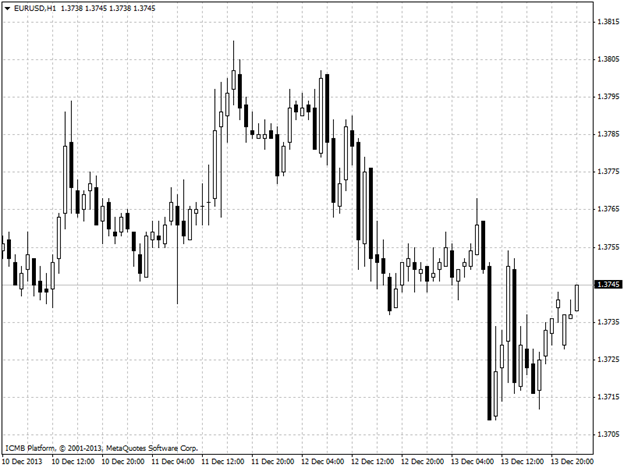

EUR/USD

The dollar was higher against the euro on Friday, amid expectations that the Federal Reserve could start scaling back its economic stimulus program at its upcoming policy meeting this week. The euro came off session lows after data on Friday showed that U.S. producer price inflation fell 0.1% in November, in line with forecasts. The soft inflation data did little to alter expectations that the Fed will begin withdrawing stimulus in the next few months after the latest nonfarm payrolls report showed that the U.S. economy added more jobs than expected in November. Demand for the single currency continued to be underpinned as expectations for further monetary easing by the European Central Bank dimmed after the bank left monetary policy unchanged at its meeting this month, following a surprise rate cut in November. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

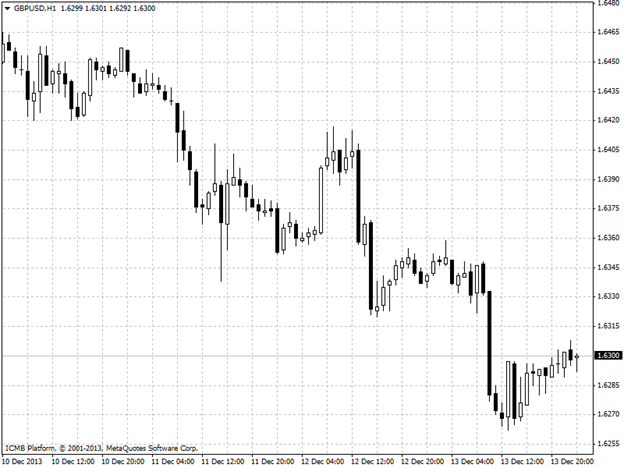

GBP/USD

The pound fell to more than two-week lows against the dollar on Friday as heightened expectations for a small reduction to the Federal Reserve’s stimulus program as soon as this week bolstered dollar demand. The pound trimmed back some losses after data on Friday showed that U.S. producer price inflation fell 0.1% in November, in line with forecasts. The soft inflation data did little to alter expectations that the Fed will begin withdrawing stimulus in the next few months after the latest nonfarm payrolls report showed that the U.S. economy added more jobs than expected in November. The pound’s losses were held in check after a recent series of upbeat economic data reinforced the view that the economic recovery in the U.K. is gaining traction, fuelling hopes that the Bank of England may raise interest rates ahead of other central banks. In the week ahead, The BoE is to publish the minutes of its latest policy setting meeting, while U.K. data on consumer prices, retail sales and employment will also be in focus.  GBP/USD Hour Chart " title="GBP/USD Hour Chart " width="624" height="468">

GBP/USD Hour Chart " title="GBP/USD Hour Chart " width="624" height="468">

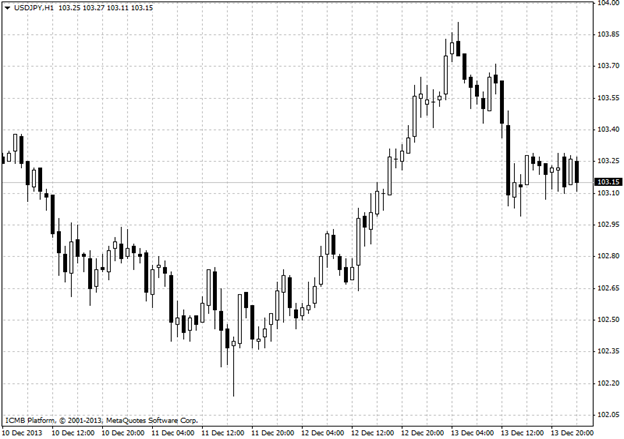

USD/JPY

The dollar scaled five year peaks against the yen on Friday, boosted by expectations that the Federal Reserve could make a small cut to its asset purchase program at its upcoming policy meeting this week. The yen remained under heavy pressure on the view that the Bank of Japan will have to increase the size of its asset-purchase program in the coming year in order to meet its target of 2% inflation by 2015. The euro also climbed to five year highs against the yen on Friday, with EUR/JPY rising to 142.83, the strongest level since October 2008, and was last down 0.27% to 141.81. In the week ahead, investors will be focusing on Wednesday’s outcome of the Fed’s monthly policy meeting, and a press conference with Chairman Ben Bernanke will be closely watched. Meanwhile, the BoJ is to hold what will be its final policy meeting of the year. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

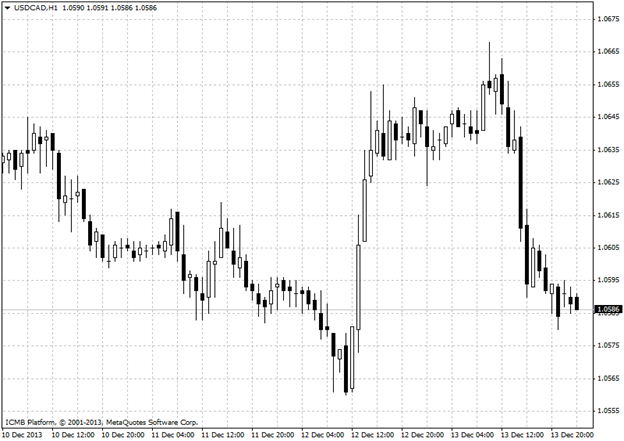

USD/CAD

The Canadian dollar moved higher against the U.S. dollar on Friday, firming up following less dovish than expected comments from Bank of Canada Governor Stephen Poloz. The Canadian dollar was boosted after Poloz said on Thursday that rates were likely to stay where they are "for some time," quelling speculation that the sluggish inflation outlook would prompt the Bank of Canada to cut rates. The U.S. dollar touched session highs in early trade on Friday after Thursday’s stronger-than-forecast U.S. retail sales data for November added to signs that the economic recovery is deepening. The upbeat data fuelled expectations for a small reduction in the pace of the Federal Reserve’s USD85 billion-a-month asset purchase program at its upcoming policy meeting. An agreement on a two-year U.S. budget deal was also seen as removing an obstacle to the winding back of monetary stimulus. Sentiment on the greenback was dented after data on Friday showed that U.S. producer price inflation fell 0.1% in November. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">