The September contract of natural gas surged 24% last week. It was the best weekly performance since September 2009 and the highest settle of the year for the continuous prompt-month. What drove the massive percentage advance? A few things. Call it the ‘trifecta.’

First, production has slipped from July’s rebound highs off the May low – perhaps fewer active rigs and major capex cuts are finally becoming a growing concern in the minds of traders. Next, LNG export demand has ticked to the highest level since late June. LNG demand is back to about flat versus this time a year ago. Finally, near-term weather forecasts turned hotter starting today through much of next week. The result was a rally based on fundamentals, but also perhaps driven by some technical short-covering.

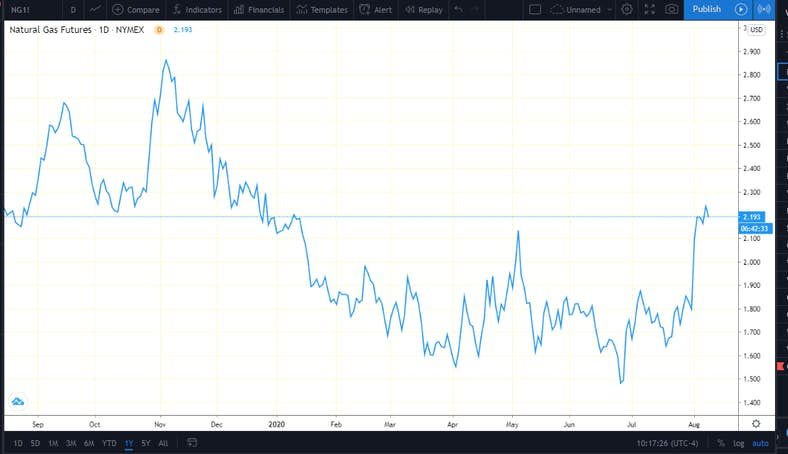

Looking closer at last week’s price-action, the prompt-month gapped higher in Sunday night futures trading from $1.81 to $1.88, but the major advance took place Monday morning. The price of $2.15 was quickly hit midday Monday, the highest tick on natural gas since the Tetco pipeline explosion price increase back in May. There was no let-up as September natural gas grinded higher to the Thursday morning peak of $2.284. A slightly bearish storage report finally brought the bears out of hibernation, and by the afternoon the market had fallen back to $2.13. Friday was rather quiet, but featured a rebound with an afternoon settle above $2.20 for the highest price of the year.

This morning, however, prices have come under pressure with the prompt-month down more than 2% to $2.19. The price of $2.30 appears to be tough to breakout from while $2.00 should support on the chart.

The market will look ahead to this week’s storage report expected to show a larger build than last week thanks to more mild weather, but smaller builds may be in store later this month.