Market movers today

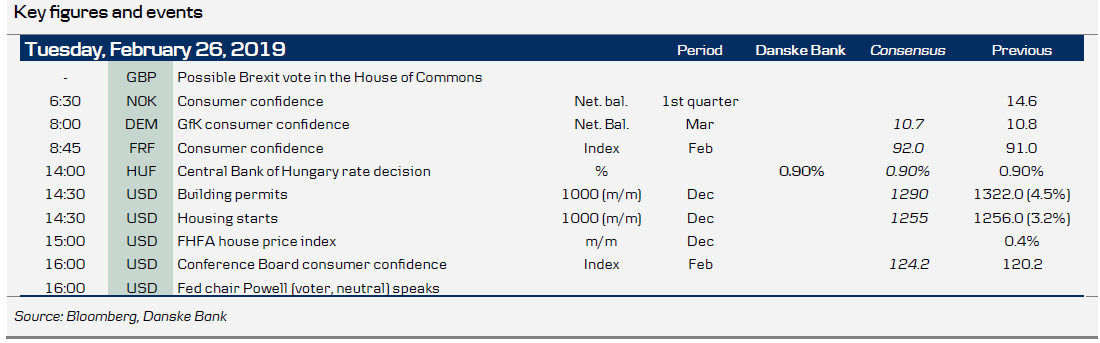

Today, a lot of information on the current situation in the US housing market is due out, such as housing starts, building permits and house prices in December this afternoon. US consumer confidence for February from the Conference Board is also due, which is likely to have rebounded after the shutdown ended. Ahead of ISM manufacturing due out on Friday, keep an eye on the Richmond index at 16:00 CET.

Fed Chair Jerome Powell begins his two-day hearing in the US Congress when he testifies before the Senate Banking Panel at 16:00 CET. As FOMC members have been very outspoken so far this year, we do not think Powell will send any new signals or move the markets by much. The Fed has clearly stated that it is on hold for now and is about to end its balance sheet run-off this year (announcement probably as early as at the March meeting).

In the UK, many Bank of England members (including Governor Mark Carney) are due to testify before the UK Treasury Committee. The BoE seems to be on hold until 'the weather has cleared up'.

Also in the UK, note there is no vote on a Brexit deal in the House of Commons today, as PM May has postponed it by another two weeks. However, the indicated vote tomorrow is still on and the question here is whether the so-called Cooper amendment - which would force May to ask for an extension of Article 50 in case she does not get a deal or wins backing for one - will pass or not. We think it is a close call given it is not the last chance the MPs will get to force May's hand. Furthermore, May is said to be discussing a possible extension of Article 50 deadline with her cabinet today.

In Europe , consumer confidence indicators in Germany and France are due out. We will look for any signs of a stabilisation in the European soft indicators.

Selected market news

Oil prices dropped more than 3% yesterday after US President Donald Trump said that 'oil prices are getting too high' and that 'OPEC should relax'. In October 2018, he made similar comments, which helped initiate the steep downturn in oil prices in Q4 - hence the anxiety in the market towards his comments. The price on Brent crude settled below USD65/bbl down from above USD67/bbl.

On Brexit, the market received two important pieces of news yesterday. First, PM Theresa May is said to be meeting with her cabinet to discuss a possible extension of Article 50 deadline; hence, a delay on Brexit. Second, Labour leader Jeremy Corbyn is said to be supportive of the so-called Cooper amendment and of a public vote on Brexit. GBP rose around 0.25% vis-à-vis EUR and USD on the news.

Scandi markets

No market movers today.

Fixed income markets

BTPs continued to rally yesterday after Fitch kept the rating unchanged on Friday night and as hunt for carry got a strong boost from the improvement in risk appetite. We expect further support for Italy this week as close to EUR40bn is coming to the market in coupons and redemptions. We continue to favour the short-end of the Italian curve and have a recommendation to buy the 1Y BOT. However, today’s focus turns to Spain, which is set to sell a new 15Y benchmark bond (Jul-30) in a syndicated deal. We expect yet another strong Spanish deal. When the Kingdom sold EUR10bn the new 10Y in January, the order book was in excess of EUR46.5bn. Norway might also launch the new 10Y syndicated deal today or tomorrow.

FX markets

GBP gained yesterday on the news that the leader of the UK Labour Party, Jeremy Corbyn, said that he is ready to support a second Brexit referendum. We have a couple of interesting days ahead of us today and tomorrow in terms of Brexit. Today, Theresa May will chair a Cabinet discussion on extending Article 50 and later today she will update parliament on the Cabinet’s decision. Tomorrow, the vote in the House of Commons is still on and the big question here is whether the so-called Cooper amendment – which would force May to ask for an extension of Article 50 in case she does not get a deal or wins backing for one – will pass or not. EUR/GBP currently trades in the low end of the 0.86-0.89 range at 0.865 and a further decline in the ‘no deal’ Brexit risk could lead to further GBP appreciation and possibly a test of 0.86 short term. However, we would need to see a more ground breaking development either in the form of an agreement of a long extension of Article 50 or the call for a second referendum to justify a sustained break below 0.86 at this stage. Especially the latter would be very positive for GBP as a ‘no Brexit’ scenario (likely after a second referendum) could send EUR/GBP sub 0.80.

Oil prices dropped sharply following Trump’s comments about oil prices ‘getting too high’ yesterday, which led to a bounce in EUR/NOK. The market is clearly anxious that we could see a repeat of the steep decline in oil prices in Q4 18 initiated by similar Trump comments. It could put a cap on oil prices in the short term and hence limit the NOK upside potential from general risk-on. That said, we still think the domestic macro story is sufficiently strong to stay long NOK for now as Norges Bank seems under-priced, in our view. In terms of oil markets, we will keep an eye on announcements from the US about plans to reduce strategic petroleum reserves further. This is a key downside risk to our oil view.