New Zealand strikes many as the promised land currently, with a strong export market and strong growth in its economy it certainly looks good. Not only that, but we have seen interest rates rise, as the Reserve Bank of New Zealand (RBNZ) looks to apply pressure to protect the inflation target.

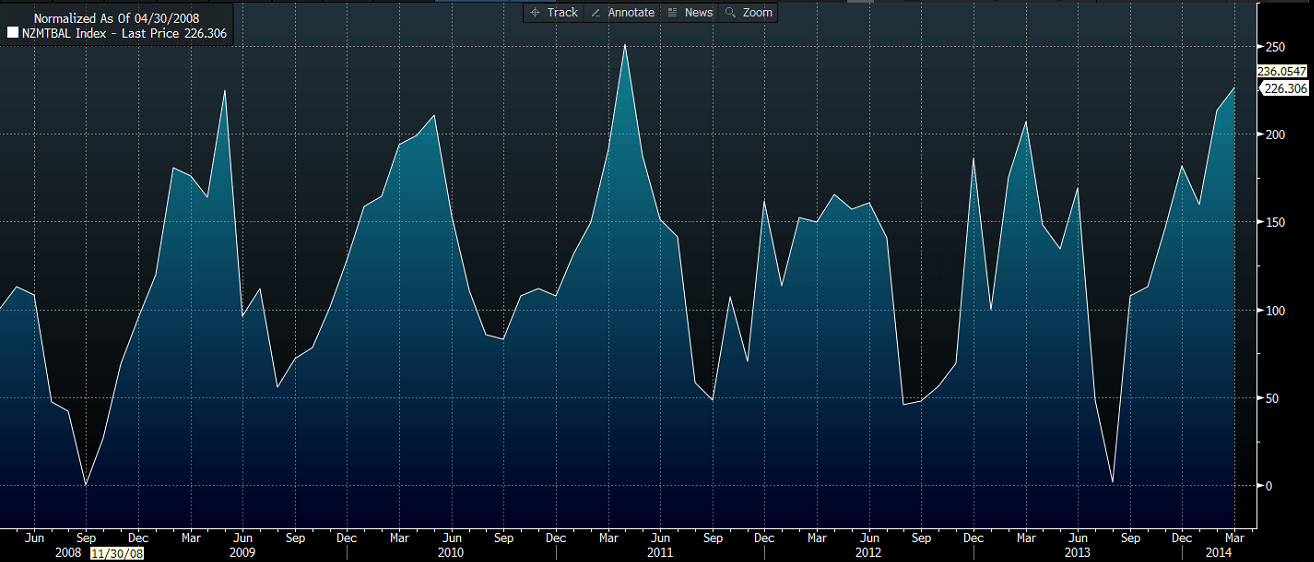

So today's data should come as no surprise to all the currency traders out there. Exports, imports and trade balance data all beat expectations – just.

Positive data across the board and rising interest rates generally lead to a stronger currency, especially when you factor in capital inflows to take advantage of rate rises. But in the case of the New Zealand dollar its very transparent and markets have long since priced this all in. Instead, we are now starting to see the emergence of concerns over the currency. With an export driven market a strong dollar will impact heavily on the market itself, especially when you factor in commodity prices, which I touched on my past article.

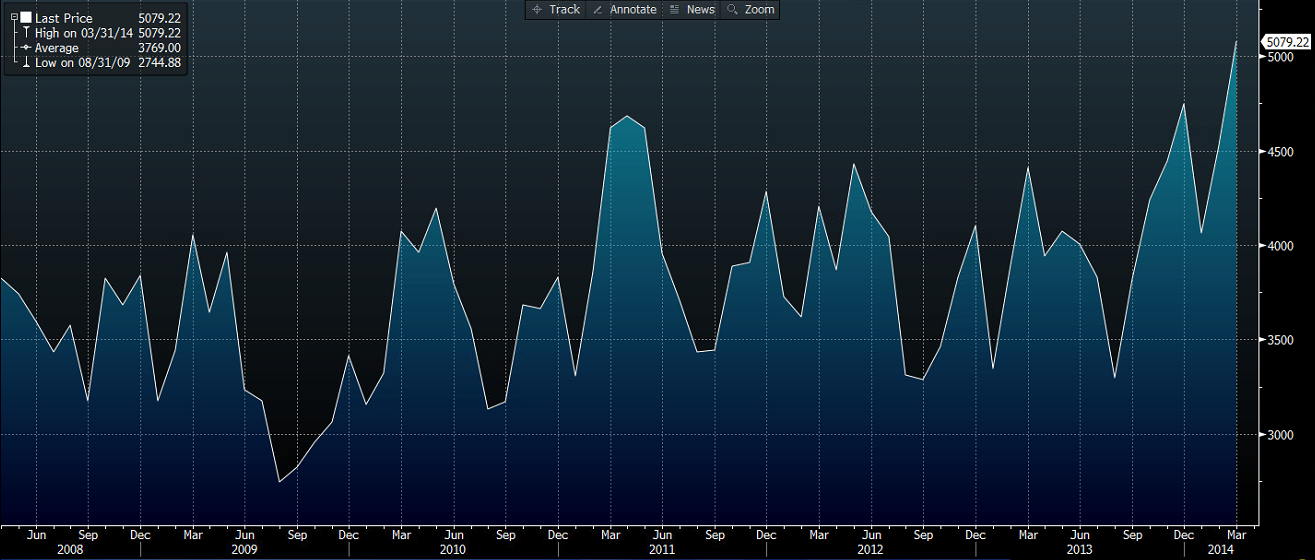

One thing is clear, is that trade balances in NZ are certainly cyclical and we should expect to see falls in the coming months. When we look at the most up to date chart from Bloomberg, it's clear that during the winter months the trade balance certainly does decrease and markets will be expecting weaker rather than stronger balances in the coming months certainly.

With the cyclical nature of the NZ economy during winter months, we could potentially see more falls. One of the main reasons is the current interest rate rises . Yes, they lead to capital inflows from markets, but at the same time they put pressure on the housing market, which in turn could lead to troubles at home, and a reduction in spending by consumers as they fight to pay more expensive mortgages.

Secondly the NZD is too high against our major competitors like the AUD and this is leading to heavy losses for some exporters. I would expect the RBNZ to get impatient and look to turn the tables on the currency during periods of weakness to get it a more considerate level for our major exporters.

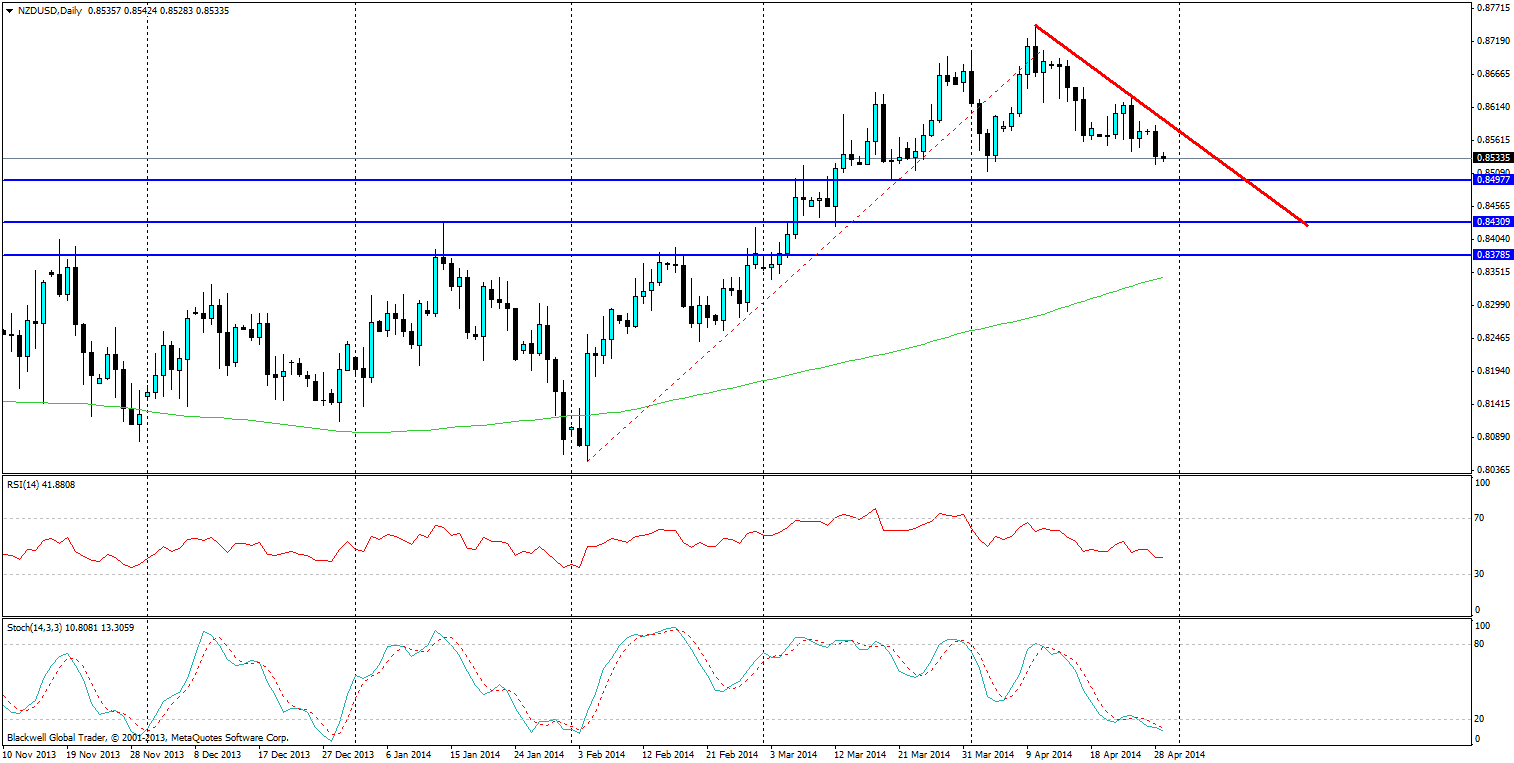

Looking at technicals for the NZD/USD, there is a downward trend line starting to form and the stoch is showing momentum certainly in the bears favour. Long term, it’s likely we will see pressure on the 85 cent level as the market generally finds anything above this to be a little to its dislike. Many economists are also pointing to a 81-83 cent level being more stable for the NZD and it’s likely we will see a dip down to there over the next few months.

While many will be looking at the NZD and thinking there is more room to rise, sadly there is not. The markets have already priced in further rate rises, and the booming economy, the NZD is in a good position, but currently it’s a little overvalued and signs are starting to point to a down trend in the market place. I see it falling further and back into the 84 cent range, but not before testing support levels all the way down.