- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fiat Chrysler (FCAU) Q2 Earnings & Revenue Beat Estimates

Fiat Chrysler Automobiles N.V. (NYSE:FCAU) is an international automotive company. It designs, manufactures, distributes and sells vehicles, components and production systems. The company owns the Abarth, Alfa Romeo, Chrysler, Dodge, Fiat, Fiat Professional, Jeep, Lancia and Ram brands. Fiat Chrysler is benefiting from rising sales in the U.S. and Europe. The company intends to expand vehicle sales in key markets throughout the world. The company also focuses on maintaining cost efficiency.

We have highlighted some of the key stats from this just-revealed announcement below:

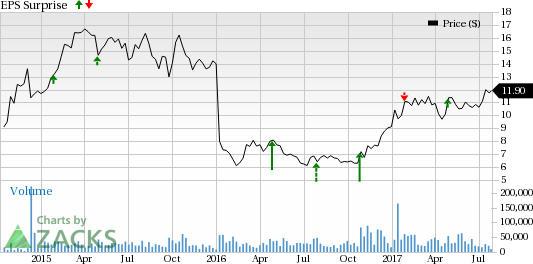

Estimate Trend & Surprise History

Investors should note that the earnings estimate for Fiat Chrysler for the second quarter have going down over the 30 days.

The company delivered positive earnings surprises in three of the trailing four quarters with an average beat of around 22.48%.

Earnings

Fiat Chrysler’s earnings increased to €0.69 (76 cents) per share in the second quarter of 2017, up about 49% from the year-ago quarter, beating the Zacks Consensus Estimate of 59 cents.

Fiat Chrysler Automobiles N.V. Price and EPS Surprise

Revenues

Fiat Chrysler reported revenues of €27.93 billion ($30.71 billion), topping the Zacks Consensus Estimate of $29.21 billion, higher than €27.89 billion recorded in the year-ago quarter.

Key Stats/Developments to Note

Fiat Chrysler reiterated its expectations for 2017. The company projects revenue in 2017 to be in the range of €115 billion to €120 billion. The company expects adjusted net profit to be over €3 billion.

Zacks Rank

Currently, Fiat Chrysler has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Fiat Chrysler Automobiles N.V. (FCAU): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.