The Nikkei 225 plummeted last night, and not surprisingly either as equity markets took a bit of a pummeling and as the Japanese Yen fell. I have talked previously about the correlation between the two in my previous articles, but suffice to say, a strengthening Yen is bad for the Nikkei and leaves a sour taste for index bulls.

The current bullish trend line in play though, is quite strong, with touches back in April and May of 2013, and some recent ones in May of this year. The bullish trend line has certainly had its fair share of testing suffice to say. But, should we expect the trend line to crack and are there signs that it might in this case?

I don’t believe so.

My reasoning is numerous on this, but I certainly believe that there is more upward momentum for the Nikkei to come, despite the pull backs as of late.

Firstly, the sales tax that has just been implemented in Japan: lifting the sales tax rate from 5% to 8%, is likely to dampen consumer spending for some time. This in turn will likely weaken the Yen in the future and lead to the Nikkei rising accordingly. The tax proceeds that are expected have already been factored into future spending from the Japanese government, so we shouldn’t expect any fiscal savings so to speak.

Secondly, with the implementation of the sales tax, the Bank of Japan will likely look to stimulate the market when it sees a drop off in consumption and a threat to its 2% inflation target, which it has reiterated numerous times it will do anything to achieve to end the country's 15 years of stagflation. Despite the current annual 50 trillion yen policy in place, markets are still unsure if this will achieve the so called golden rate that the Bank of Japan is aiming for.

Thirdly, the Yen dropping below the 100 mark against the USD poses some risks for the country. Export markets bleed when it touched the 70 mark, and corporations rallied the government to act to restore the competitive pricing of the Yen. It is in the country's best interest not to let current levels fall any further, especially with very competitive neighbours such as China and South Korea nipping at their heels.

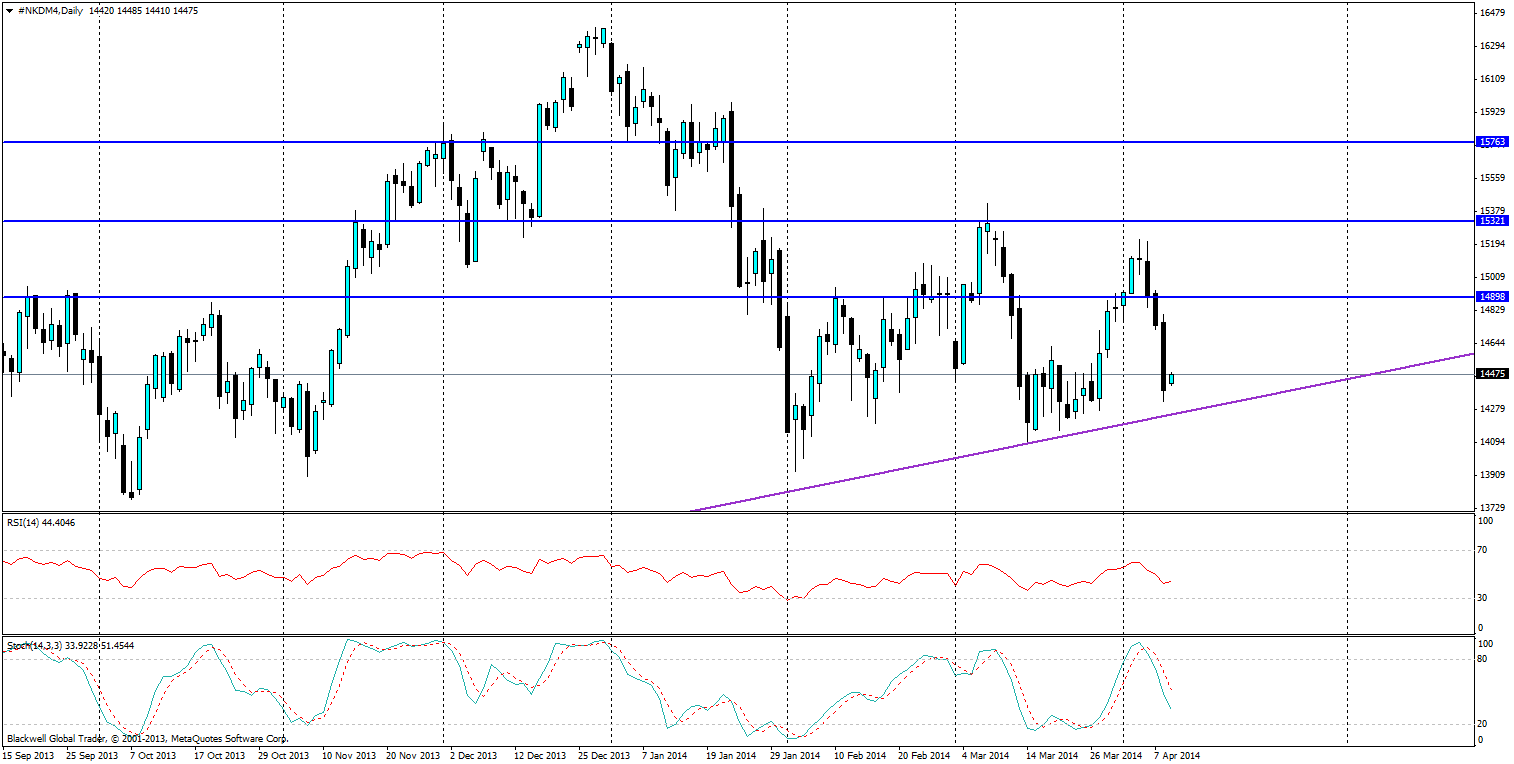

Source: Blackwell Trader (Nikkei 225, D1)

The technical aspect is much easier to digest though for the Nikkei: a solid bullish trend line coupled with a heavy ranging motion. The RSI is starting to show a turn while the slow stock is still showing momentum downwards. While the RSI is certainly showing things are starting to shift upwards its worth, be a little cautious and setting entry points about the market, as a shift to the current trend line before bouncing off could be more realistic than the Nikkei charging back up the charts.

Resistance levels are likely to be found at 14898, 15321 and 15763. While looking for take profit opportunities, the first level of resistance will be the safest option when the Nikkei rises. I would not expect any massive movements in the current climate until we see signs of stimulus from the Bank of Japan, which could be some time away, or until it has had time to digest the recent tax increases on goods, which could take up to two months at least. As for support levels, I would expect to see the trend line at play used as dynamic support, but I would certainly reassess these levels if the Nikkei climbs higher to the current resistance levels.

The Nikkei is certainly looking like a good opportunity for traders. With a strong Yen currently containing the Nikkei and the Bank of Japan’s mandate to keep inflation rising to the 2% threshold, it looks likely we will see rises for the Nikkei. Keep in mind the trend line which is strong as well when looking for gains, but any breakthrough could signal the bears looking to take control or consolidation within the market.