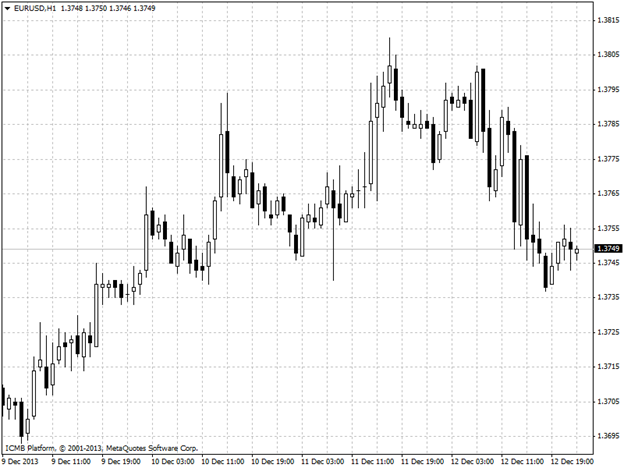

EUR/USD

The euro slumped against the dollar on Thursday after data revealed U.S. retail sales advanced more than expected in November, another sign for investors that the Federal Reserve is close to tapering its USD85 billion in monthly bond purchases, possibly next week. The Commerce Department reported earlier that U.S. retail sales rose 0.7% in November, beating market expectations for a 0.6% increase. Core retail sales, which are stripped of automobiles, rose 0.4%, above forecasts for a 0.2% increase. The data kept expectations alive that the Federal Reserve will soon decide to taper its USD85 billion in monthly bond purchases, possibly at Dec. 17-18 policy meeting. Meanwhile in Europe, industrial production in the euro area fell by 1.1% in October and rose just 0.2% from a year earlier. Economists were forecast a monthly increase of 0.3% and an annual gain of 1.1%, and the disappointing readings gave investors reason to sell the euro for dollars on Thursday. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

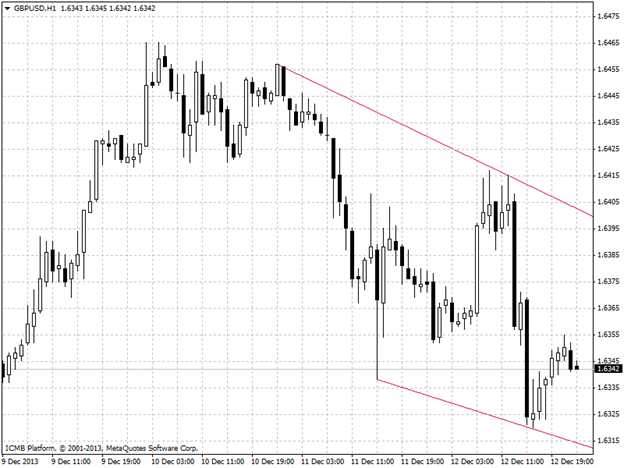

GBP/USD

The pound remained moderately lower against the U.S. dollar on Thursday, as investors were cautious ahead of the Federal Reserve's policy meeting next week, after mixed U.S. data fuelled fresh uncertainty over the nation's economic recovery. The Department of Labor said the number of people who filed for unemployment assistance in the U.S. last week rose to a two month high of 368,000, compared to expectations for an increase to 320,000 from the previous week’s revised total of 300,000. A separate report showed that U.S. retail sales rose 0.7% in November, above expectations for a 0.6% increase. Core retail sales rose 0.4%, above forecasts for a 0.2% increase the Commerce Department said. But the pound’s losses looked likely to remain limited after a recent series of upbeat economic data reinforced the view that the economic recovery in the U.K. is gaining traction, fuelling hopes that the Bank of England may raise interest rates ahead of other central banks.  GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

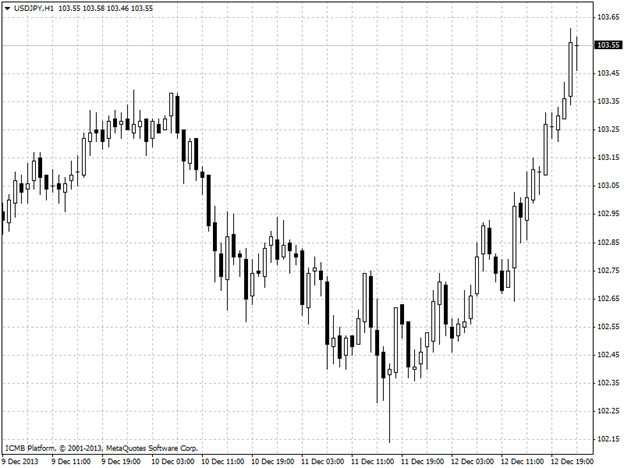

USD/JPY

The dollar shot up against the yen on Thursday after U.S. retail sales figures beat expectations and sent investors taking up positions on the possibility that the Federal Reserve could announce plans to scale back its USD85 billion monthly asset-purchasing program as early as next week. The Commerce Department reported earlier that U.S. retail sales rose 0.7% in November, beating market expectations for a 0.6% increase. Core retail sales, which are stripped of automobiles, rose 0.4%, well above forecasts for a 0.2% increase. Elsewhere, the U.S. Department of Labor said the number of individuals filing for initial jobless claims assistance last week rose to a two-month high of 368,000, far surpassing expectations for an increase to 320,000 from the previous week’s revised total of 300,000. Markets shrugged off the news, attributing the increase to holiday volatility typical this time of year, while a budget deal underway in the U.S. Congress also sent the dollar rising amid sentiments that fiscal uncertainties may fade and further convince the Fed the economy is in less need of monetary support. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

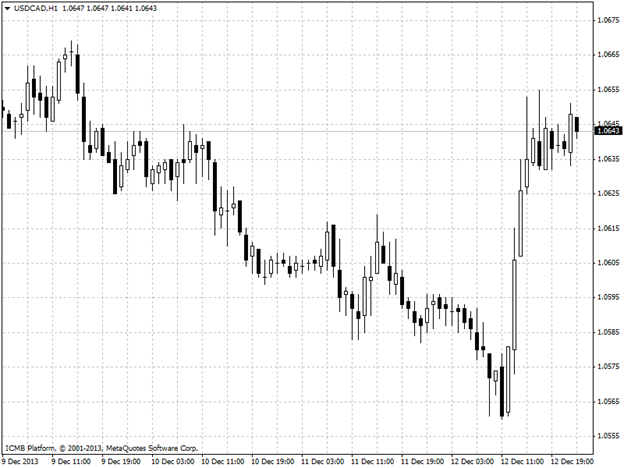

USD/CAD

The U.S. dollar rose to session highs against the Canadian dollar on Thursday as demand for the greenback was underpinned by expectations that the Federal Reserve will start to reduce its stimulus program at next week’s policy meeting. Demand for the dollar continued to be underpinned by expectations that an agreement on a two year U.S. budget deal would prompt the Fed to begin tapering its USD85 billion a month asset purchase program at its policy meeting scheduled for December 17 - 18. The release of some mixed U.S. data on initial jobless claims and retail sales did little to shift expectations on the timing of possible Fed tapering. A separate report showed that U.S. retail sales rose 0.7% in November, above expectations for a 0.6% increase. Core retail sales rose 0.4%, above forecasts for a 0.2% increase the Commerce Department said. In Canada, data on Thursday showed that the new house price index inched up just 0.1% in October, below forecasts for a 0.3% gain and following a flat reading in September. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">