- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

New Zealand Dollar Ready To Turn?

The New Zealand dollar has taken an absolute beating as of late, as markets thrashed it in the wake of Reserve Bank of New Zealand (RBNZ) comments and weak commodity data. This was further confirmed yesterday with the recent Fonterra milk forecast payout; while not an economic calendar event, it should be, given the impact the dairy sector has on the economy.

The Milk impact is largely missed by overseas investors but it has a large impact on the economy, and especially when it comes to spending, and the $6/kg payout will have a very large impact as 4 billion dollars is going to be cut from the primary economy where there otherwise would have been spent based on estimated forecasts earlier on. With the lack of spending in the economy, it will certainly influence inflation, which has so far been a little weaker, and as a result the RBNZ has held back from raising interest rates. This hit to the payout will undoubtedly lead to a flow on effect too inflation and we may now not see any further interest rates rises until the end of year or until early 2015.

Despite all of this it’s not all doom and gloom for the kiwi dollar for currency traders. Yes, we are going to see weaker times for the NZDUSD in the short term, but in the long term, it's still a very attractive for carry traders who are looking for fixed interest returns.

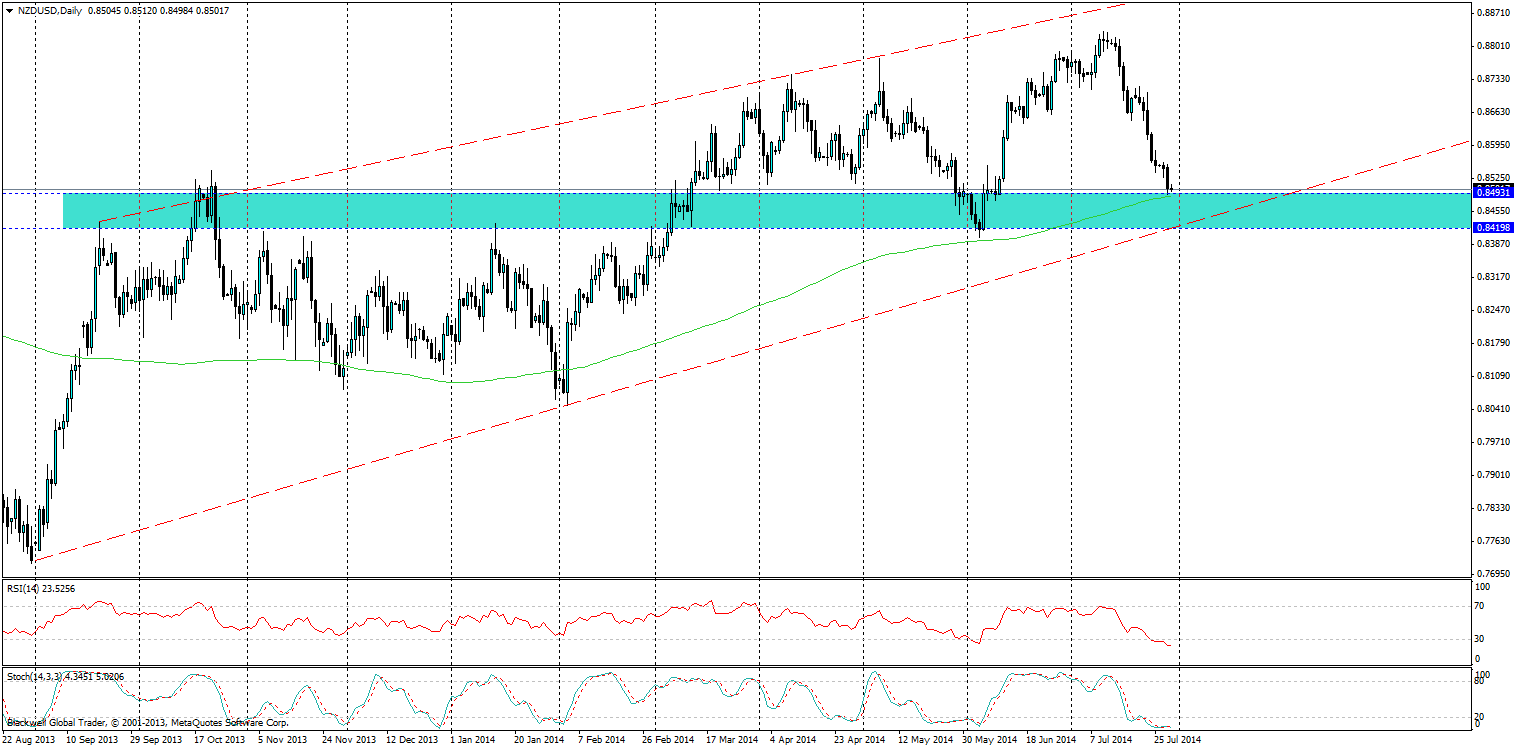

Currently the NZDUSD is sitting just below the turning zone that many will be looking to watch and see. The NZD has been in a strong channel for some time now and that bullish sentiment still remains despite the weakness, and the carry traders will be looking for a turning point in the market and they will find it at the trend line which is presently in the market.

When targeting the NZDUSD the 0.8493-19 zone on the trend line is likely to see a lot of volatility as the market battles it out to see if we will see a push higher, or in fact a push lower through the trend line and into bear territory. I would expect the bullish traders to come back into the market after being scared away in the recent weeks, and the trend line is where they will target. If you look at the indicators you can see that the market is heavily oversold in its present form as people hold of buying at present, momentum as well is still in favour of the bears.

So while the movement is southwards currently, it’s not because traders have abandoned the market, they are instead waiting to strike and they are getting ever closer to the point of coming back into the market at present. Look for movements higher out of the present zone or a breakdown on the trend line as it’s likely we will see a bounce back as traders come back into the market hunting for yield.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.