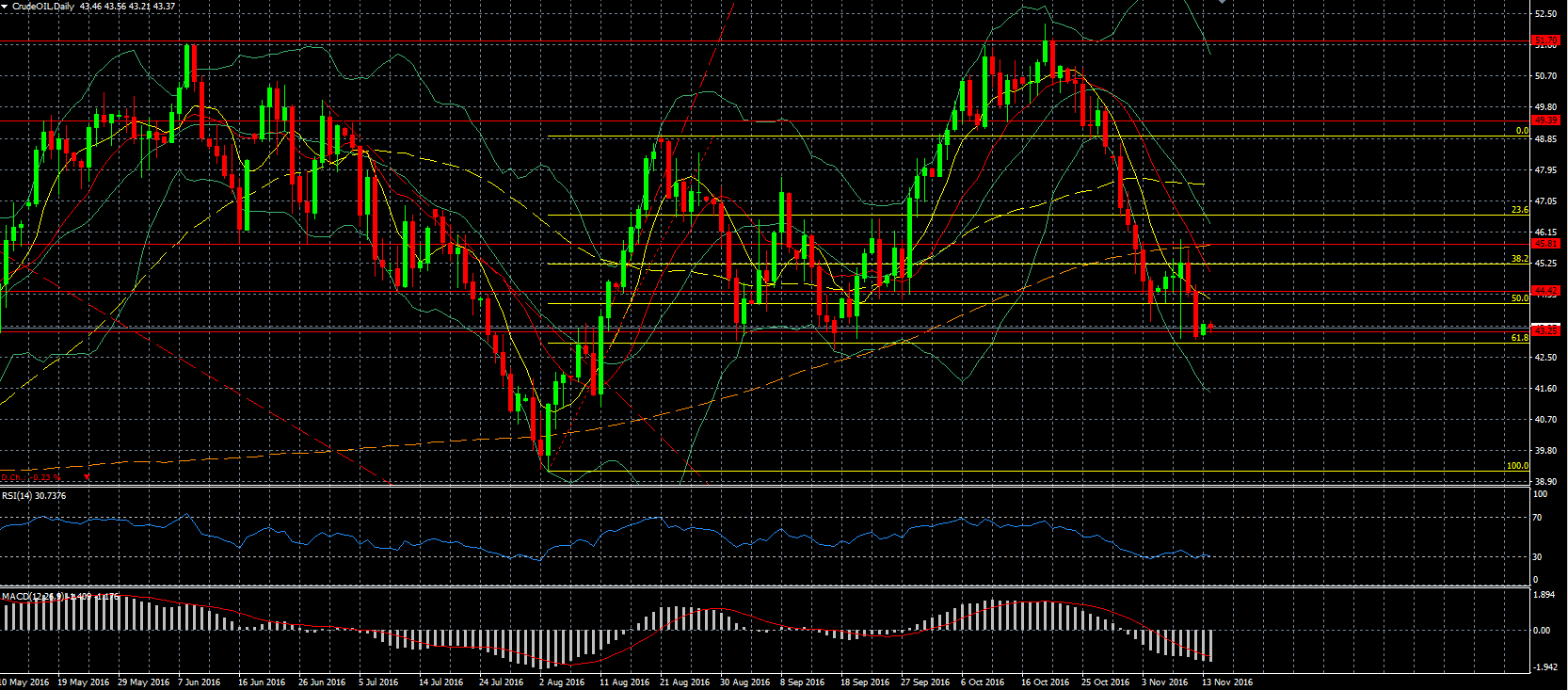

Oil – moved further down to the lowest level since September as also the OPEC report reaffirmed that without a serious production cut, there will also be an oversupply in 2017. This comes as demand is expected to increase less than expected. In addition, OPEC production went up and reached a new record. We can see that around this level is some support, and if we drop below this, we can find the next support around the 40 level. In addition, back in the US, the number of active rigs continued to climb, signaling that we can production in the US to increase further as well.