- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Netflix (NFLX) Cuts Stream Quality In Israel On Coronavirus Woes

Netflix (NASDAQ:NFLX) will reduce the bitrate of its streams for 30 days, in an attempt to lower its network traffic by 25% in Israel, per a Reuters report. The announcement comes after the Ministry of Communications urged the streaming giant to help reduce load on the country’s infrastructure.

Internet traffic is increasing as more and more people are spending time at home, in line with social-distancing guidelines during the coronavirus pandemic.

Internet service providers reported a 20%-30% rise in use in Israel on average since the outbreak began, per the country’s Ministry Of Communication’s report.

The streaming giant agreed to comply with the new measure set to be implemented gradually over the week. Netflix videos in standard definition uses 1 GB of data per hour, while HD videos use 3 GB data per hour.

Last week, Netflix, YouTube, Disney (NYSE:DIS) , Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) had announced that they will downgrade their video quality to ease the pressure on the Internet and to facilitate work-from-home and online learning during the period of confinement in European countries to combat the spread of coronavirus (COVID-19).

Solid International Content to Counter Competition

Netflix’s expanding international content portfolio is not only expected to contribute to subscriber addition but also offset stiff competition from the likes of Disney, Apple and Amazon.

Notably, Disney+ has gained 28.6 million subscribers since its November 2019 launch. It is predicted to hit 126 million subscribers worldwide by 2025.

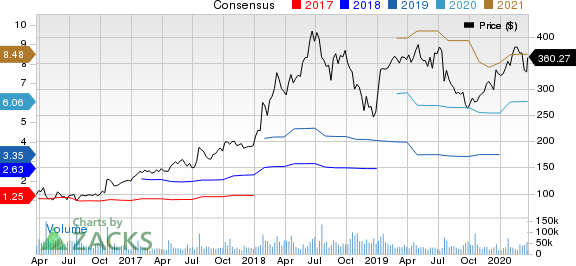

Netflix, Inc. Price and Consensus

Moreover, Apple’s aggressive pricing strategy of $4.99 per month for Apple TV+ has intensified competition for Netflix in the streaming market.

Nonetheless, Netflix is well poised to make the most of this surge in consumption owing to its diversified content portfolio, courtesy of heavy investments in production and distribution of localized, foreign-language content and an expanding international footprint.

The company is working on projects across Mexico, Spain, Italy, Germany, Brazil, France, Turkey and the entire Middle East to drive international subscriber growth. Notably, the company’s streaming service is available in 190 countries.

Markedly, the company generated $1.56 billion in revenues from its Europe, Middle-East and Asia (EMEA) segment in fourth-quarter 2019. Netflix reported 51.8 million paid subscribers in EMEA market at the end of 2019, representing 31% of its worldwide customer base.

Moreover, the streaming giant will invest around $17.3 billion this year in content, according to a Wall Street forecast, up from $15.3 billion in 2019, per a Variety report.

Last month, Netflix rolled out a new feature on its interface that will show the daily overall top-10 titles in a subscriber’s country, as well as the top 10 most popular series and films when users select TV shows or movies tabs.

Netflix currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.