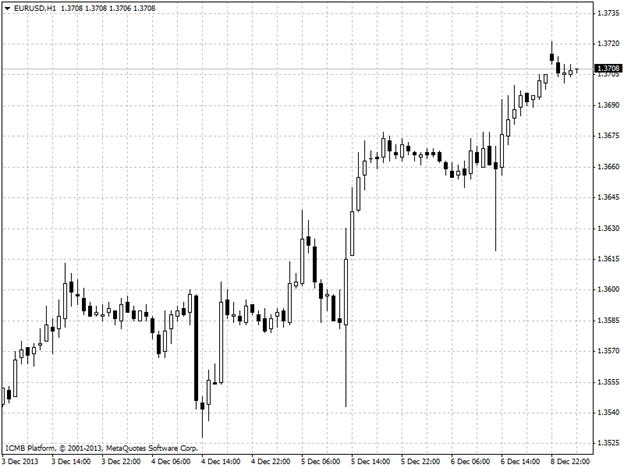

EUR/USD

The euro rose to five week highs against the dollar on Friday as the dollar shrugged off a report showing that the U.S. economy added more jobs than expected in November. The U.S. economy added 203,000 jobs in November, above expectations for jobs growth of 180,000, the Labor Department said. The unemployment rate fell to a five year low of 7.0% from 7.3% in October. The report came one day after official data showed that the U.S. economy grew at an annual rate of 3.6% in the three months to September, well above the preliminary estimate for 2.6%. Demand for the single currency continued to be underpinned after European Central Bank President Mario Draghi indicated that further monetary easing by the bank is not imminent. The ECB left rates on hold at record lows of 0.25% on Thursday, as widely expected. The bank raised its growth forecast for 2014 to 1.1% from 1.0% and predicted growth of 1.5% in 2015. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

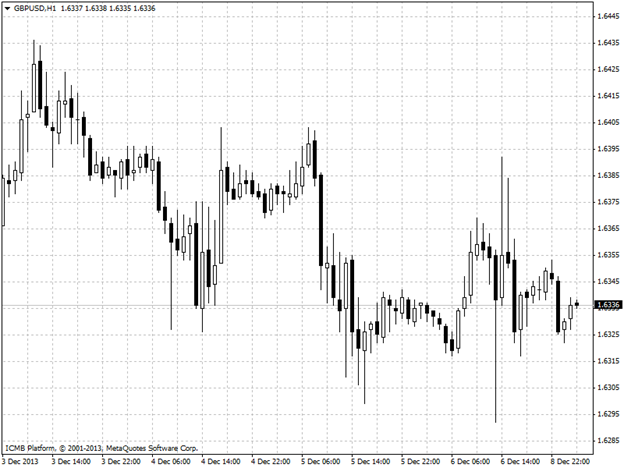

GBP/USD

The pound ended the week close to 27-month highs against the dollar on Friday, with the dollar little changed after a report showed that the U.S. economy added more jobs than forecast in November. The U.S. economy added 203,000 jobs in November, above expectations for jobs growth of 180,000, the Labor Department said. The unemployment rate fell to a five year low of 7.0% from 7.3% in October. The report came one day after official data showed that the U.S. economy grew at an annual rate of 3.6% in the three months to September, well above the preliminary estimate for 2.6%. Demand for sterling continued to be underpinned after a recent series of upbeat U.K. data indicated that the economic recovery is deepening, boosting hopes that the Bank of England may tighten monetary policy before other central banks. The BoE left interest rates on hold at 0.5% on and left its asset purchase program unchanged at GBP375 million following its monthly meeting on Thursday, in a widely expected decision. GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

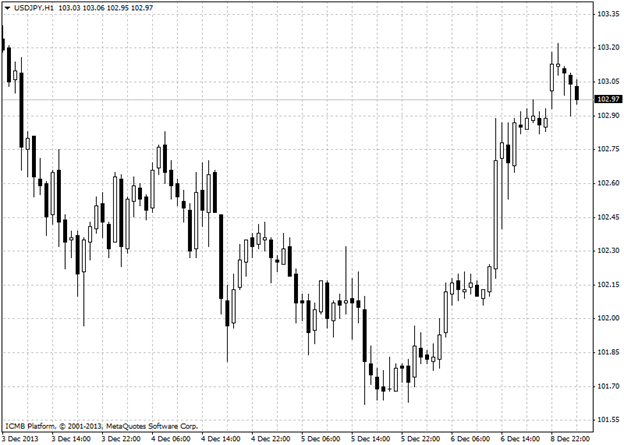

USD/JPY

The dollar strengthened against the yen on Friday after data showing that the U.S. economy added more jobs than forecast in November cemented the view that the Federal Reserve will soon start to roll back its stimulus program. The U.S. economy added 203,000 jobs in November, above expectations for jobs growth of 180,000, the Labor Department said. The unemployment rate fell to a five year low of 7.0% from 7.3% in October. The report came one day after official data showed that the U.S. economy grew at an annual rate of 3.6% in the three months to September, well above the preliminary estimate for 2.6%. The yen remained under pressure amid expectations that the Bank of Japan will have to expand its stimulus program in the coming months, in order to meet its target of 2% inflation by 2015. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

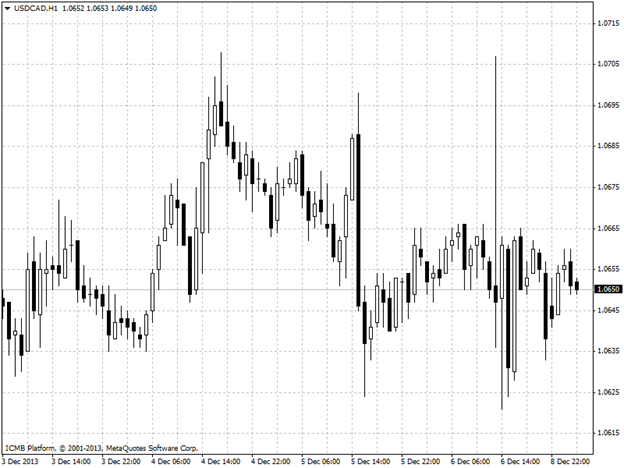

USD/CAD

The U.S. dollar initially rose to three-and-a-a-half year highs against the Canadian dollar on Friday after the release of a stronger-than-forecast U.S. jobs report for November, before erasing gains to end the session lower. The U.S. economy added 203,000 jobs in November, above expectations for jobs growth of 180,000, the Labor Department said. The unemployment rate fell to a five year low of 7.0% from 7.3% in October. The report came one day after official data showed that the U.S. economy grew at an annual rate of 3.6% in the three months to September, well above the preliminary estimate for 2.6%. In Canada, data on Friday showed that the economy added 21,600 jobs in November, far more than the 12,000 forecast by economists. The unemployment rate was steady at 6.9%. However, the Canadian dollar remained under pressure amid concerns that the subdued inflation outlook may prompt the Bank of Canada to keep interest rates on hold for longer. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">