The Oil market has been very volatile in recent weeks, if not months. Still, there is certainly no reason to take your eye off the ball when it comes to oil markets.

There has been a lot of talk about fundamentals in the market, and so far they really have had very little impact in the long run, apart from the fact that demand is just not there. Many have talked about the influence of OPEC and Saudi Arabia. For the most part, that should not worry the market unless anything unusual happens, which it has not so far.

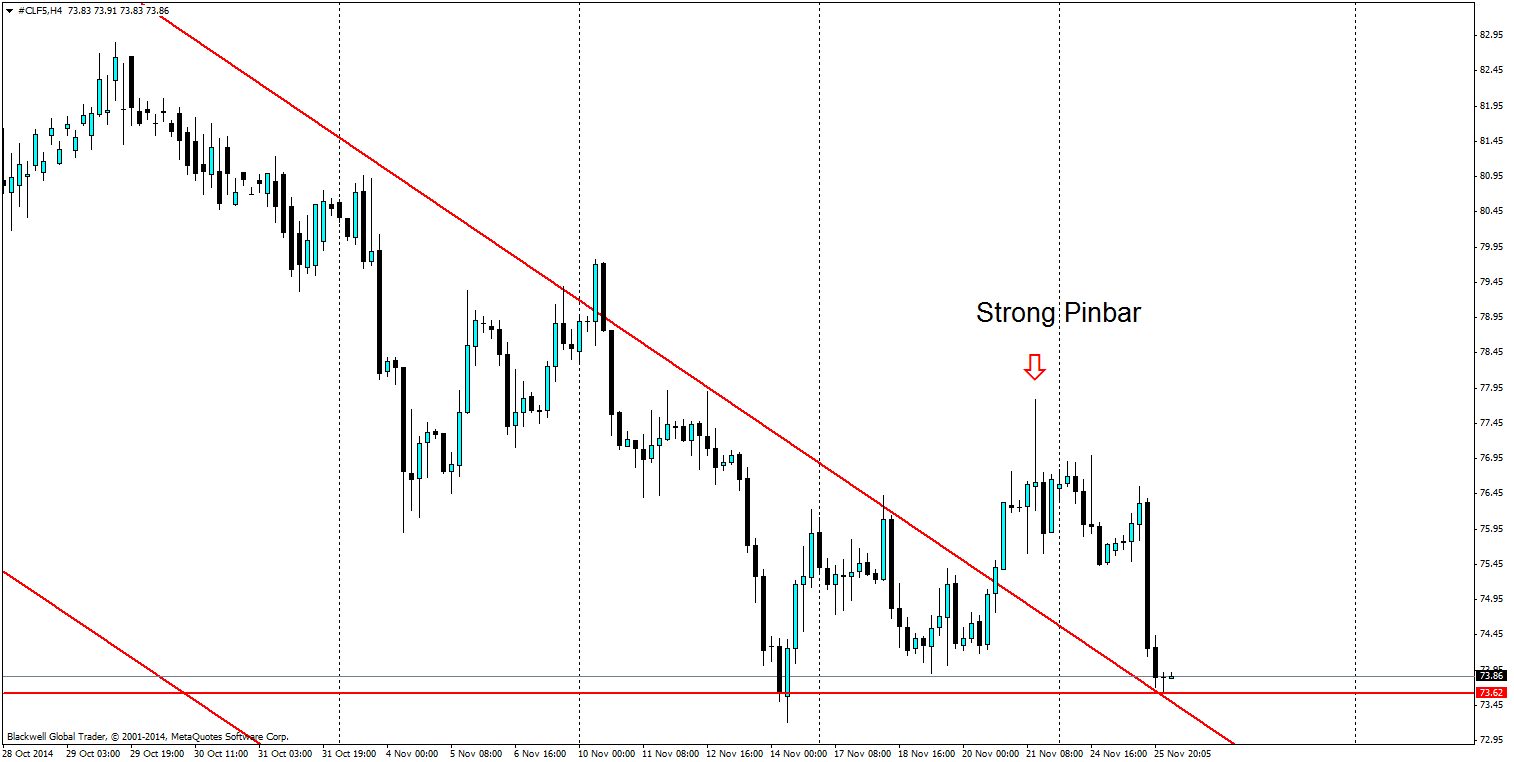

On the charts is where it matters, and what we have seen up to now is a trending market step up the pace and become steeper and more aggressive as of late. However, last week we saw a slight reprieve and a possible false breakout which has since looked to start falling again as demand in the market is still not there.

When looking for price targets, 73.62 is the support floor, which is holding up quite nicely at present. It’s likely it may act as solid support for some time. However, market pressure lower is still there and we may be looking for the next major level for oil. This level can be found at 68.56 and is likely to be a strong turning point for oil if we get there, since we may actually find some more bulls in this market for a change.

On the H4 chart, above, we can see the price action as it pushes the bulls out of the market. We’ve seen a strong pin bar on the charts, followed by aggressive selling as a result, with that level holding up as a strong area of resistance.

Overall, oil looks to still be under the pump and until we saw a confirmed amount of momentum driving higher, oil looks likely to stay under the bears' control. If you’re an oil trader, I would strongly be looking to the sell side of things in the short term, as it looks like the bulls are still not there for traders.