- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Harley-Davidson (HOG) Q3 Earnings In Line, Revenues Beat

Harley-Davidson, Inc. (NYSE:HOG) reported earnings of 40 cents per share in the third quarter of 2017, in line with the Zacks Consensus Estimate. However, earnings were lower than 64 cents, recorded in the year-ago quarter.

Net income decreased to $68.2 million from $114.1 million, recorded a year ago.

Motorcycle and related products revenue declined to $962.14 million in the third quarter of 2017, down from $1.1 billion in the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of $960.8 million. The company also lodged consolidated revenues of $1.15 billion, deteriorating from the prior-year tally of $1.27 billion.

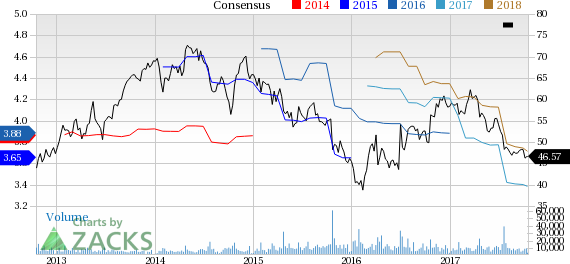

Harley-Davidson, Inc. Price, Consensus and EPS Surprise

Operating income decreased to $96.7 million from $178.4 million in the year-ago period.

Motorcycles and Related Products

The decline in revenues from Motorcycles and Related Products was due to lower motorcycle shipments. Operating income plunged to $19.6 million from $108.9 million, a year ago.

During the quarter, revenues from Harley-Davidson motorcycles fell 17.2% to $653.3 million. The company shipped 41,662 motorcycles to dealers and distributors worldwide during the third quarter of 2017, compared with 48,611 shipments in the third quarter of 2016.

Harley-Davidson’s worldwide dealer retail sales of new motorcycles dropped 6.9% to 64,209 units from 68,955 motorcycles in the year-ago quarter. This was due to weak industry conditions including impact of hurricane Harvey and Irma in Southeast and Texas.

Harley-Davidson’s overseas dealer of retail sales for new motorcycles in the United States declined 8.1% to 41,793 motorcycles. International sales went down 4.6% to 22,416 motorcycles from 23,486 in the prior-year quarter.

All the regions posted a decline in sales from the prior-year quarter. Canada witnessed a 3.3% decrease, Latin America’s sales reduced 11.5%, Middle East and Africa (EMEA) region’s sales slipped 1.4%, while Asia-Pacific region witnessed a 6.7% drop.

Revenues from Parts and Accessories slid 0.7% to $229.7 million, while revenues from General Merchandise — including MotorClothes apparel and accessories — gained 11.3% to $72.7 million.

Harley-Davidson Financial Services (HDFS)

Revenues in the Financial Services segment increased 3.2% to $189.1 million in the third quarter of 2017. Operating income improved 11% to $77.1 million from the year-ago figure of $69.4 million.

Financial Position

Harley-Davidson had cash and cash equivalents of $683.1 million as of Sep 24, 2017 compared with $790.3 million as of Sep 25, 2016. Long-term debt curtailed to $4.61 billion from $5.17 billion as of Sep 25, 2016.

For the nine months ended on Sep 24, 2017, Harley-Davidson’s operating cash inflow improved to $949.1 million from $927.8 million, a year-ago. Capital expenditures diminished to $114.1 million from $162.7 million in the year-ago period.

Share Repurchases

Harley-Davidson spent $222 million to repurchase 4.5 million shares in third-quarter 2017. At third-quarter end, the company had authorization to buy back another 10.6 million shares.

Looking Forward

Harley-Davidson reiterated its expectation to ship 241,000-246,000 units in 2017, roughly reflecting a 6-8% decline from 2016.

In the fourth quarter of 2017, the motor company expects to dispatch around 46,700-51,700 motorcycles compared with 42,414 units, shipped in the year-ago period.

The company continues to expect a 1% dip in operating margin from the 2016-levels. Also, it expects to incur capital expenditures of worth $200-$220 million this year.

Price Performance

Shares of Harley-Davidson have significantly underperformed the industry year to date. The stock has lost 20.1% versus the industry’s 25.9% rally.

Zacks Rank & Key Picks

Harley-Davidson currently carries a Zacks Rank #4 (Sell).

Some auto stocks worth considering are Adient PLC (NYSE:ADNT) , Cummins (NYSE:CMI) and Continental AG (OTC:CTTAY) , all holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Adient has an expected long-term earnings growth rate of 10.6%.

Cummins has an expected long-term earnings growth rate of 12%.

Continental has an expected long-term earnings growth rate of 7.1%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Adient PLC (ADNT): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Harley-Davidson, Inc. (HOG): Free Stock Analysis Report

Continental AG (CTTAY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.