After a gloomy week in global stock markets and downbeat global news, investors face the Holiday Season worrying that the Grinch has stolen Christmas.

However, subtle signs point to the possiblity that a major stock market rally could be imminent.

On My Wall Street Radar

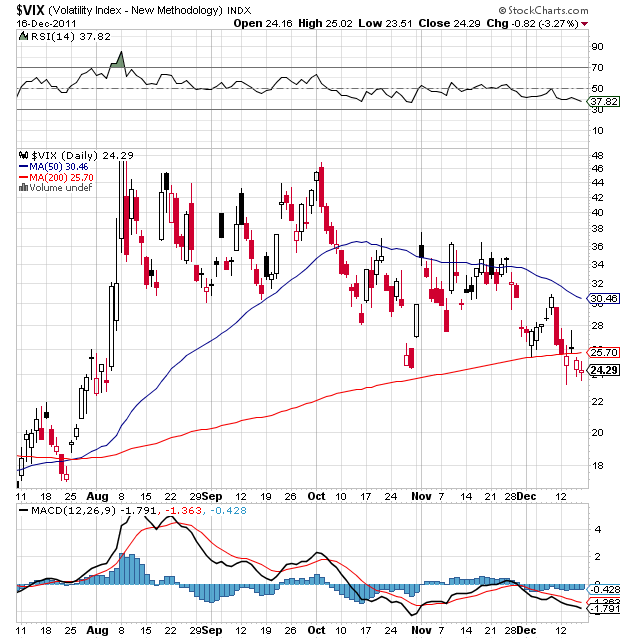

The VIX (NYSEARCA:VXX) is widely known as the “fear” index, and in spite of all of the fear in recent weeks, the chart above clearly indicates that fear and volatility have not reentered the marketplace. In fact, quite the contrary has happened as the VIX (NYSEARCA:VXX) is in a steady downtrend and now has made several closes below its 200 day moving average. This would indicate that the option market is looking for declining volatility which generally corresponds to rising stock prices over the next 30 days.

The Economic View From 35,000 Feet

The Economic View From 35,000 Feet

It’s all about Europe, it has been all about Europe and this week could mark a significant turning point in this ongoing and most would agree, annoying, crisis.

Here are the important points:

1. Spanish 2 Year Bond yields dropped to four month lows after last week’s well received auction which sold twice its original target.

2. The European Central Bank starts offering three loans to Euro Zone banks next week in what could be a powerful and dramatic refinancing operation to improve liquidity in the region and stimulate demand for the region’s government bonds.

3. Spanish 2 Year Bonds dropped to the lowest levels seen in four months

4. The European Stability Fund (ESM) will be launched a year earlier than planned in mid-2012 with 500 billion Euros to lend to troubled nations and Germany may accelerate its payments into the fund.

Bottom line: Markets have been demanding immediate action from European leaders and the ECB and this week could see the start of significant efforts in that direction.

Beyond Europe, economic reports at home continue to show improvement and significant technical, seasonal and fundamental indicators point to the possibility that an important shift may be imminent:

1. Small cap stocks (NYSEARCA:IWM) are traditionally market leaders and they made a quick turn late last week with the Russell 200 Index (NYSEARCA:IWM) reclaiming its 50 day moving average.

2. “Dr. Copper,” (NYSEARCA:JJC) widely viewed as a leading indicator of global economic activity appears that it might have put in a double bottom.

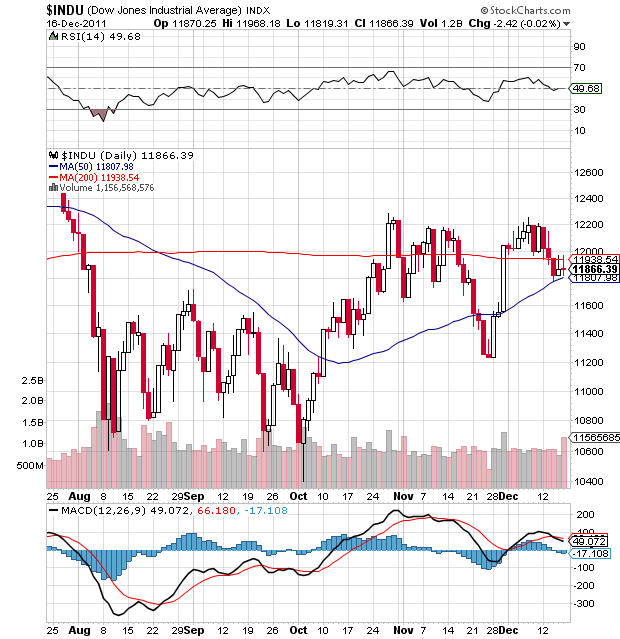

3. The Dow Jones Industrial Average (NYSEARCA:DIA) stubbornly clings to its 50 day moving average and the 50 day average is turning up and heading towards crossing the 200 day which is widely known as “The Golden Cross.”

4. Seasonality points to the probability of a rally as the next two weeks are traditionally one of the strongest periods of the year on a historical basis.

5. This week brings a rash of domestic economic news in the housing sector, on Thursday we get the final Q3 GDP reading and leading indicators and Friday brings reports on income and durable goods orders. Any positive news here would be welcomed by market participants.

Bottom line for stock and ETF investors: The markets are being driven by Europe and fear of an implosion there. Heightened action in the region will likely be bullish, along with declining European bond rates, seasonal factors and ongoing complacency among professional options traders. Low volumes will exaggerate moves in either direction and so we can expect volatility to continue. 2012 could be a different story, but for today, a major rally could be imminent.

Disclaimer: Wall Street Sector Selector actively trades a wide range of exchange traded funds (ETFs) and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Signs Point To Major Stock Market Rally

Published 12/19/2011, 04:04 AM

Updated 05/14/2017, 06:45 AM

Signs Point To Major Stock Market Rally

Subtle Signs Point To Possibility Of Major Stock Market Rally

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.