NZD/USD rallied yesterday to 0.7089 high following positive Global Dairy Trade (GDT) with 1.7% compared to -6.3% on previous session. Kiwi boosters found comfort with collapsing U.S Index yesterday with 99.44 low. Today, the pair has managed to recover few pips from session low and is currently trading around 0.7032 handle. A fresh wave of global risk aversion, coupled with a modest US dollar recovery from multi-week lows, has been key factors weighing on the major on Wednesday.

Eyes now are focused on RBNZ interest rate decision with high forecasts that rates are to be left at the current 1.75%. However, since rates are a done deal, the market will be looking for any hawkish signals they can find from Gov Wheeler. This central bank is notorious for talking their currency down and Gov Wheeler may take this opportunity to drive the currency lower. However, if he sounds more upbeat or offers any hawkish hints, there may be an opportunity to buy the kiwi.

Fundamentals:

1- NZD Interest Rate Decision today at 8:00 PM GMT.

2- NZD RBNZ Wheeler speech today at 8:00 PM GMT.

3- USD Unemployment Claims tomorrow at 12:30 PM GMT.

4- USD speech tomorrow at 12:45 PM GMT.

Technical:

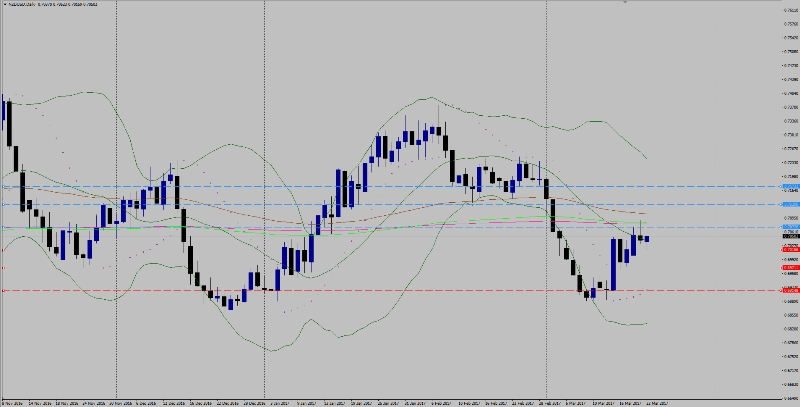

Trend: Bearish Sideways

Resistance levels: R1 0.7072, R2 0.7129, R3 0.7132

Support levels: S1 0.7016, S2 0.6971 , S3 0.6914

Remark: Look forward for kiwi local data today. U.S data tomorrow not to be missed especially Yellen speech which will determine U.S index levels for the coming days.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.