- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Neogen (NEOG) Q3 Earnings & Revenues Miss, Margins Decline

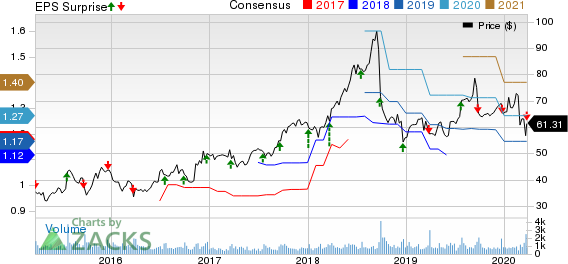

Neogen Corporation’s (NASDAQ:NEOG) third-quarter fiscal 2020 earnings per share (EPS) of 23 cents lagged the Zacks Consensus Estimate of 27 cents by 14.8%. The company’s EPS lagged the year-ago figure of 25 cents by 8%.

Revenues in the quarter grew 2.2% on a year-over-year basis to $99.9 million, missing the Zacks Consensus Estimate of $102.1 million by 2.2%.

Per Neogen, it registered modest contribution from genomics services (2%) and growth in a number of its food safety product lines despite the coronavirus pandemic. The company also registered strong top-line contributions from most of its key geographies.

The reported quarter was the 112th of the last 117 quarters to mark a year-over-year revenue increase.

Further, Neogen made four acquisitions to enhance its global foothold, which includes the acquisition of its distributors in Argentina and Uruguay. Also, the recent buyouts of its food safety distributors in Australia and Italy are expected to aid its top line as it can now directly sell its entire portfolio of food safety, animal safety and genomics products in most countries.

Segments in Detail

Food Safety: For the quarter under review, revenues in the segment totaled $50.5 million, down 1.2% year over year. The year-over-year decline was driven by a significant decrease in sales of drug residue test kits after Neogen’s exclusive relationship with its distributor of dairy antibiotic tests in Europe ended during the quarter. Another factor denting the segment’s revenues is the loss of forensic kit sales in Brazil due to a large number of customers switching to an alternative technology platform.

However, the decline in revenues was partially offset by 5% growth in sales of the company’s general sanitation products (including the AccuPoint Advanced product line), 4% increase in rapid diagnostic tests sales, 4% rise in Neogen’s food allergen product line.

Animal Safety: In the fiscal third quarter, the segment recorded revenues of $49.4 million, reflecting 5.9% growth from the year-ago quarter. The uptick mainly resulted from the domestic genomics business, with an additional incremental volume of rodenticides, insecticides, and certain cleaners and disinfectants. The company’s global animal genomics business recorded an uptick of 8% in the reported quarter, resulting from strength in the domestic companion animal market, and the global genomic testing of beef and dairy cattle, swine and poultry.

Notably, in the reported quarter, Neogen launched Igenity + Envigor. Per the company, it is the first and only genetic test in the beef industry that measures heterosis in crossbred cattle.

Margin Details

Gross margin contracted 29 basis points (bps) to 45.4% in the fiscal third quarter.

Sales and marketing expenses increased 5.7% to $17.7 million, whereas administrative expenses rose 7.7% to $10.8 million. Research & development expenses were $3.8 million, up 17.7%. All these expenses elevated operating costs by 7.7% to $32.3 million.

During the reported quarter, operating income was $13 million, which declined 10.9% from the year-ago quarter’s $14.6 million. Operating margin contracted 192 bps to 13.1%.

Our Take

Neogen exited the fiscal third quarter on a disappointing note, with earnings and revenues missing the Zacks Consensus Estimate. Nonetheless, the company witnessed a solid performance by the Animal Safety segment and strong contributions from the Food Safety segment’s product lines. Acquisitions by Neogen also resulted in a revenue uptick.

However, headwinds like unstable economic conditions, mainly resulting from the coronavirus outbreak, currency issues and changes in Neogen’s international business equations impacted its revenues both domestically and globally. Escalating costs and contraction in both margins are concerning as well.

Zacks Rank & Key Picks

Neogen currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks, which reported solid results this earnings season, are Stryker Corporation (NYSE:SYK) , STERIS plc (NYSE:STE) and ResMed Inc. (NYSE:RMD) .

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Its fourth-quarter revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

STERIS reported third-quarter fiscal 2020 adjusted EPS of $1.45, outpacing the Zacks Consensus Estimate by 1.4%. Net revenues of $774.3 million outpaced the consensus estimate by 3.3%. The company has a Zacks Rank #2 at present.

ResMed currently carries a Zacks Rank #2. It reported second-quarter fiscal 2020 adjusted EPS of $1.21, surpassing the Zacks Consensus Estimate by 19.8%. Its revenues of $736.2 million outpaced the consensus mark by 1.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Stryker Corporation (SYK): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

Neogen Corporation (NEOG): Free Stock Analysis Report

STERIS plc (STE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.