NeuroVive Pharmaceutical's (ST:NVP) planned rights issue (subject to approval at the EGM) is expected to bring in a minimum guaranteed amount of at least SEK55m (gross), which would extend the cash reach to 2019 and past several R&D events. Namely, the company will be able to initiate two new clinical trials with both leading assets KL1333 (Phase I) for genetic mitochondrial diseases and NeuroSTAT (Phase II) for traumatic brain injury (TBI). In addition, the company will advance its broad preclinical portfolio, aiming to out-license one of the assets, NV556, for NASH. Our updated valuation is SEK1.44bn or SEK18.0/share compared to SEK1.38bn or SEK26.3/share previously.

New funds could finance operations into 2019

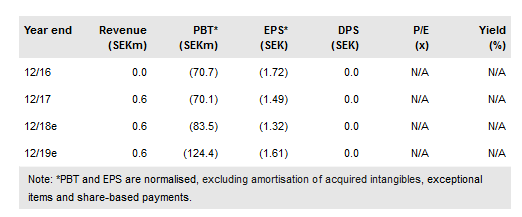

On 15 February 2018, NeuroVive announced a rights issue, which could raise up to SEK78.5m gross in total. 70% of the issue is guaranteed by several existing investors. We have included the guaranteed amount of SEK55.0m in our model which, if added to end-FY17 cash, results in SEK84m. According to our model this is sufficient for FY18, while potential funds from the remaining part of the rights issue and attached warrants (see below) could extend the cash reach well into 2019.

To read the entire report Please click on the pdf File Below: