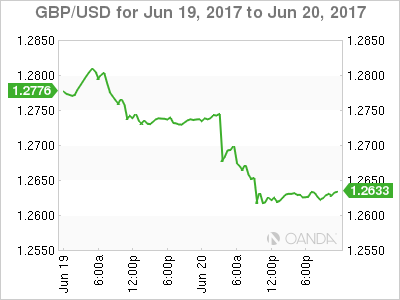

The British pound has recorded strong losses in the Tuesday session. In North American trade, GBP/USD is trading at 1.2620, down 0.90%. On the release front, there are no economic indicators out of the UK. Earlier on Tuesday, BoE Governor Mark Carney warned against interest rate hikes.

In the US, the current account deficit increased to $117 billion, but this beat the forecast of $124 billion. On Wednesday, the US will release Existing Home Sales and Crude Oil Inventories.

BoE Governor Carney was unusually blunt in a speech in London on Tuesday, when addressing interest rate policy. Carney poured cold water on raising interest rates, saying that “now is not yet the time to begin that adjustment”. With the economy having weathered the Brexit storm quite well, there have been calls for the BoE to raise rates, which hasn’t happened in over a decade.

The pressure was ratcheted higher last week, when three of nine MPC members voted to raise rates. Clearly, Carney felt the need to act and resist the calls for higher rates. The cautious Carney noted that consumer spending had dropped, and that more time was needed to evaluate how the economy reacted to the “reality of Brexit negotiations”. Carney finds himself in a corner, as he is dead set against hiking rates, but the weak pound has pushed inflation to unhealthy levels, as CPI rose 2.9% in May. If Carney holds back on any rate increases, inflation could continue to climb.

The Federal Reserve raised rates last week, but what surprised the markets was the upbeat tone of the rate statement. Fed policymakers noted that the labor market remained strong, and dismissed weak inflation levels as being temporary.

On Monday, Federal Reserve of New York President Charles Dudley continued the upbeat message, cautioning the Fed against halting its current tightening cycle. Dudley said that the tight labor market should lead to higher wages, which in turn would push inflation to the Fed’s target of 2.0%. If the Fed continues to send out a hawkish message, the odds of a rate hike in December (or even in September) are likely to increase.

Almost One Year On, Brexit Talks Get Underway

GBP/USD Fundamentals

Tuesday (June 20)

- 3:15 US FOMC Member Stanley Fischer Speaks

- 3:30 BoE Governor Mark Carney Speaks

- 8:30 US Current Account. Estimate -124B. Actual -117B

- 15:00 US FOMC Member Robert Kaplan Speaks

Wednesday (June 21)

- 10:00 US Existing Home Sales. Estimate 5.54M

- 10:30 US Crude Oil Inventories. Estimate -1.2M

*All release times are EDT

*Key events are in bold

GBP/USD for Tuesday, June 20, 2017

GBP/USD June 20 at 12:15 EDT

Open: 1.2730 High: 1.2758 Low: 1.2601 Close: 1.2622

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2313 | 1.2401 | 1.2571 | 1.2706 | 1.2865 | 1.2946 |

- GBP/USD was flat in the Asian session. The pair posted considerable losses in European trade and the downturn continues in North American trade

- 1.2571 is providing support

- 1.2706 is the next line of resistance

Further levels in both directions:

- Below: 1.2571, 1.2401 and 1.2313

- Above: 1.2706, 1.2865, 1.2946 and 1.3058

- Current range: 1.2706 to 1.2865

OANDA’s Open Positions Ratio

GBP/USD ratio is showing movement towards long positions. Currently, short positions have a majority (54%), indicative of trader bias towards GBP/USD continuing to move lower.