For the 24 hours to 23:00 GMT, the GBP fell 0.37% against the USD and closed at 1.6768, after the BoE Governor, Mark Carney played down speculations for an earlier-than-expected interest rate hike in the UK economy by indicating that the central bank would only raise its benchmark interest rate if the economy expands and fully utilises its additional wasteful spare capacity. Meanwhile, the British Pound further came under pressure after the BoE, in its quarterly inflation report, lowered its expectations for unemployment in the nation but at the same time maintained its growth forecast for the UK economy in 2014. Negative sentiment for the British Pound was also fuelled after the Office for National Statistics reported that jobless claims in the economy fell by only 25,100 in April, versus market estimate of 30,000 and that average wages excluding bonus also registered a less-than-expected rise of 1.3% in the first quarter of 2014. However, the ILO unemployment rate in the UK fell to a five-year low level of 6.8% in the three months to March.

In the Asian session, at GMT0300, the pair is trading at 1.6773, with the GBP trading slightly higher from yesterday’s close.

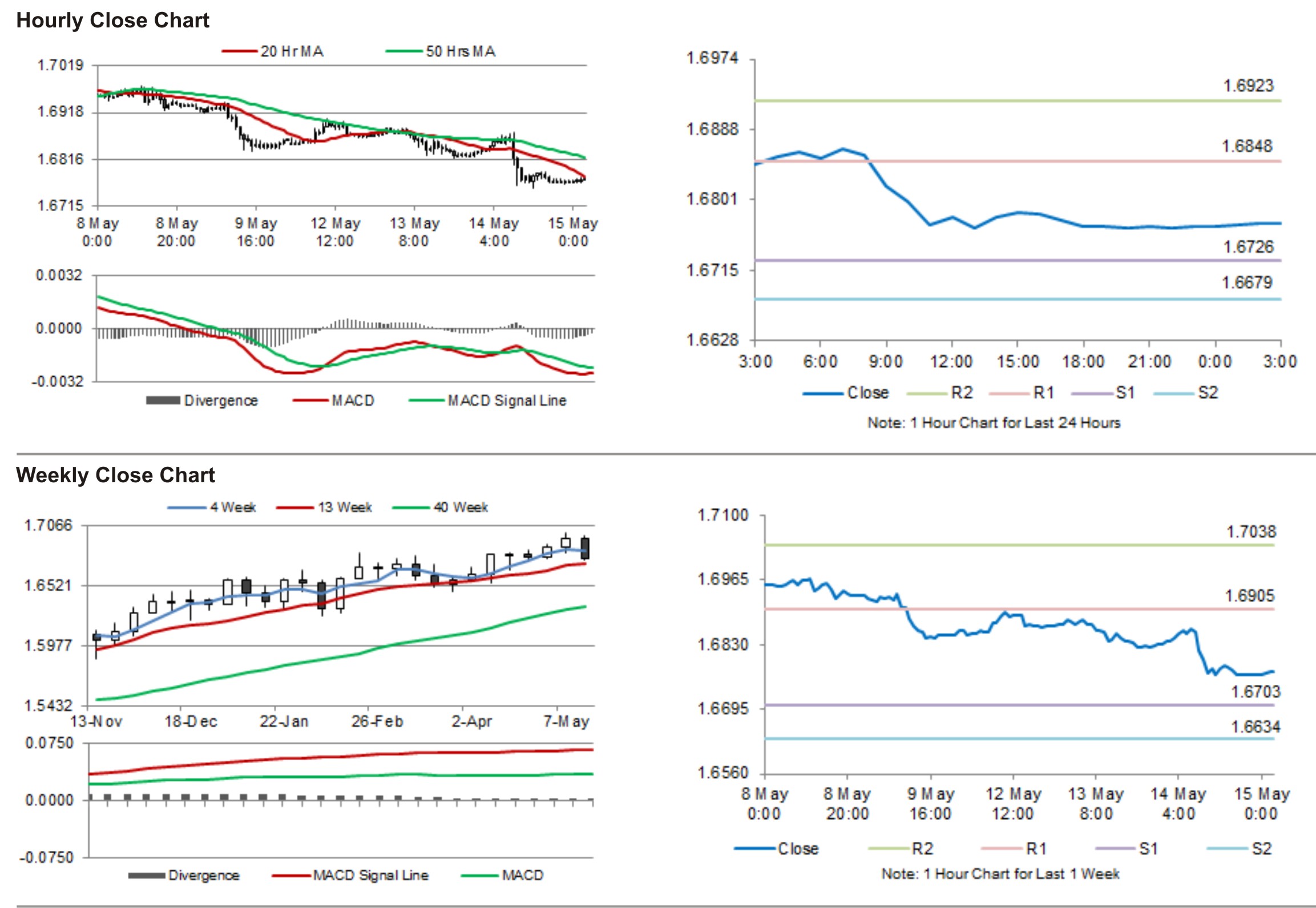

The pair is expected to find support at 1.6726, and a fall through could take it to the next support level of 1.6679. The pair is expected to find its first resistance at 1.6848, and a rise through could take it to the next resistance level of 1.6923.

Later today, the Conference Board is expected to publish a report on its leading economic index for the UK economy.