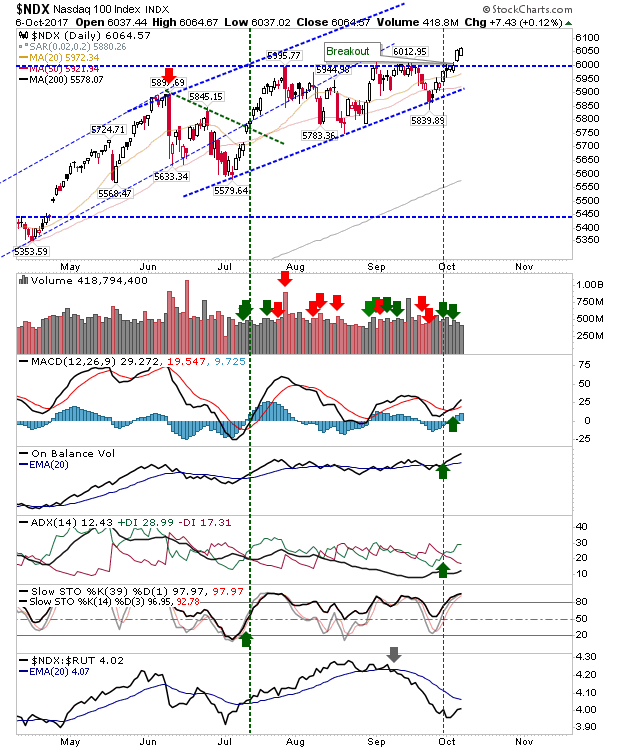

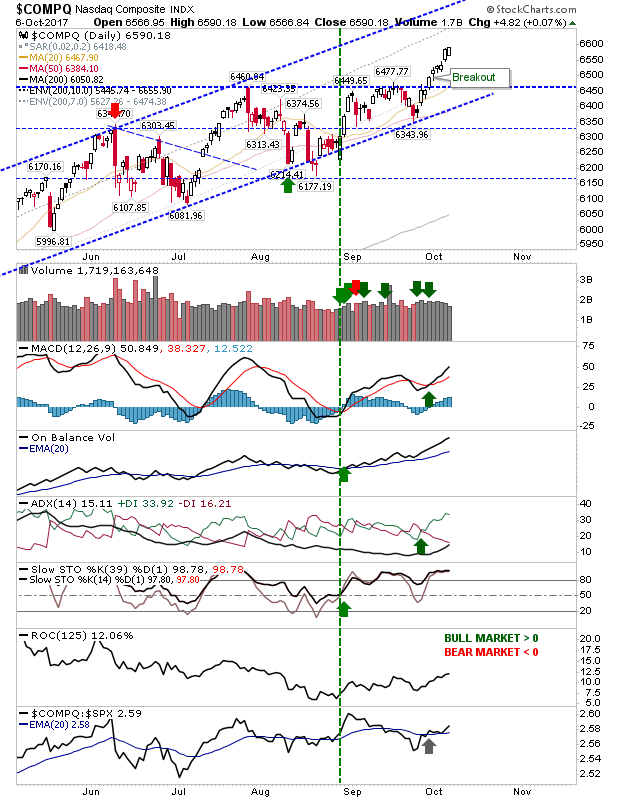

Friday was a lackluster day and there was little of interest outside of Tech averages. The NASDAQ and NASDAQ 100 finished higher - holding their breakouts. Momentum and long-term holders have little reason to sell, but taking partial profits would be prudent.

Best of the action was reserved for the NASDAQ and NASDAQ 100; each finished at the highs of the day without doing much. The NASDAQ 100 holds its breakout along with the NASDAQ. What's key for these indices is that breakouts hold. Technicals are all bullish.

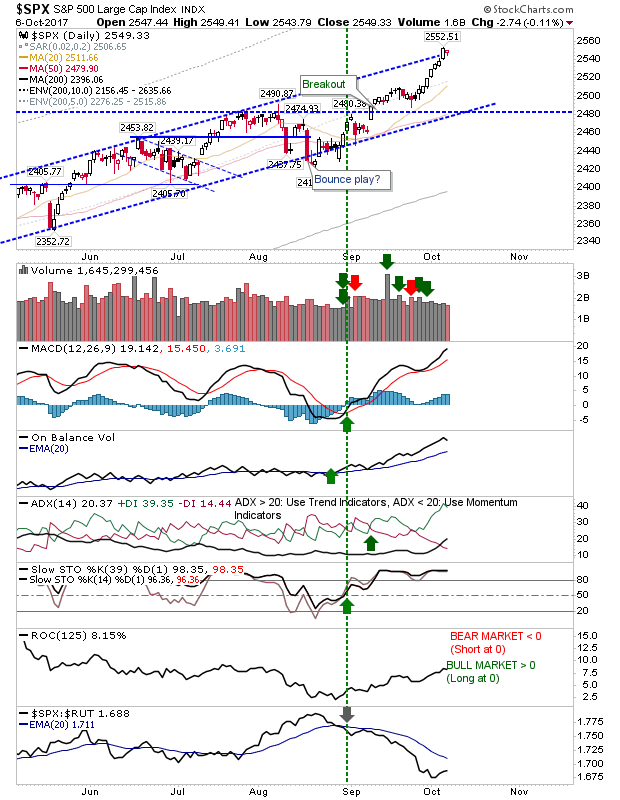

On Friday, the S&P tagged upper channel resistance then didn't make much progress beyond this. The pattern to Thursday suggests a Bearish Doji Harami which offers a chance for shorts to take a play with a stop above 2,553.

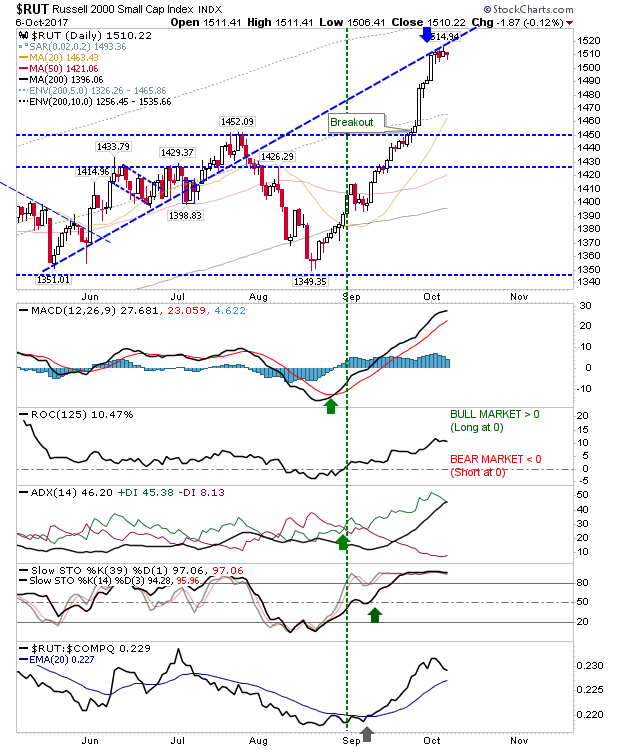

The Russell 2000 has stalled a little after making substantial gains since August. The area where it stalled was a resistance area but the fact it has held these gains in tight action near highs suggests there is more to on the way for the coming week. Why technicals suggest 'short' this might be the better 'long' or swing trade. Technicals net 'bullish'.

For today: shorts can look to the S&P, longs may actually get some joy from the Russell 2000. Existing holders of the NASDAQ and NASDAQ 100 can probably stay holding their positions.