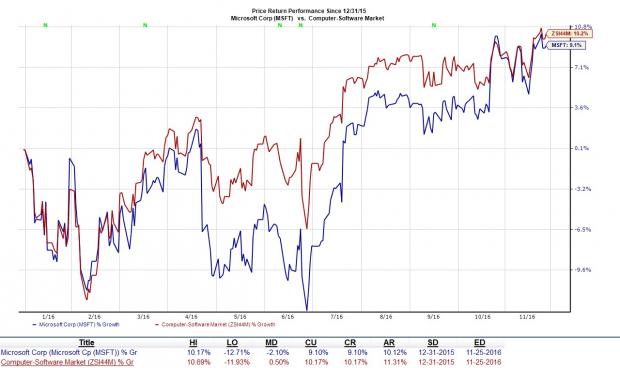

Shares of Microsoft Corporation (NASDAQ:MSFT) have been steadily trending higher over the last one year. The stock generated a return of 9.10% as compared with the Zacks Computer-Software Industry’s year-to-date return of 10.17%.

The upward momentum in the stock has been primarily driven by strong cloud growth. The continuing enterprise strength, benefits from the Office 365 subscription model, strong growth prospects of Azure and promising new products are expected to generate top-line growth in 2016.

Per a report published in the South China Morning Post, Microsoft is expanding in China by strengthening its bonds with Chinese businesses in the region.

The Current State of Affairs

Microsoft’s cloud platform Azure currently enjoys nearly 17% share of the cloud computing market in China, second only to Alibaba Group Holding Limited’s (NYSE:BABA) Alibaba Cloud. However, Microsoft believes that it can scale up its market share by making some strategic partnerships in the region.

We note that Microsoft introduced its business of cloud computing in China nearly two years ago. However, the company is gradually recognizing the importance of partnerships that cloud play a pivotal role in expanding its cloud business presence in the country.

Currently, Windows and Office remain Microsoft’s main revenue growth drivers. However, amid declining PC sales worldwide, the revenue stream could get adversely affected. The need of the hour is to diversify into other emerging sectors and Microsoft is doing just that.

Cloud Scope

As per an IDC report, worldwide public cloud services spending is estimated to reach a whopping $195 billion by 2020 growing at a CAGR of 20.4%. Given the huge growth prospects the segment offers, it’s no surprise that Microsoft is trying its level best to expand in the aforementioned field.

Zacks Rank & Key Picks

At present, Microsoft has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space include Konami Holdings Corp. (OTC:KNMCY) and Rosetta Stone Inc. (NYSE:RST) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Notably, the consensus estimate for Konami Holdings’ current year improved to $1.59 from $1.39 over the last 30 days.

The consensus estimate for Rosetta’s current year narrowed down to a loss of $1.62 from a loss of $1.94 over the last 30 days.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks' private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks' private trades >>

MICROSOFT CORP (MSFT): Free Stock Analysis Report

ROSETTA STONE (RST): Free Stock Analysis Report

KONAMI CORP-ADR (KNMCY): Free Stock Analysis Report

ALIBABA GROUP (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research