No Bitcoin frenzy at CME yet

- Monday was the first full day of trading for the Bitcoin futures market of CME. Volume and volatility was low, moderating any expectations of a new significant surge in the price of the cryptocurrency. Main reasons cited for the low volume and lack of excitement were high initial margins that are required, Dollar deposits instead of Bitcoin and time limitations set by exchange opening hours. In addition to that, warnings about the cryptocurrency increase as France’s finance minister is pushing for a debate about regulating the cryptocurrency at the next G20 meeting and the governor of the National Bank of Denmark states that bitcoin is a dangerous bubble. It remains to be seen whether Bitcoin is a bubble or not and if the warnings consist a self-fulfilling prophecy or not.

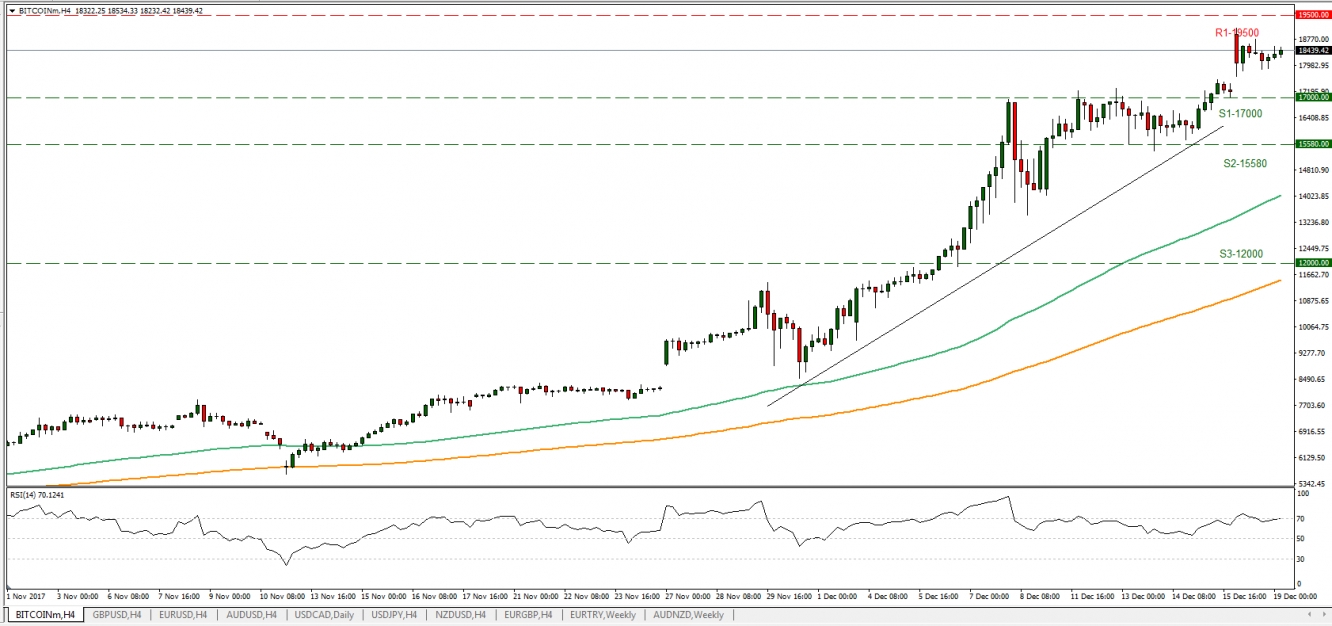

- Bitcoin dropped on Monday during the Asian morning, however it regained some of its losses during the European day and continued to trade in a consolidative manner throughout the day between the 17000 (S1) support level and the 19500 (R1) resistance level. Should the pair be influenced by the bad press and the low volumes we could see it break the 17000 (S1) support level and aim for the 15580 (S2) support zone. Should the cryptocurrency come under buying interest, it could break the 19500 (R1) resistance level and aim for the 21000 (R2) resistance hurdle.

US tax overhaul gaining support, effectiveness questioned

- Senator Collins stated that it will vote the tax reform adding further assurance that the bill will pass. As certainty of reform passing rises, media reports suggest that scrutiny about the effectiveness of the tax reform also increases. Tax issues arise between federal government and individual states as loopholes are found in the proposed reform. On the international aspect of the proposed tax reform, worries seem to grow in the EU as it may influence US subsidiary businesses in Europe and have a wider impact on global tax rules and even financial stability should one consider the effects on the US deficit.

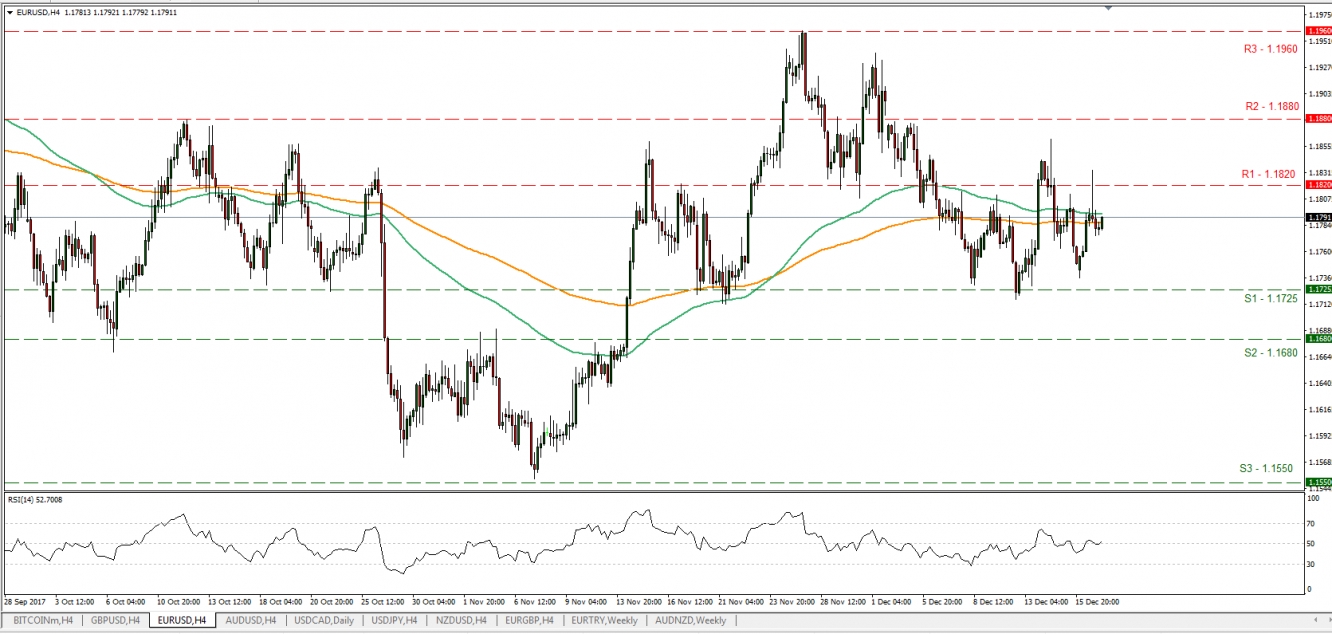

- EUR/USD, yesterday Monday, during the Asian and European morning rose by 98 pips, broke the 1.1820 (R1) resistance barrier for a short period of time, and later surrendered some of its gains and continued to trade between the 1.1725 (S1) support level and the 1.1820 (R1) resistance level. Should the bears take the driver’s seat we could see the pair braking the 1.1725 (S1) level and aim for the 1.1680 (S2) support zone. Should the bulls take the reins again today we could see the pair break the 1.1820 (R1) resistance level again and aim for the 1.1880 (R2) resistance zone.

In Today’s other economic data

- We get from Germany the Ifo Business Climate indicator for December and New Zealand’s milk auctions figures for the past two weeks. Later on the US Building stats for November are to be released

- As for speakers, Federal Reserve Bank of Minneapolis President Neel Kashkari will speak today.

BTC/USD

Support: 17000 (S1), 15580 (S2), 12000 (S3)

Resistance: 19500 (R1), 21000 (R2), 23000 (R3)

EUR/USD

Support: 1.1725(S1), 1.1680 (S2), 1.1550 (S3)

Resistance: 1.1820(R1), 1.1880(R2), 1.1960(R3)