- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Massive Investment Demand Puts Silver Back On The Mainstream Radar

With silver up 30% for the month, the shiny metal is now back on the Mainstream Media Radar. Yeah, it’s been seven long years since silver traded at $24, but now it looks as if it is just in the beginning stages of a new Bull Market.

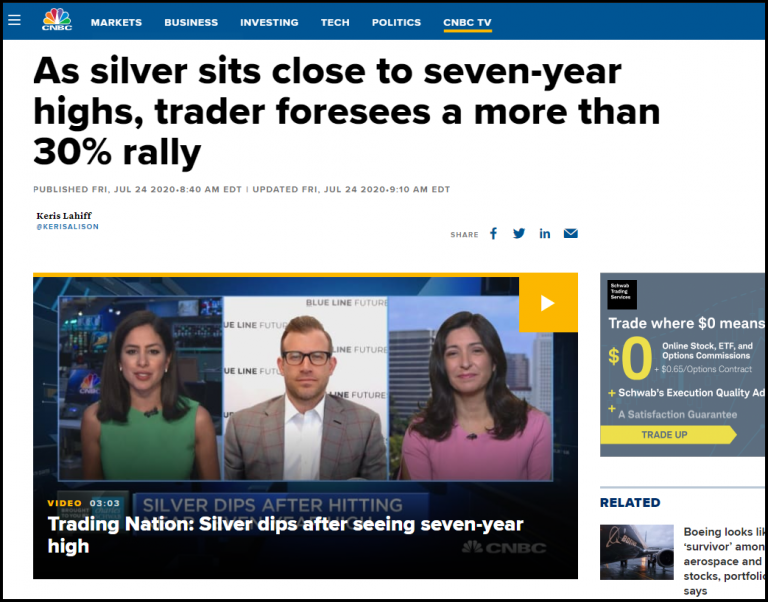

Last Friday, CNBC ran an interview with Bill Baruch, president of Blue Line Capital. He said that when silver was trading at $22 on Friday, he expected more gains. And, this precisely what took place this week.

This is what Bill Baruch stated during his interview:

Bill Baruch, president of Blue Line Capital, expects more gains.

“I love the precious metals and have always said that you need a portion of your portfolio at minimum in precious metals, so silver has some room to run here,” Baruch said on CNBC’s “Trading Nation” on Thursday.

Baruch says the charts suggest $26 per ounce could be the next hurdle, a level of resistance stretching to 2011 that could now become support. If it moves past that, he says ”$30 could be in the cards, too.”

When Bill Baruch made that comment last Friday, silver was trading at $22. I published the weekly chart below in my article last Wednesday titled, Silver Price Gets The Green Light To Move Higher, showing the next target level of $26-$26.50:

And, on late Monday night during Asian trading, silver reached a high of $26.27, in the middle of the $26-$26.50 target level. However, in a very short period, silver sold off $4 before recovering back to $24.

With the silver price up 30% in July, along with reaching the $26 target level, it seems like the next move is a correction lower, consolidation before the next leg higher.

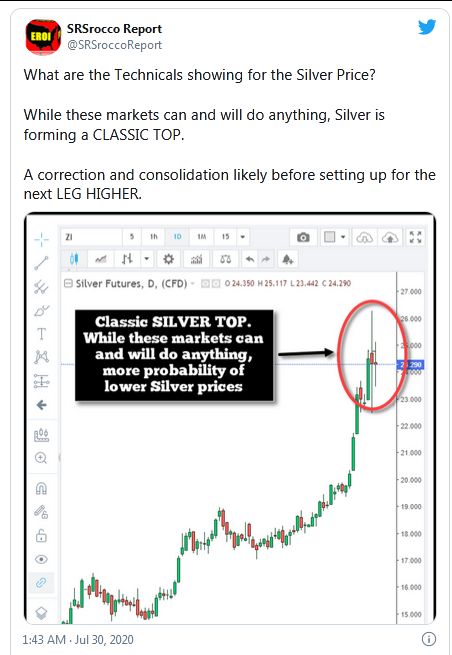

I replied to someone via my SRSrocco Twitter Feed, why I thought silver had put in a short-term top:

This is a daily chart of silver on Investing.com (spot price differs from Kitco.com). The large spike on Tuesday suggests a top, but we will have to wait and see what happens over the next two trading days in July. Even though anything can happen in these markets today, like Kodak surging 550% in one day at the peak, there is more of a probability that silver will correct lower before its next leg higher.

Massive Investment Demand Partially Responsible For Silver Rally

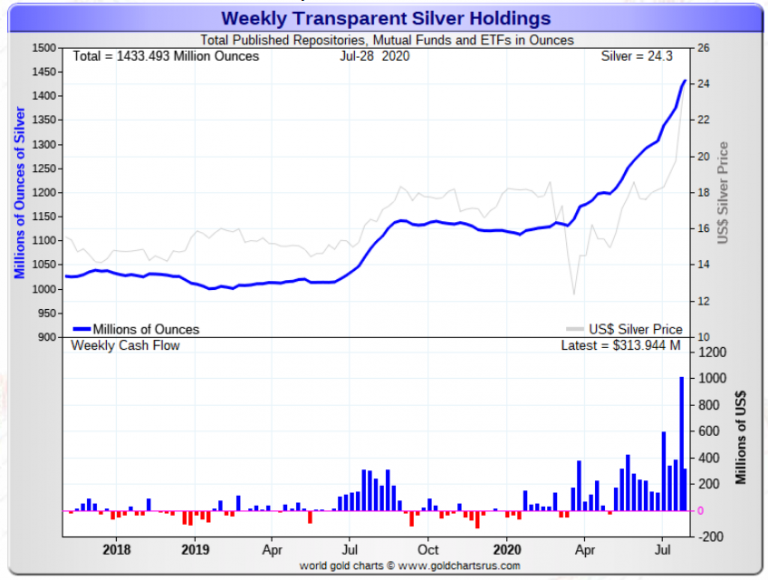

In looking at the data, it seems that physical investment demand was partially responsible for the present rally in silver. With investors flocking into physical silver bars and coins, along with increased investment demand for the Silver ETFs, etc, a great deal of metal was acquired from the market.

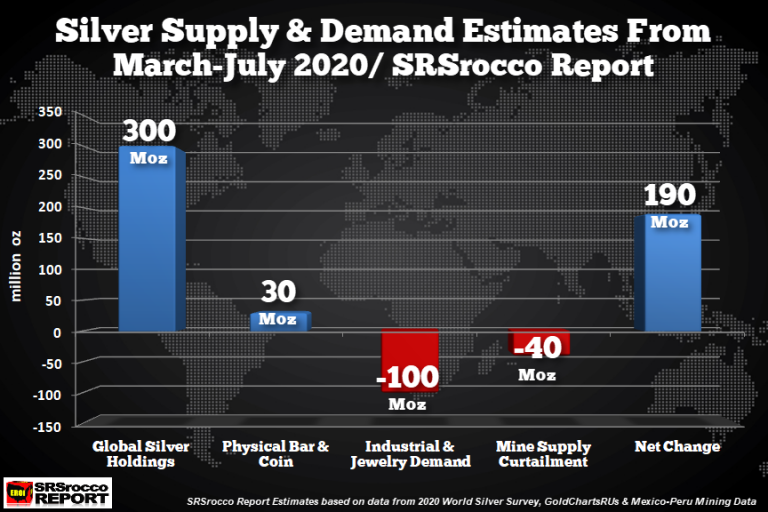

According to estimates, I calculated using the data from GoldChartsRUs.com, 2020 World Silver Survey, and Mexico-Peru Ministry of Mines, I put together the following chart on net changes in Silver Supply & Demand March-July 2020:

According to GoldChartsRUs.com, total global silver holdings increased by approximately 300 million oz (Moz) from March to July. I estimated that the public acquired an additional 30 Moz of physical bar and coin. Some may think it was more, but due to the shutdown of refineries, Official Mints, and supply-chain disruptions, I believe 30 Moz of additional silver bar and coin was acquired compared to the same period last year.

I then estimated a loss of about y 100 Moz of Industry and Jewelry demand during the same period and 40 Moz curtailment of global silver mine supply. Thus, the net change in Silver Supply & Demand for March-July was approximately 190 Moz. With investors moving into the Silver ETFs, etc, increased metal inventories are the result. So, we can plainly see that most of the physical demand came from Silver ETFs, etc.

Now, I don’t know if all the metal these ETFs claim is in their inventories. Actually, I don’t care. What I like to focus on is “SILVER INVESTMENT SENTIMENT.” And we have seen this positive silver investment sentiment in seven years.

Regardless, as the Fed and central banks continue to prop up the economy and financial system with Liquidity, the fundamentals for silver will only improve. Even though we may see corrections along the way, SILVER IS NOW IN A NEW BULL MARKET.

Related Articles

Will WTI crude oil hit 67.00 key level? MACD and stochastics indicate further losses WTI crude oil futures dived below the long-term descending trend line again, meeting the...

Oil prices are largely under pressure amid demand concerns, while the European gas market continues to sell off aggressively Energy – TTF Sell-Off Continues Oil prices continued...

Oh man, can President Trump’s leadership move markets. President Trump’s deal-making and negotiating skills are changing the hearts and minds of world leaders as he leaves his...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.