No surprises overnight, with the US Federal Reserve keeping interest rates unchanged as expected.

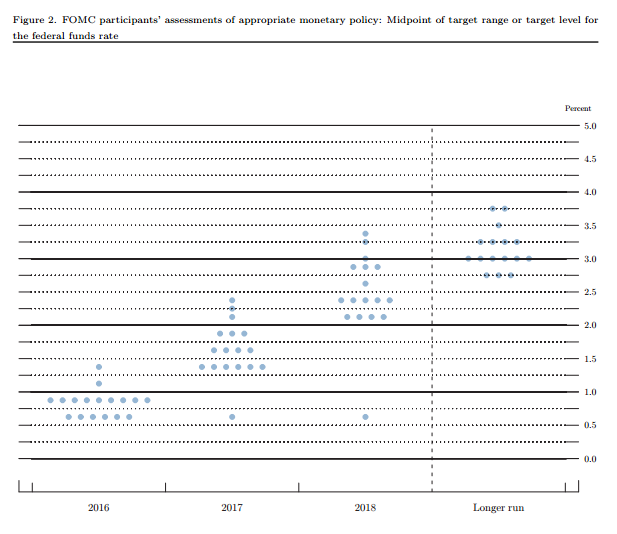

The Fed has however continued down the path that they are still looking to raise interest rates twice this calendar year. Something that markets aren’t taking their word on just yet…

“The pace of improvement in the labor market has slowed while growth in economic activity appears to have picked up.”

In the accompanying statement, they spoke about their expectations that the labour market is expected to strengthen after the most recent horrible NFP prints (one swallow does not a summer make…), but did lower their economic growth forecasts for both 2016 and 2017.

The takeaway is that the Fed is still on the same path that they have been, but for traders long USD, the risks around further poor data releases are massive.

If you’re really keen, check out the full FOMC Statement from the Federal Reserve here, as well as the FOMC projections including the following ‘dot plot’ here too.

Onto the charts and really we don’t have too much to talk about following the release.

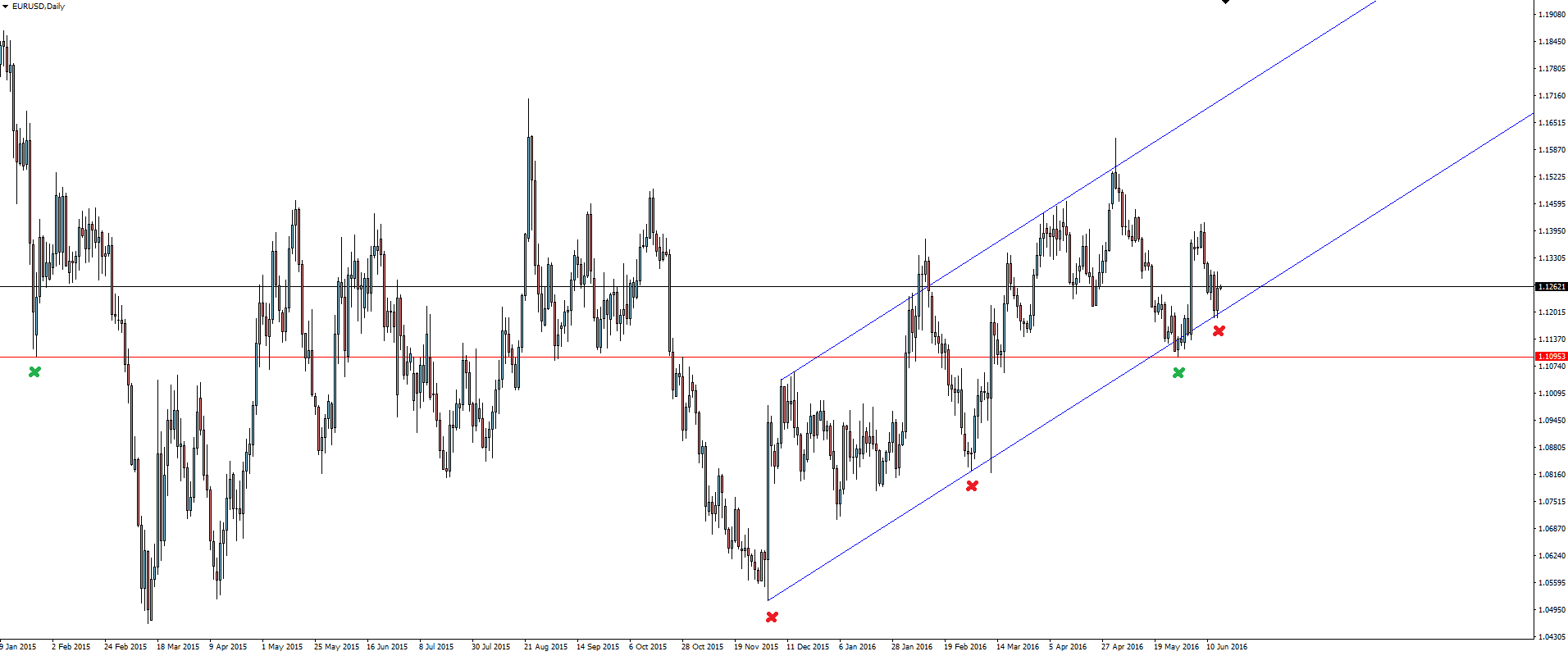

EUR/USD Daily:

So with the muted reaction to the Fed keeping interest rates on hold for another month, my ‘famous last words‘ at the bottom of yesterday’s blog didn’t come back to bite me after all. Markets got exactly what they were expecting, and most importantly for traders, exactly what they had priced in.

Back at the start of the month in our Yellen Kisses June and July Goodbye blog, we were following the above channel with the bottom line (green x’s) drawn from the bottom and the most obvious first swing. This ignores the news spike that pushed below it and as you can see from the most recent price action, the level has been respected nicely.

Chart of the Day:

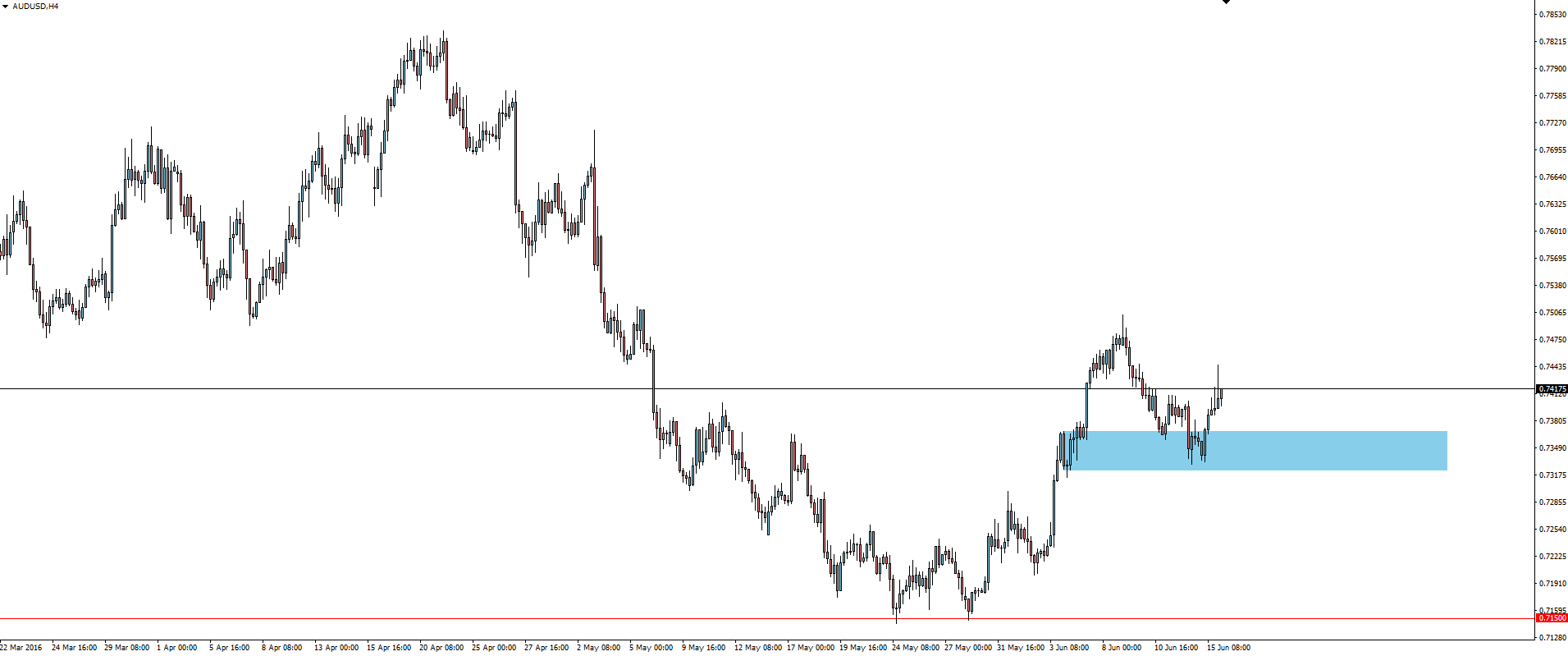

I’ve been talking up the potential of being bullish AUD/USD for a while now, and the Fed again gave us another gem setup to potentially add to longs.

AUD/USD 4 Hour:

The area marked on this chart is exactly the same as the type of areas on that first blog. Just simply another area of consolidation that price pulled back into and kicked back out of on the back of the FOMC release. Pick your areas of interest and manage your risk around them.

On the Calendar Thursday:

Brace yourselves…

NZD GDP q/q

CAD BOC Gov Poloz Speaks

AUD Employment Change

AUD Unemployment Rate

AUD RBA Deputy Gov Lowe Speaks

JPY Monetary Policy Statement

JPY BOJ Press Conference

CHF Libor Rate

CHF SNB Monetary Policy Assessment

CHF SNB Press Conference

GBP Retail Sales m/m

GBP MPC Official Bank Rate Votes

GBP Monetary Policy Summary

GBP Official Bank Rate

USD CPI m/m

USD Core CPI m/m

USD Philly Fed Manufacturing Index

USD Unemployment Claims

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.