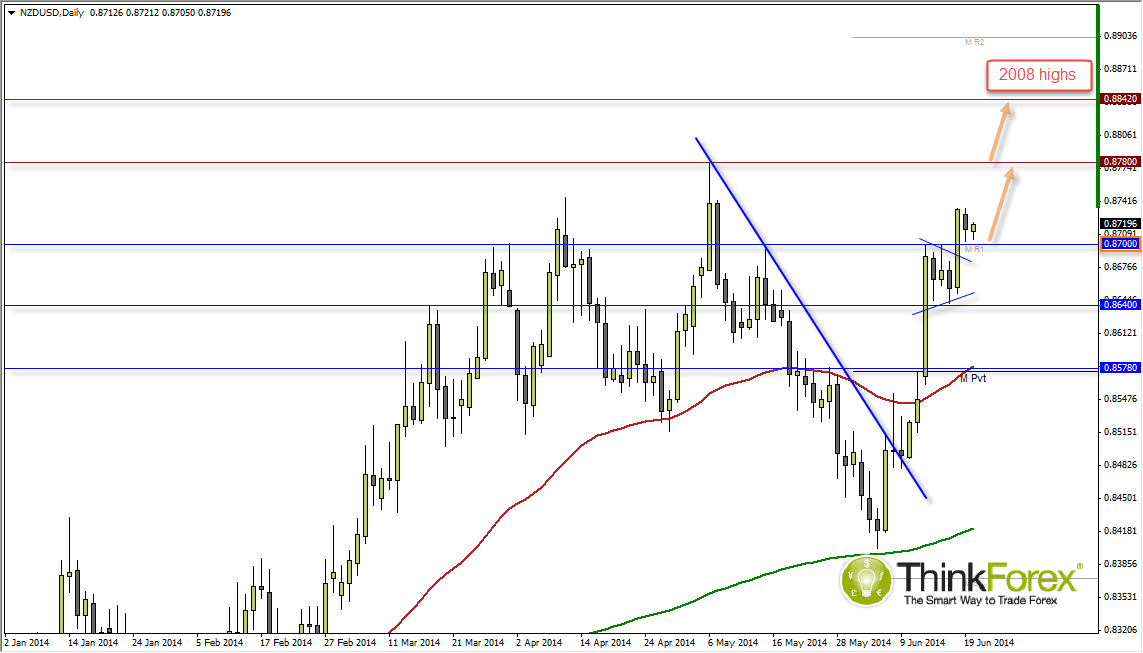

The initial target of 0.87 was reached following the RBNZ rate hike and following a quick consolidation and break above this resistance level, may now provide support going forward for new bullish trades.

The USD Index continues to look heavy and my initial target is back down to 80, which will continue to provide bullish support for AUD and NZD. I also expect it to trade below 79 over the next couple of months before printing a 6.4yr cycle low. Until then the higher-yielding currencies should remain their bullish tones and provide some nice little runs before the inevitable reversals.

Yesterday's close produced a Bearish Harami to suggest sideways trading, but as long as we remain above 0.87 then my near-term bias will also remain bullish. A break below this key level will see me put NZD/USD aside until I see basing patterns at support to anticipate the next leg up.

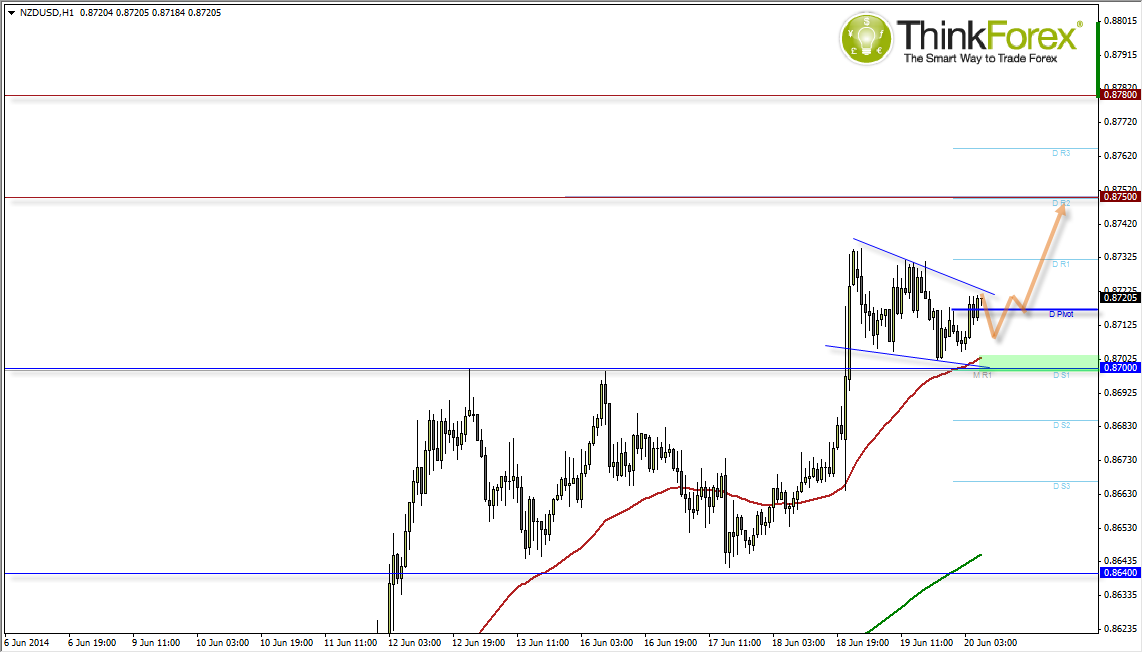

Currently oscillating around the Daily Pivot it would not be unwise to expect another leg down towards 0.87. Here we have several technical support levels including the 50he eMA, DS1 and horizontal S/R. I expect this level to hold going into the end of the week, so in the event of a dull Friday (and no extreme gaps over the weekend) this may provide buying opportunities next week for those with more patience.

However bias is pretty clear: Above 0.870 targets 0.875 and 0.878 highs from 2008.