Overall Technical Picture

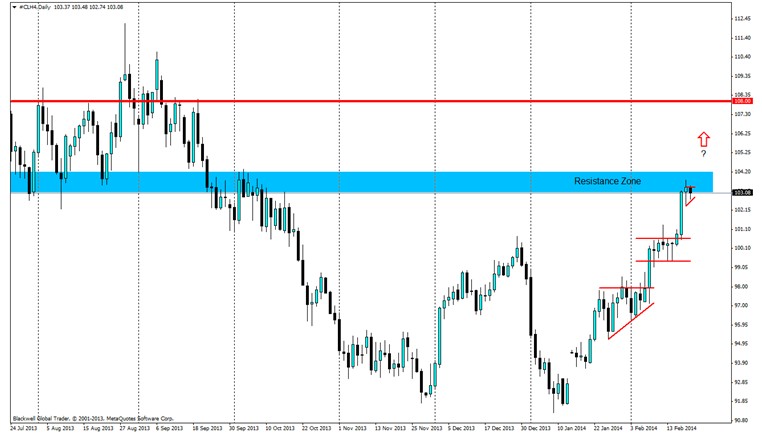

Oil has recently broken out of the 100 mark with a big bullish close on 02/02/14 and is looking very bullish technically. Observers with a keen eye can see that price has successfully reversed from a downtrend, beginning in Sep 2013 with the break out of the major double bottom. The previous impulsive bear movement at the end of Dec 2013 has been overtaken by the bulls. This puts me firmly in a bullish bias.

Zooming into the price structure of late, I can see that price has been moving up steadily. Each upward spurt has been met with about a week’s worth of consolidation as seen by the ascending triangle and bullish rectangle I have marked out on the charts. We have now approached consolidation in a zone of previous support that is now offering resistance. Intraday traders can look for breakout triggers in this zone. There could be a very potent breakout trade here as the next resistance zone sits at around 108.

Fundamentals

Light sweet crude for March delivery rose 0.9% to $103.31 a barrel on the New York Mercantile Exchange. Prices are at their highest level since 08/10/13 and have bounced 12.7% from last month's lows. Brent crude for April delivery, the global benchmark, gained one cent to $110.47 a barrel. Notably, in OPEC’s February Monthly Oil Market Report, world oil demand for 2014 was revised up by 50 tb/d to 1.1 mb/d.

You might have also read in the news lately that the U.S. has been facing a cold spell. After the polar vortex chill in January, yet another cold spell is predicted for most of the U.S in the coming weeks. This has certainly contributed to demand in oil. However, China (the world’s second largest oil consumer) just printed poormanufacturing data indicating that its economy shrank yet again for the second consecutive month.

For the supply side, OPEC is looking to cut crude shipments to 24.06 mb/d from 24.74 mb/d as refinery maintenance programs curb demand. Refineries start to switch from winter-grade fuel to summer-grade fuel in the coming months and seasonal spikes are always expected during this period. Additionally, there has been unrest in Venezuela (major oil supplier), as well as export disruptions in Libya and South Sudan.

So aside from the negative data out of China, everything still points toward a bullish bias.

With all things considered, we can appreciate why Oil is in a consolidation mode both technically and fundamentally. Do put Oil on your watch-list and look to see if you can catch a break out to a bigger move if it materialises.