The natural gas futures September contract backed up the prior week’s massive 24% gain with a small advance last week – that’s a win for the bulls as many recent rallies have been met with selling pressure in short-order. Last week seemed to be quite bullish on the charts considering prices consolidated between $2.08 and $2.28 before Friday’s surge above $2.30.

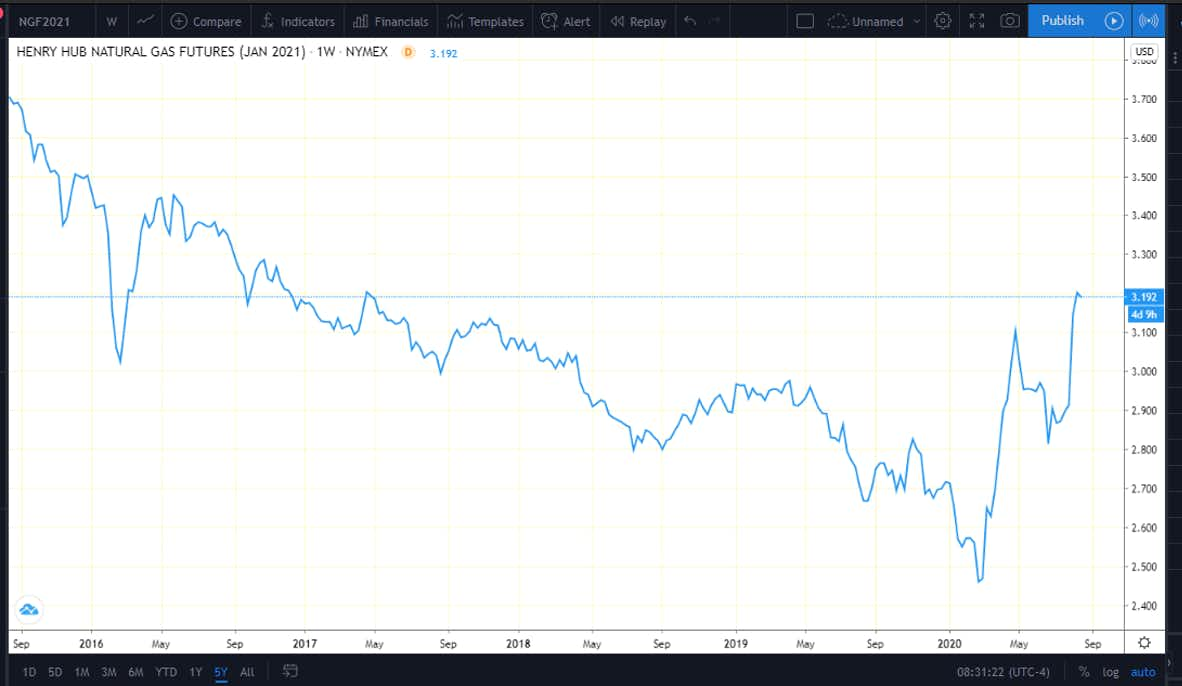

The settle was the highest since December 5, 2019. It’s the best two-week stretch for natty in nearly 5 years. Interestingly, prices for January 2021 touched their highest level since late 2016. The market appears to be growing every-more concerned about a tightening supply/demand balance come this winter.

Recently, production has softened while LNG export demand appears to have bottomed. Of course, the major near-term story is intense heat out west. Phoenix is on pace for its highest summer on record while CAISO was forced to enact rolling blackouts this weekend – more is on the way as the heat persists. Triple digit temps were notched in Washington state and ERCOT had record weekend demand on Saturday.

Looking closer at price-action, the prompt-month was quite boring virtually the entire week until the buying burst on Friday. News-flow was a little catalyst for intraweek gyrations. LNG exports generally increased while production went back and forth day to day. Thursday’s EIA storage report did little to move the market – it was larger than normal and slightly bearish to expectations.

The real story was the jump from $2.17 to $2.379 on Friday. Why’d that happen? Maybe traders were nervous ahead of the extreme heat in the west. SoCal spot cleared above $6 for the weekend. Also, there has been very odd trading in the former natural gas exchange-traded products DGAZ and UGAZ. There may have been strange trading mechanics at play too. Resistance is in the upper $2s while $2.30 and $2.05 should be support.

Chart used with permission from TradingView.com