- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Wyndham (WYN) Beats Earnings Estimates In Q3, Lags Sales

Wyndham Worldwide Corporation (NYSE:WYN) reported mixed third-quarter 2017 results wherein earnings surpassed the Zacks Consensus Estimate while revenues lagged the same.

Earnings and Revenues Discussion

Adjusted earnings of $2.03 per share beat the Zacks Consensus Estimate of $2 by 1.5%. Also, the bottom line was up 7.4% year over year on the back of higher revenues as well as the company’s share repurchase program. However, third-quarter earnings were negatively impacted by higher expenses along with the effect of Hurricanes Irma and Maria.

Net revenues of $1.63 billion improved 4% year over year on the back of increased contribution from all of its segments. However, the top line lagged the Zacks Consensus Estimate of $1.67 billion by roughly 2%.

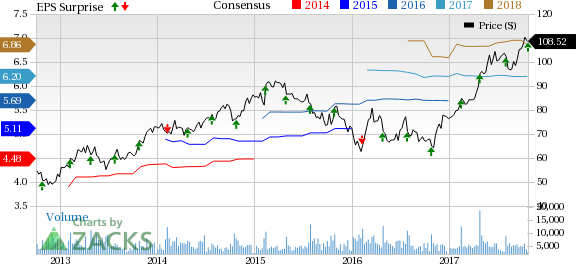

Wyndham Worldwide Corp Price, Consensus and EPS Surprise

Inside the Headline Numbers

Adjusted EBITDA (excluding share-based compensation expenses) increased 3.1% year over year to $436 million. Results primarily reflect growth in revenues, partially offset by higher variable compensation expenses and the hurricane impacts.

Per the company, “weather events in the third quarter had an unusually pronounced effect on operating results.” In fact, hurricanes reduced revenues, net income and EBITDA by an estimated $13 million, $6 million, and $9 million, respectively.

Notably, Wyndham has been functioning through its three operating segments: Hotel Group, Destination Network (formerly known as Vacation Exchange and Rentals) and Vacation Ownership.

Hotel Group revenues were $368 million, up 1.1% from the year-ago figure, which reflected higher franchise fees as well as growth in the company's Wyndham Rewards credit card program.

Domestic same store RevPAR (revenue per available room) improved 2.3%. At constant currency, global system-wide same store RevPAR increased 3.3% year over year.

Adjusted EBITDA increased 4% to $122 million.

Revenues at Destination Network were $511 million, an increase of 5% from the year-ago figure.

Exchange revenues declined 1% year over year at $158 million. While exchange revenue per member rose 1%, the average number of members declined 2%.

Vacation rental revenues were $327 million, reflecting 7.6% year-over-year growth. At constant currency and excluding acquisitions, vacation rental revenues increased 3% driven by a 2% increase in transaction volumes and a 1% increase in average net price per rental.

Adjusted EBITDA increased 6% to $150 million, reflecting increased vacation rental volumes and favorable foreign currency movements, partially offset by the adverse impact of the hurricanes.

Revenues at Vacation Ownership increased 4% year over year to $773 million. The uptick reflects an increase in gross VOI sales as well as higher consumer financing revenues, even though hurricanes in the third quarter negatively impacted VOI sales.

Gross VOI sales in the third quarter increased 7% year over year. Meanwhile, tour flow was up 7% but volume per guest (VPG) was down 1%, primarily reflecting a 16% increase in sales to new owners in North America, which produces a lower VPG.

Adjusted EBITDA decreased 3% to $190 million as higher gross VOI sales and consumer financing revenues were offset by a higher provision for loan losses and increased variable compensation expenses.

2017 Guidance

For 2017, the company projects adjusted net income in the range of $618 million to $628 million, down from the previous expectation of $631 million to $652 million. Also, adjusted earnings per share are anticipated in a band of $5.95 to $6.05, lower than the previously expected range of $6.04 to $6.24 per share. The Zacks Consensus Estimate for 2017 earnings is currently pegged at $6.20 per share.

Wyndham expects full-year revenues to come in the range of $5.8 billion to $5.85 billion (previously $5.8–$5.95 billion). Adjusted EBITDA is now projected to be in a band of $1.38 billion to $1.395 billion (previously $1.41 billion to $1.44 billion).

Markedly, the company estimates that the adverse weather events might reduce full-year revenues by $33-$43 million, net income by $15-$21 million and EBITDA by $24-$32 million.

Zacks Rank & Upcoming Peer Releases

Wyndham carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other hotel stocks, Hyatt Hotels Corporation (NYSE:H) , Red Lion Hotels Corporation (NYSE:H) and Marriot Vacations Worldwide Corporation (NYSE:VAC) are expected to release their quarterly numbers on November 2. The Zacks Consensus Estimate for the quarter’s bottom line is pegged at 17 cents for Hyatt, 19 cents for Red Lion Hotels and $1.11 for Marriott Vacations.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Wyndham Worldwide Corp (WYN): Free Stock Analysis Report

Hyatt Hotels Corporation (H): Free Stock Analysis Report

Red Lion Hotels Corporation (RLH): Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.