The euro is showing little movement in the Tuesday session, as EUR/USD is trading at 1.1150. On the release front, German PPI declined by 0.2%, weaker than the forecast of -0.1%. This marked the first decline since September 2016. Elsewhere, the Eurozone’s current account surplus dropped sharply to EUR 22.2 billion, compared to a forecast of EUR 31.3 billion. In the US, today’s major event is Current Account. On Wednesday, the US releases Existing Home Sales and {{{ecl-75||{0|Crude Oil}}Inventories}}.

The political landscape has finally settled in France, after two months of elections. On Sunday, President Emmanuel Macron easily won a majority in presidential elections. Macron’s En March party won about 60% of the seats in the National Assembly. However, voter turnout was very low, at just 42%, as voter fatigue and the expected result contributed to a low turnout. Still, there is no arguing that it’s an impressive victory for the young and charismatic Macron, whose party is barely a year old. Macron ran on a pro-business agenda, promising to relax regulations and reform labor laws in order to make the French economy more competitive, but France’s powerful trade unions are sure to push back against any legislation that will take away rights or benefits from workers. The unions have not shied away from going on strike or organizing mass protests in past conflicts with the government, so Macron will be hard-pressed to implement reforms while keeping peace on the labor front. Macron is also staunch supporter of the EU, and hopes to raise France’s stature and clout in Europe, especially with Britain heading out the door.

One year after the Brexit referendum, which sent shock waves across Britain and the European Union, formal negotiations between the two sides began on Monday in Brussels. Both sides were on their best behavior, and the two chief negotiators even exchanged gifts. The parties published a concise Terms of Reference for the negotiations, which provided an outline of the talks as set by the Europeans. The paper pointedly did not mention trade talks, but rather listed the initial issues that will be discussed: 1) legal status of EU citizens in the UK; (2) Northern Ireland/Ireland border; and (3) financial obligations of the UK to the EU. With Prime Minister May trying to cobble together a minority government, her position is much weaker than before the disastrous election, and the British position has become more flexible. Philip Hammond, the British finance minister, has said that he wants a business-friendly and pragmatic Brexit and that no deal would be bad for the UK. He did, however, warn the Europeans not to craft an agreement that punished the UK for leaving the club. The negotiations are expected to resume on July 10, when the parties will delve into substantial issues.

EUR/USD Fundamentals

Tuesday (June 20)

- 2:00 German PPI. Estimate -0.1%. Actual -0.2%

- 3:15 US FOMC Member Stanley Fischer Speaks

- 4:00 Eurozone Current Account. Estimate 31.3B. Actual 22.2B

- 8:30 US Current Account. Estimate -124B

- 15:00 US FOMC Member Robert Kaplan Speaks

Wednesday (June 21)

- 10:00 US Existing Home Sales. Estimate 5.54M

- 10:30 US Crude Oil Inventories. Estimate -1.2M

*All release times are EDT

*Key events are in bold

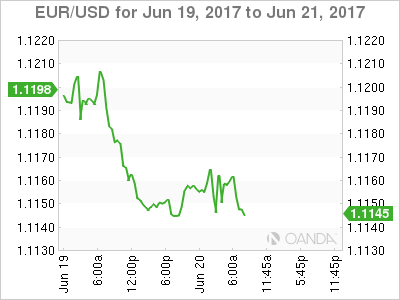

EUR/USD for Tuesday, June 20, 2017

EUR/USD Tuesday, June 20 at 6:00 EDT

Open: 1.1148 High: 1.1165 Low: 1.1141 Close: 1.1160

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0873 | 1.0985 | 1.1122 | 1.1242 | 1.1366 | 1.1465 |

EUR/USD has shown little movement in the Asian and European sessions

- 1.1122 is providing support

- 1.1242 is the next resistance line

Further levels in both directions:

- Below: 1.1122, 1.0985 and 1.0873

- Above: 1.1242, 1.1366, 1.1465 and 1.1534

- Current range: 1.1122 to 1.1242

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Tuesday session. Currently, short positions have a majority (71%), indicative of EUR/USD breaking out and moving lower.