- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Newmont Poised On Debt Cuts & Growth Projects Amid Cost Woes

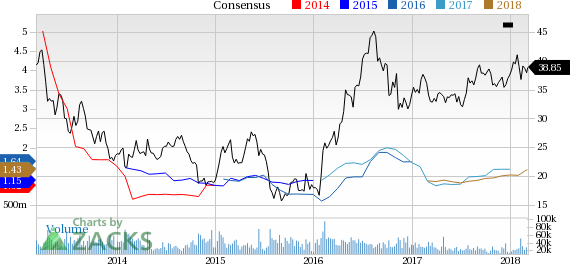

On Mar 6, we issued an updated research report on gold mining giant, Newmont Mining Corporation (NYSE:NEM) .

Newmont recorded wider year-over-year loss in fourth-quarter 2017. Its adjusted earnings were in line with the Zacks Consensus Estimate while sales trailed.

The company expects attributable gold production in the range of 4.9-5.4 million ounces for 2018 and 2019 factoring in full potential mine plan, recovery improvements and throughput.

Newmont’s shares have gained 9.8% in the last three months, outperforming the industry’s 3.9% decline.

Investment in Growth Projects & Debt Reduction to Drive Results

Newmont is making notable progress with its growth projects. The company continues to invest in growth projects in a calculated manner. It is pursuing a number of projects including Subika Underground and Ahafo mill expansion in Africa and Twin Underground in North America.

In fourth-quarter 2017, Newmont successfully started commercial production at its Tanami expansion project in Australia, which is expected to improve gold production at the mine. The Subika Underground and Ahafo mill expansion projects represent additional upside. Commercial production at Subika is expected in the second half of 2018 while the same for the Ahafo expansion is expected in the second half of 2019. Commercial production from the Twin Underground expansion is also expected in mid-2018.

We are also impressed with the company’s efforts to reduce debt and improve efficiency. Newmont reduced its net debt to $0.8 billion at the end of 2017. Since 2013, the company has been streamlining its balance sheet and has lowered its net debt by more than 83%.

Rising Production Costs Pose Headwind

Rising production cost is a concern for the company. Newmont’s all-in sustaining costs (AISC) rose 5% to $968 in last reported quarter, mainly due to higher per unit cost applicable to sales (CAS), higher exploration costs and increased sustaining capital. Increased project spending is expected to keep AISC at elevated levels moving ahead.

Newmont expects its AISC to be between $965 and $1,025 per ounce in 2018, higher than $924 recorded for full-year 2017.

Zacks Rank & Stocks to Consider

Newmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Steel Dynamics, Inc. (NASDAQ:STLD) , Westlake Chemical Corporation (NYSE:WLK) and United States Steel Corporation (NYSE:X) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics has an expected long-term earnings growth rate of 12%. Its shares have soared 37.3% over the last six months.

Westlake Chemical has an expected long-term earnings growth rate of 12.2%. Its shares have moved up 53% over the past six months.

U.S. Steel has an expected long-term earnings growth rate of 8%. Its shares have rallied 65.2% over the last six months.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Newmont Mining Corporation (NEM): Free Stock Analysis Report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

United States Steel Corporation (X): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.