- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Quest Diagnostics (DGX) Is A Suitable Pick For Investors

Madison, NJ-based Quest Diagnostics, Inc. (NYSE:DGX) , a provider of commercial laboratory services, has been on a growth trajectory of late. It has rallied 35.4% over the past one year, ahead of the S&P 500’s 15.5% gain. The stock has a market cap of $14.92 billion.

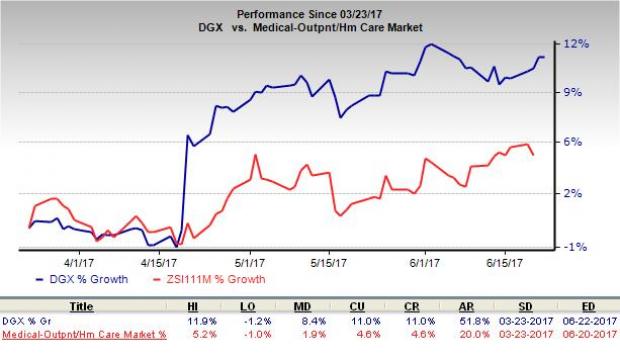

Also, the company has gained 11%, better than the Zacks categorized Medical - Outpatient and Home Healthcare sub-industry's gain of 4.6% in the last three months.

Notably, Quest Diagnostics’ current year estimate revision trend is favorable. Over the past 60 days, three analysts have raised their earnings estimates, with no movement in the opposite direction. The magnitude of estimate revision increased around 1% to $5.56 per share over the same time frame. The company has a trailing four-quarter average positive earnings surprise of 5.2%.

With strong growth prospects, this Zacks Rank #2 (Buy) company is an attractive pick at present.

We note that, management’s 2017 guidance is based on new and extended two-point strategy to generate shareholder value – accelerating growth and driving operational excellence. Lately, the company has raised its outlook for revenue growth for the period 2017–2020 to 3–5%. Earnings for the same period are expected to grow faster than revenues in the mid-to-high single digit range.

Presently, the company has partnered with a number of other heath care players. These include the latest tie-up with Safeway and HealthOne Systems of HCA Healthcare. Other recent alliances include Quintiles, a leading provider of biopharmaceutical development and commercial outsourcing services, Memorial Sloan-Kettering, the University of California and the latest professional lab services relationship with Barnabas Health.

Meanwhile,Quest Diagnostics has been focusing on areas with high potential such as gene-based esoteric testing for cancer, cardiovascular disease, infectious disease and neurological disorders. The company recently announced the launch of a test service that helps physicians evaluate patient response to drug therapy used to treat infection with hepatitis B virus. This is the first test of its kind available in the U.S. Management is currently on track to open a total of 200 patient service centers in Safeway stores by the end of 2017.

Management also announced agreements to acquire two laboratory businesses in Lewisville, Texas, namely Med Fusion and Clear Point. The businesses jointly provide a complete range of cancer diagnostic services to physicians and provider networks. We expect this deal to boost Quest Diagnostics’ growth in the cancer diagnostic segment.

However, downside may come from the current market environment which remains challenging for Quest Diagnostics in the form of continued decline in healthcare utilization rate, commercial pricing pressure and reimbursement headwind. Additionally, the company faces intense competition from hospital-affiliated labs primarily on the basis of quality of service.

Other Key Picks

Other top-ranked medical stocks are Align Technology, Inc. (NASDAQ:ALGN) , Inogen, Inc. (NASDAQ:INGN) and Accelerate Diagnostics, Inc. (NASDAQ:AXDX) . Notably, Align Technology and Inogen sport a Zacks Rank #1 (Strong Buy), while Accelerate Diagnostics carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Align Technology has an expected long-term adjusted earnings growth of almost 24.1%. The stock has added roughly 33% over the last three months.

Inogen has a long-term expected earnings growth rate of 17.5%. The stock has gained around 28% over the last three months.

Accelerate Diagnostics has an expected long-term adjusted earnings growth of 30%. The stock has gained roughly 30.1% over the last three months.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

Inogen, Inc (INGN): Free Stock Analysis Report

Accelerate Diagnostics, Inc. (AXDX): Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.