The big picture

The action was down under this morning as the Reserve Bank of New Zealand (RBNZ) signaled it will start raising rates in the first half of next year and Australia’s unemployment rate rose to 5.8% in November from 5.7% in October. The RBNZ said that given the outlook for faster inflation, “it is becoming unnecessary to maintain the current degree of monetary stimulus” and that “the bank will increase the official cash rate as needed in order to keep future average inflation near the 2 percent target midpoint.” This was a more specific statement than after the last meeting in October, when Gov. Wheeler said that increases “will likely be required” in 2014. The market is now discounting about 100 bps of tightening next year. Nonetheless NZD/USD was virtually unchanged from Wednesday’s European opening – it came off during the European day yesterday and rebounded during New York and Asian trading to trade unchanged. New Zealand is likely to be the first of the G10 countries to raise rates. Although that likelihood is already in the price, given the likelihood that disinflation continues in the other major countries and that central banks elsewhere keep rates lower for longer than currently anticipated, I see room for further appreciation of the NZD. On the other hand, AUD fell continually yesterday except for a few seconds following the employment data. The rise in unemployment was as expected while the change in employment beat estimates – 21k jobs were created in November, up from 1.1k in October and double estimates of 10k. The news initially sent the AUD up sharply, as one might expect, but it hit the 0.9080 resistance from a previous low and fell back in minutes. That suggests to me the depth of negative sentiment for the AUD.

The other main theme in the market was news that President Obama is likely to nominate former Israeli central bank Governor Stanley Fischer to take Janet Yellen’s place as Vice Chair at the Fed, the #2 position there. This would solve one of the perceived problems with Ms. Yellen’s candidacy, namely that she does not have enough international experience or experience handling financial crises. Mr. Fischer has a vast array of contacts in the international banking community (ECB President Draghi was a former student of his when he was teaching at MIT), while as the #2 official at the IMF in the 1990s, he spent several years managing the Fund’s response to crises in Russia, Asia and Latin America. However Mr. Fischer is known to dislike forward guidance and so his nomination could prove to be a challenge to Ms. Yellen and the current policy framework. “You can’t expect the Fed to spell out what it’s going to do,” Mr. Fischer said in September. “Why? Because it doesn’t know…We don’t know what we’ll be doing a year from now. It’s a mistake to try and get too precise.”

As a result, US interest rates went higher (the far Fed Funds futures +1 bp, 10yr yields +5 bps), equities lower (S&P 500 -1.1%) and the dollar generally declined. Apparently the prospect of policy disunity trumps the prospect of higher yields. Either that, or (more likely) people just want some excuse to sell dollars.

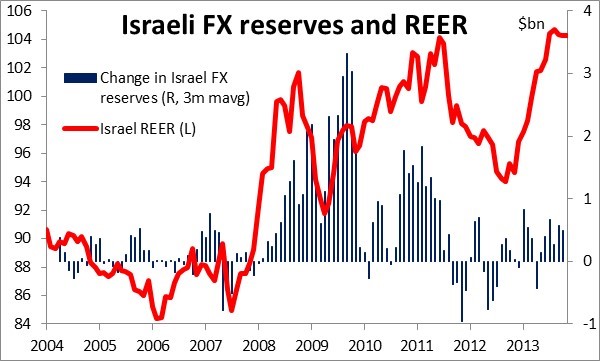

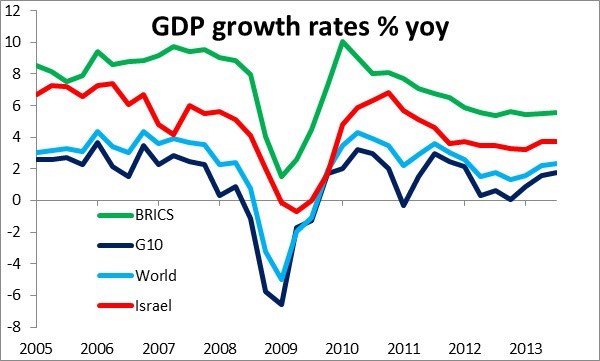

I think Mr. Fischer would be likely to adapt to the prevailing philosophy of the Fed. He has previously stated his approval of the Fed’s extraordinary measures, such as quantitative easing. "They appear to be effective and they essentially do that by working off either the provision of liquidity in markets where liquidity has effectively dried up, or by changing interest rates other than the central bank interest rate," he said last month. Fischer cannot easily be characterized as a dove or a hawk. Despite a focus on fighting inflation, he cut rates along with other major central banks in 2008 in an effort to head off the effects of the global crisis despite relatively high domestic inflation. He also went against his own policy of staying out of financial markets by intervening in the FX market to weaken the shekel and help local exporters. On the other hand, he was among the first to raise interest rates just a year after cutting them (Nov. 2009). As a result, Israel escaped the worst effects of the crisis and maintained a relatively healthy growth rate, dipping only briefly into recession. During his tenure at the Bank of Israel, the shekel appreciated by 16% on a real effective exchange rate basis and inflation averaged 2.5% yoy, far below the 4.8% in the preceding 10 years.

In my view, his nomination should be seen as providing a superb management team at the Fed, which should be USD-positive. Furthermore, less forward guidance should in fact be good for the dollar as it’s usually used to dampen down expectations of rate hikes.

Following Germany’s release yesterday of its final CPI for November, France, Italy and Sweden take their turn today. French CPI came out as expected, unchanged mom in November vs a 0.1% decline in October. The forecast of Italy’s final CPI for the month is the same as the initial estimate at +0.6% yoy. Sweden’s CPI is also expected to have remained unchanged in November mom vs -0.2% in October. This will give a positive sign to the yoy rate. (+0.2% vs -0.1%). We also have the Swiss National bank meeting. The central bank is expected to keep its target for 3m CHF LIBOR at 0.00% and reaffirm the EUR/CHF floor at 1.20 CHF. These figures are widely expected and would probably have no impact on CHF, which is already hitting a 2013 high vs USD. SNB president Jordan holds a press conference after the meeting. Eurozone’s industrial production is estimated to have risen 0.3% mom in October, a turnaround from -0.5% in September.

Later in the day, US retail sales for November are expected to have risen 0.6% mom, an acceleration from +0.4% in October. The closely watched retail sales excluding autos and gasoline are expected to rise 0.3%, the same rate as in October. Weekly jobless claims for Dec 7 are forecast to rise to 320k from 298k, which could be a USD-negative factor for the market.

Elsewhere, Canada’s new housing price index is expected to rise 0.1% mom in October vs an unchanged figure in September.

We have five speakers today. In addition to SNB President Jordan, ECB president Mario Draghi speaks in European parliament debate on ECB’s annual report, ECB’s governing council member Erkki Liikanen speaks at a Bank of Finland quarterly press briefing and ECB’ Asmussen speaks at a press conference. Finally, Bank of Canada Governor Poloz speaks on “Monetary policy and risk management”.

The Market:

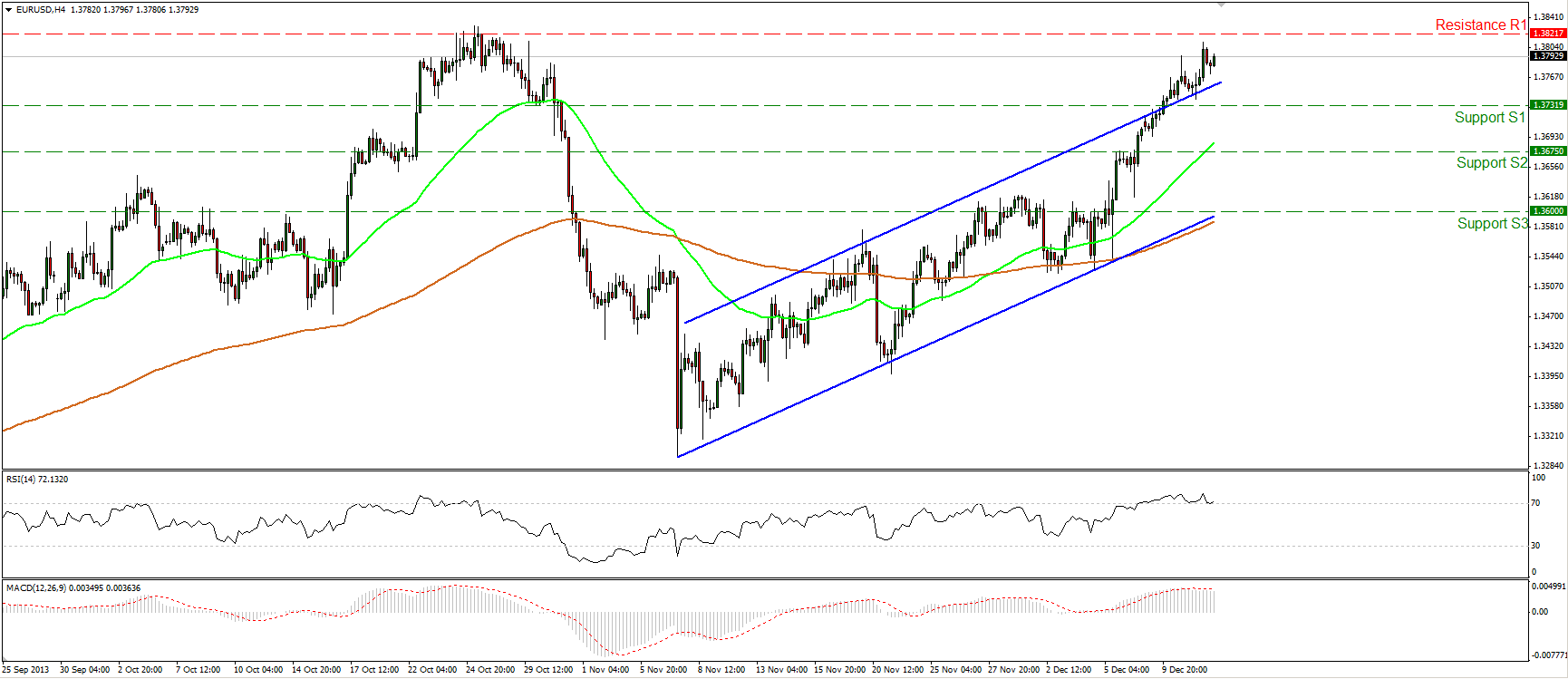

EUR/USD  EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="600" height="361">

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="600" height="361">

The EUR/USD continued moving higher on Wednesday, getting closer towards October’s highs at 1.3821(R1). In my view, we may experience some consolidation near those highs. If the longs manage to win the battle and overcome the hurdle of 1.3821 (R1), I expect them to target the 1.3935 (R2) barrier. The bias remains to the upside since traders manage to maintain the rate above the upper boundary of the upward sloping channel and the 50-period moving average remains above the 200-period moving average. On the weekly chart, the 50-week moving average seems ready to cross above the 200-week moving average, which is often a bullish sign.

• Support: 1.3731 (S1), 1.3675 (S2), 1.3600 (S3)

• Resistance: 1.3821 (R1), 1.3935 (R2), 1.4200 (R3).

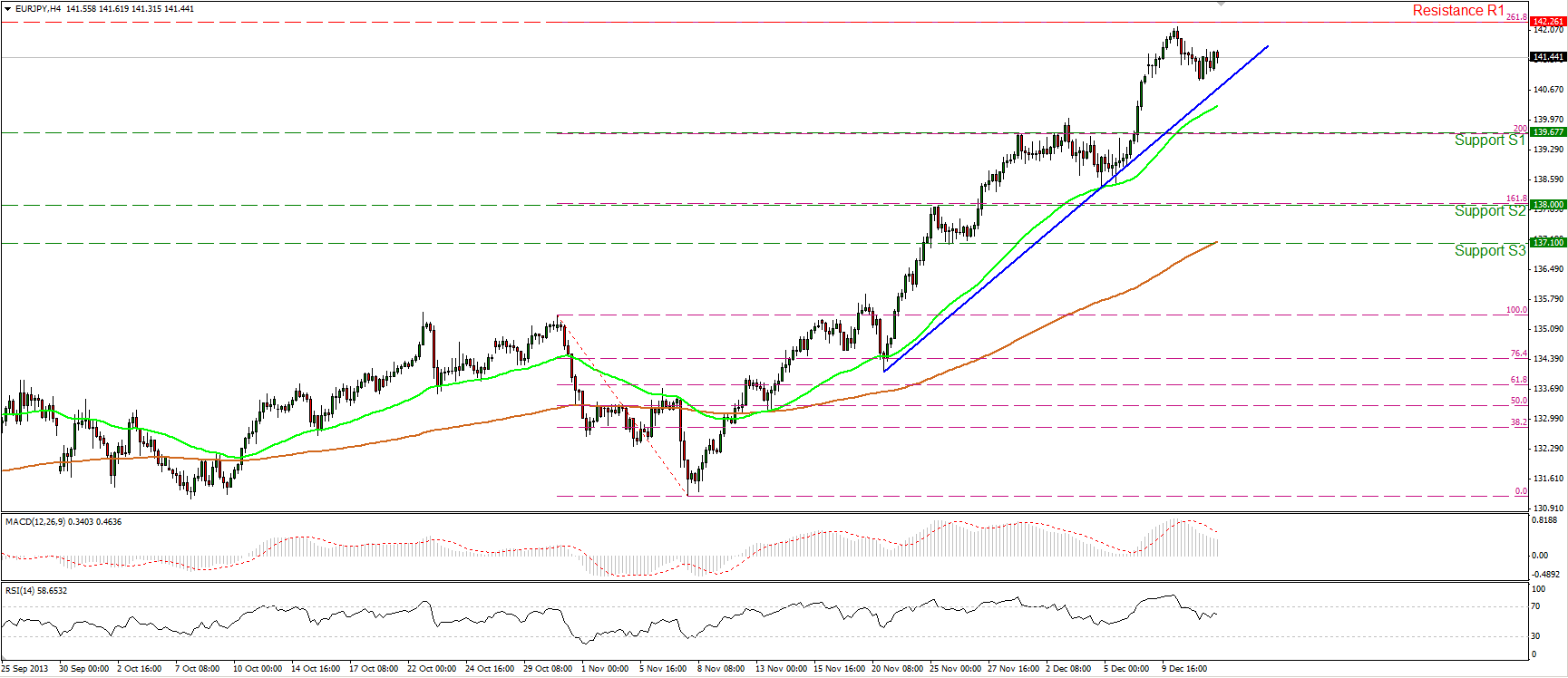

EUR/JPY EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="361">

EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="361">

The EUR/JPY is consolidating slightly above the blue uptrend line, below the 261.8% Fibonacci extension level of the downward wave prior to the uptrend. A clear break above that level will drive the price into territory last seen back in September 2008. The next resistance barrier is found on the weekly chart at 148.93 (R2). The pair remains in an uptrend, as confirmed by the blue uptrend line and by the fact that the 50-period moving average remains above the 200-period moving average, supporting the lows of the price.

• Support: 139.67 (S1), 138.00 (S2), 137.100 (S3).

• Resistance: 142.26 (R1), 148.93 (R2), 156.77 (R3).

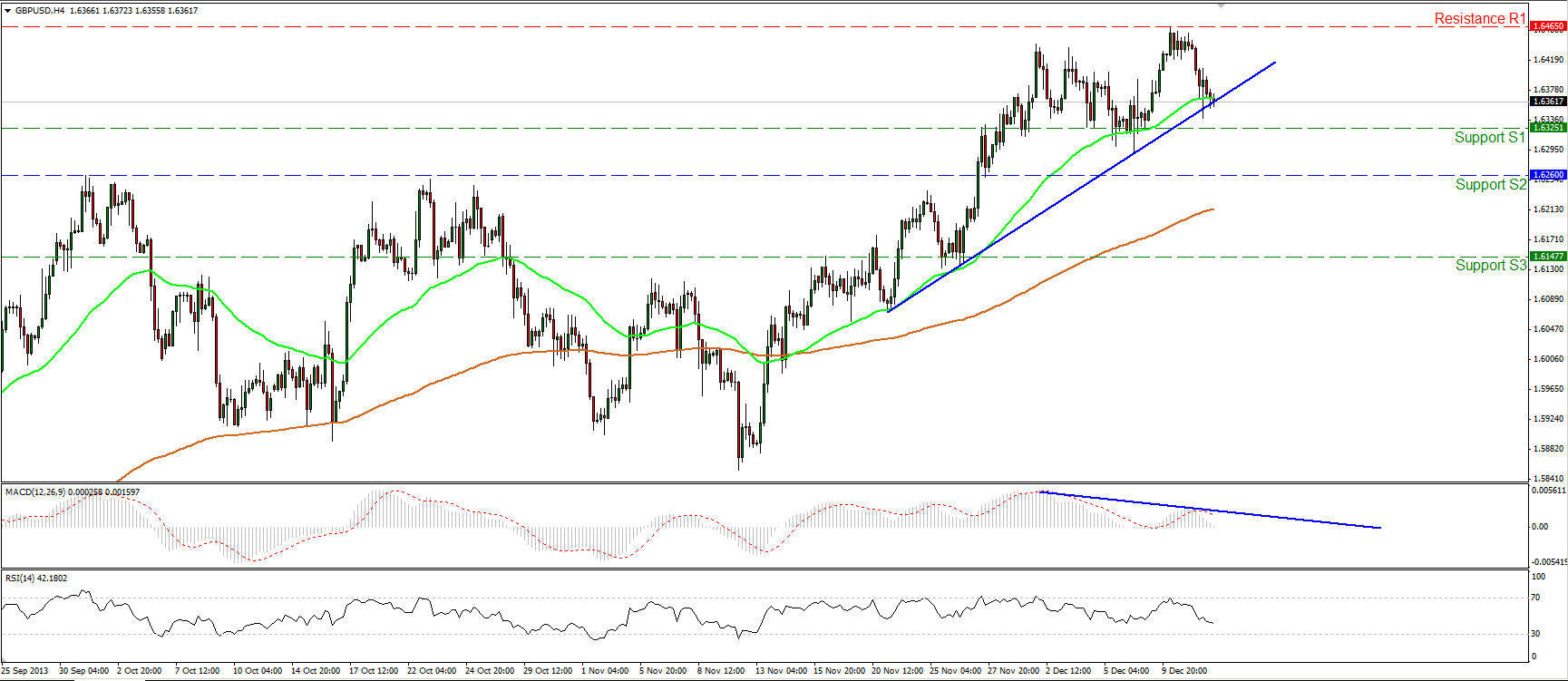

GBP/USD GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="600" height="361">

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="600" height="361">

The GBP/USD moved lower and at the time of writing is testing the blue uptrend line near the reading of the 50-period moving average. A break below the trend line followed by a dip below the support of 1.6325 (S1) may turn the short-term bias to the downside. The weakness of the rate is also indicated by the negative divergence between the MACD and the price action. However, since the pair has not violated the blue trend line yet, technically the uptrend remains in effect for now.

• Support: 1.6325 (S1), 1.6260 (S2), 1.6147 (S3).

• Resistance: 1.6465 (R1), 1.6575 (R2), 1.6736 (R3).

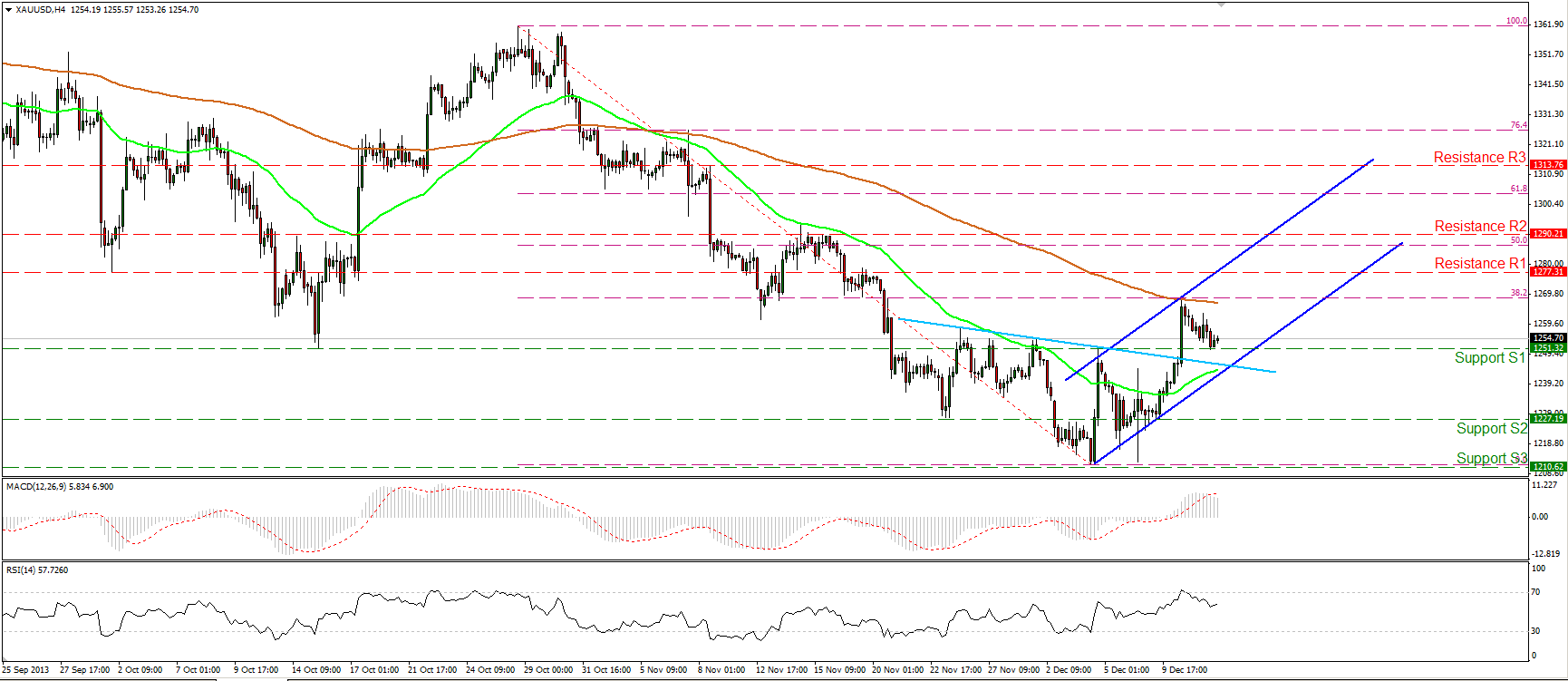

Gold XAU/USD Hourly Chart" title="XAU/USD Hourly Chart" width="600" height="361">

XAU/USD Hourly Chart" title="XAU/USD Hourly Chart" width="600" height="361">

Gold moved lower after hitting the 38.2% Fibonacci retracement level of the prevailing downtrend. If the metal rebounds at the area between the neckline (light-blue line) and the lower boundary of the channel, it would confirm the validity of the “complex head and shoulders bottom” formation mentioned in previous comments. On the other hand, further decline will signal that the recent advance was just a 38.2% retracement of the prior downtrend.

• Support: 1251 (S1), 1227 (S2), 1210 (S3).

• Resistance: 1277 (R1), 1290 (R2), 1313 (R3).

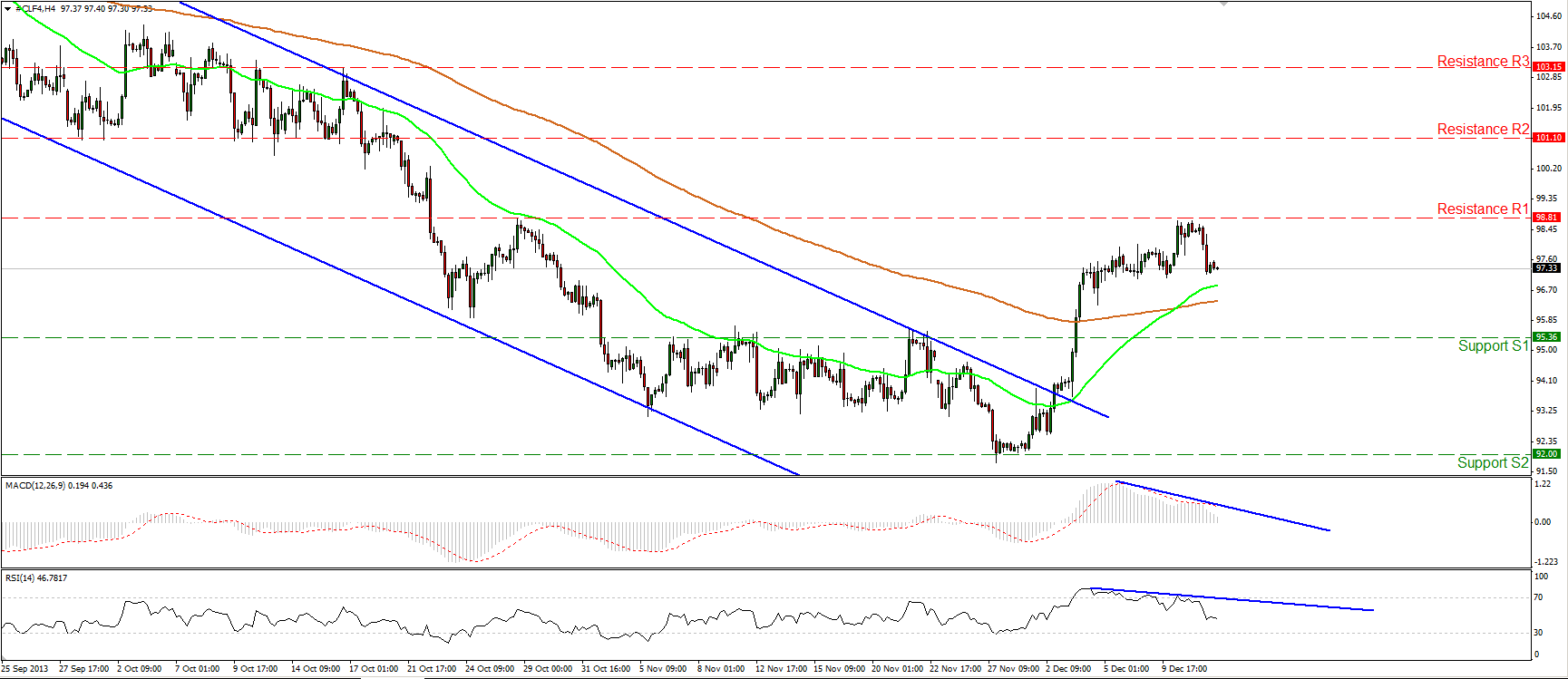

Oil

WTI moved lower, confirming my expectations of a pullback. Both momentum studies follow downward paths and as a result I would expect further retracement or consolidation before the bulls prevail again. As long as the 50 period moving average remains above the 200-period moving average and as long as the previous low at 92.00 (S2) holds, the possibility that the price will form a higher low is still in the game.

• Support: 95.36 (S1), 92.00 (S2), 90.10 (S3).

• Resistance: 98.81 (R1), 101.10 (R2), 103.15 (R3).

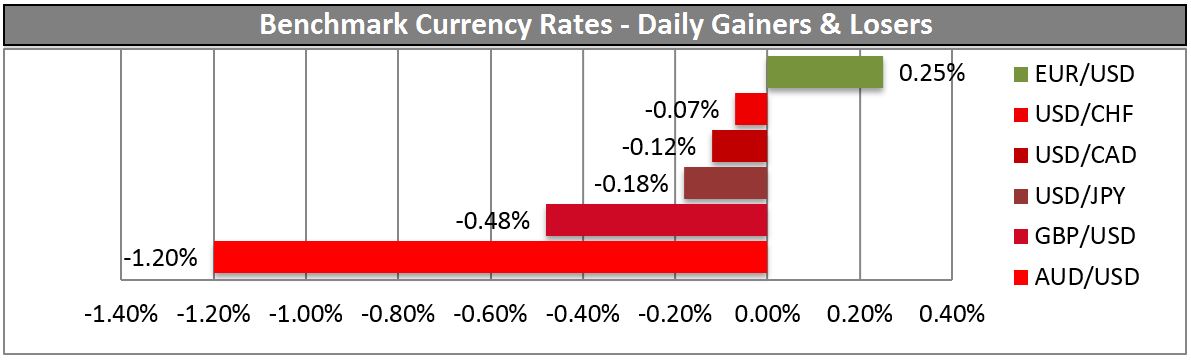

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

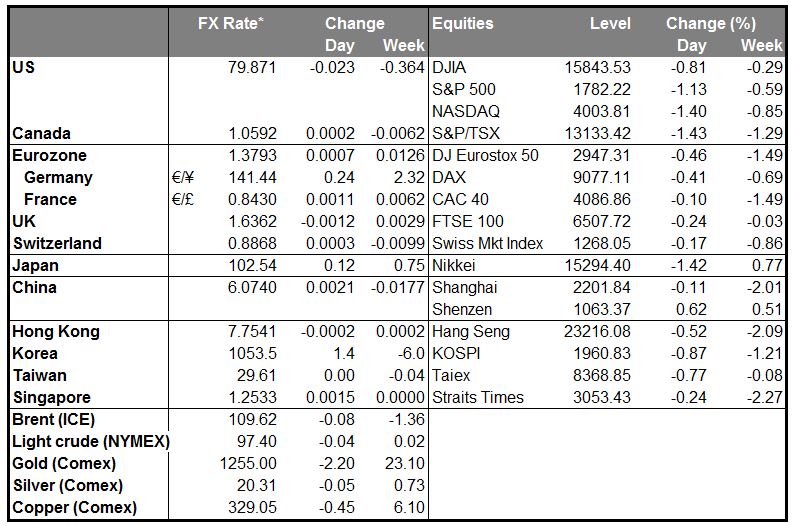

MARKETS SUMMARY