U.S retail sales data for the month of May and April clearly shows a surge in consumer spending, eliminating concerns expressed by some economists that the economy is likely to lose momentum in the second quarter of 2019. Notably, at the end of this month, the U.S. economy is expected to record its largest expansion in history.

Increase in May retail sales was broad-based, reflecting solid gains in almost all categories. At this stage, it will be prudent to invest in consumer discretionary stocks with a favorable Zacks Rank and strong growth potential.

Healthy Retail Sales Data

On Jun 14, the Department of Commerce reported that retail sales increased 0.5% in May. Although the metric lagged the consensus estimate of an increase of 0.7%, it still indicates a fare number. Moreover, retail sales in April were revised to a gain of 0.3% from a loss of 0.2%, marking an improvement of 0.5%. Retail sales remained positive for the third straight month.

Sales at auto dealerships accelerated 0.7% in May after declining 0.5% in April. Receipts at service stations climbed 0.3%. Building materials and garden equipment sales inched up 0.1%. Online and mail-order purchases surged 1.4%. Sales at bars and restaurants grew 0.7% in May.

Consumer Spending Expected to Remain Robust

In May, core retail sales (excluding auto sales) jumped 0.5%. For April, core retail sales were revised upward by 0.4% from the previously unchanged figure. Since auto sales constitute around 20% of total retail sales and sales of the auto industry remain vulnerable, core retail sales primarily correspond to the consumer spending part of U.S. GDP.

Robust increase in core retail sales in the first two months of second-quarter 2019 indicates that consumer spending also remained robust. Notably, consumer spending constitutes two-third of U.S. GDP. Consequently, momentum of the U.S. economy is expected to remain firm in the second quarter, sidetracking concerns raised by some economists for a slowdown.

U.S. GDP Likely to Hold Momentum

Several economists have estimated that real consumer spending is up more than 4% annually so far in the second quarter. This is a much higher rate than an increase of 1.3% in the first quarter of 2019. Notably, U.S. GDP growth was 3.1% in the first quarter.

Several economists have raised eyebrows about the health of the U.S. economy buoyed by some tepid economic data released in the past one month. Non-farm payroll increased just 75,000 in May. Wage rate retreated to 0.2% compared with the consensus estimate of 0.3%. Inflation --- both core personal consumption expenditure (PCE) index and consumer price index (CPI) --- remained subdued at 1.6% and 0.1%. The Fed’s target rate was 2%.

However, consumer confidence index skyrocketed in May to 134.1, its highest level since November 2018. More importantly, the Expectations Index, which is a measure of the consumers’ short-term (for next six months) outlook for income, business and labor market conditions, surged to 106.6 from 102.7 in April. Strong consumer confidence data indicates that consumer spending is likely to witness robust growth in the coming months thereby boosting the second quarter GDP.

Our Top Picks

We have narrowed down our search to five consumer discretionary stocks with strong growth potential. Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

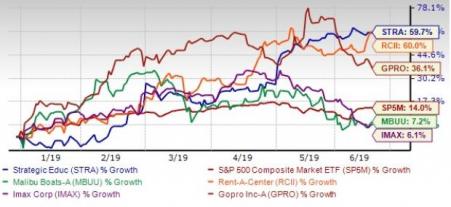

The chart below shows price performance of our five picks year to date.

Strategic Education Inc. (NASDAQ:STRA) provides a range of post-secondary education and non-degree programs in the United States. The company has expected earnings growth of 36.2% for the current year. The Zacks Consensus Estimate for the current year has improved by 6.8% over the last 60 days.

Malibu Boats Inc. (NASDAQ:MBUU) operates as a designer, manufacturer and marketer of sport boats primarily in the United States. The company has expected earnings growth of 40% for the current year. The Zacks Consensus Estimate for the current year has improved by 4.3% over the last 60 days.

Rent-A-Center Inc. (NASDAQ:RCII) leases household durable goods to customers on a rent-to-own basis. The company operates through four segments: Core U.S., Acceptance Now, Mexico and Franchising. The company has expected earnings growth of 100% for the current year. The Zacks Consensus Estimate for the current year has improved by 12.8% over the last 60 days.

IMAX Corp. (NYSE:IMAX) operates as an entertainment technology company specializing in motion picture technologies and presentations worldwide. The company has expected earnings growth of 26.4% for the current year. The Zacks Consensus Estimate for the current year has improved by 6.5% over the last 60 days.

GoPro Inc. (NASDAQ:GPRO) develops and sells cameras, drones, and mountable and wearable accessories in the United States and internationally. The company has expected earnings growth of 265.2% for the current year. The Zacks Consensus Estimate for the current year has improved by 40.7% over the last 60 days.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft (NASDAQ:MSFT) stock in the early days of personal computers… or Motorola (NYSE:MSI) after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Rent-A-Center, Inc. (RCII): Free Stock Analysis Report

Malibu Boats, Inc. (MBUU): Free Stock Analysis Report

GoPro, Inc. (GPRO): Free Stock Analysis Report

IMAX Corporation (IMAX): Free Stock Analysis Report

Strategic Education Inc. (STRA): Free Stock Analysis Report

Original post

Zacks Investment Research