- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

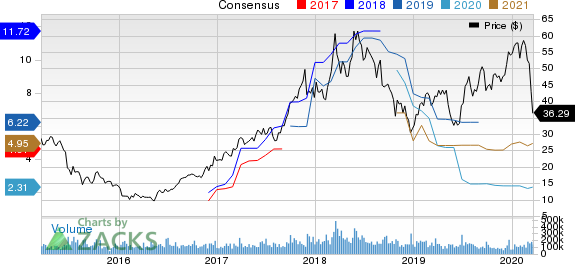

Micron (MU) To Report Q2 Earnings: What's In The Offing?

Micron Technology (NASDAQ:MU) is scheduled to report second-quarter fiscal 2020 results on Mar 25.

For the quarter, the company expects revenues of $4.5-$4.8 billion. The Zacks Consensus Estimate is currently pegged at $4.66 billion, suggesting a decline of 20.2% from the year-ago reported figure.

Management projects earnings to be between 29 cents and 41 cents per share. The consensus mark for earnings stands at 38 cents, calling for a 77.8% slump.

Over the trailing four quarters, the company’s earnings surpassed the Zacks Consensus Estimate twice for as many misses, the average positive surprise being 0.4%.

Factors to Consider

The coronavirus outbreak is expected to have negatively impacted Micron’s fiscal second-quarter performance. The virus has not only claimed human lives but is also affecting the business community with global demand-and-supply disruptions.

High business exposure to China makes the company more vulnerable, as the country has been on a lockdown since late January due to the virus outbreak. Micron’s early quarter benefits from resuming chip shipments to Huawei might have been significantly offset by global business disruptions since late January.

Further, higher mix of lower-margin NAND, coupled with low memory prices and minimal decline in manufacturing cost, is likely to have strained margins.

Also, underutilization expenses associated with the impending acquisition of IM Flash Technologies, its joint venture with Intel (NASDAQ:INTC) , are expected to have dented margins.

In addition, DRAM revenues are likely to have declined year over year and sequentially as well. The Zacks Consensus Estimate for DRAM revenues is currently pegged at $3 billion, indicating a 25.8% year-over-year decline and 3.7% sequentially.

Nonetheless, Micron is witnessing progress in customer inventory adjustments in most of its end-markets since second-half 2019. This might have positively impacted bit demand for DRAM during the fiscal second quarter. A solid uptick in DRAM bit shipments for the cloud, graphics, gaming consoles and automotive application markets is anticipated to have been a positive in the quarter to be reported.

Moreover, the 1Z DRAM chips, which Micron began to ship last August, are expected to have been a tailwind to its business during the period in discussion. Notably, in the fiscal first quarter, the 1Z DRAM chips had the fastest revenue ramp up for any product in its history.

Nevertheless, prevailing weakness in pricing across most market segments is expected to have dampened Micron’s computing and networking business unit. The Zacks Consensus Estimate for revenues from this segment stands at $1.7 billion, indicating a plunge of 35.4% from the year-ago reported number.

What Our Model Says

Our proven model predicts an earnings beat for Micron this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Micron currently carries a Zacks Rank of 2 and has an Earnings ESP of +5.05%.

Some Other Stocks With Favorable Combinations

Here are a couple of stocks worth considering as our model shows that these have the right combination of elements to beat on earnings in the upcoming releases:

Cadence Design Systems, Inc. (NASDAQ:CDNS) has an Earnings ESP of +3.07% and holds a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inovalon Holdings, Inc. (NASDAQ:INOV) has an Earnings ESP of +2.34% and currently carries a Zacks Rank of 2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Micron Technology, Inc. (MU): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Inovalon Holdings, Inc. (INOV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.