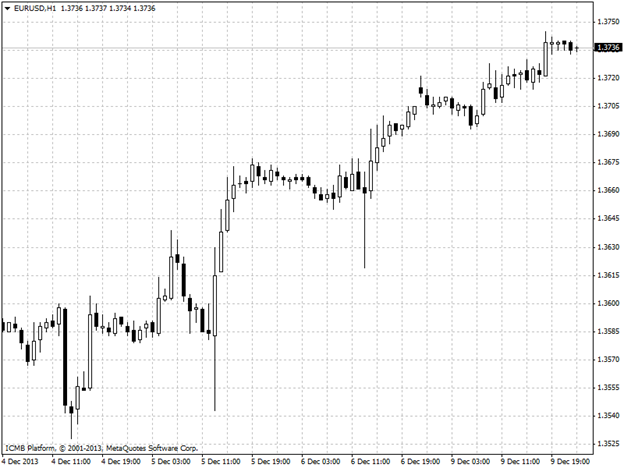

EUR/USD

The euro rose against the dollar on Monday as investors previously camped out in safe-haven dollar positions sold the greenback to take on risk after spending the weekend digesting better-than-expected U.S. jobs data. Meanwhile in the euro zone, data released earlier revealed that Germany's trade surplus narrowed in October as imports grew faster than exports, shrinking to EUR16.8 billion from EUR18.7 billion in September. Germany exported goods worth EUR92.9 billion, up only fractionally from EUR92.7 billion in September, while imports grew by 2.8% to EUR76.1 billion from EUR74.0 billion. A separate report showing that German industrial production unexpectedly declined by 1.2% in October, missing expectations for a 0.8% rise, met muted reaction from investors. On Tuesday, European Central Bank President Mario Draghi is to speak at an event in Rome. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

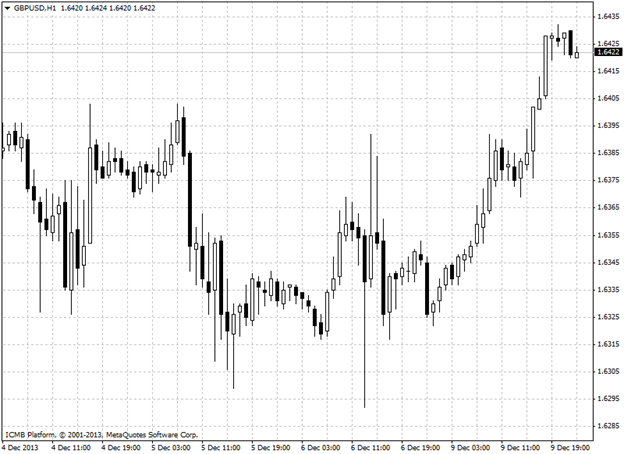

GBP/USD

The pound hit fresh session highs against the U.S. dollar in light trade on Monday, as demand for riskier assets remained supported by Friday's strong U.S. employment report. Separately, the pound also remained supported after a recent series of upbeat U.K. data indicated that the economic recovery is deepening, boosting hopes that the Bank of England may tighten monetary policy before other central banks. In the euro zone, data showed that Germany's trade surplus narrowed in October as imports grew faster than exports, shrinking to EUR16.8 billion from EUR18.7 billion in September. The euro shrugged off a report showing that German industrial production unexpectedly declined by 1.2% in October, missing expectations for a 0.8% rise. GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

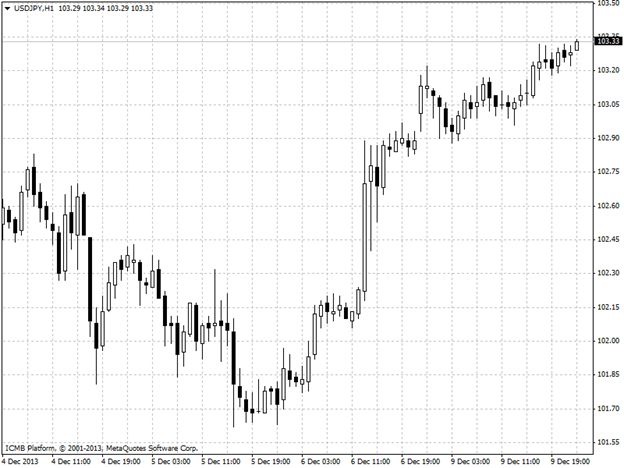

USD/JPY

The dollar firmed against the yen on Monday after better-than-expected U.S. jobs and consumer-sentiment reports cemented expectations for the Federal Reserve to begin tapering its monthly asset-purchasing program in the near future. Earlier Monday, Fed St. Louis President James Bullard said the chances of a Fed decision to taper asset purchases are growing now that the labor market has shown improvement. “A small taper might recognize labor market improvement while still providing the Committee the opportunity to carefully monitor inflation during the first half of 2014,” Bullard said in prepared remarks of a speech he delivered earlier. “Should inflation not return toward target, the Committee could pause tapering at subsequent meetings.” The yen, meanwhile, has come under pressure recently amid expectations for the Bank of Japan to beef up stimulus programs to meet its 2% inflation target by 2015. Earlier this month, BoJ Governor Haruhiko Kuroda pledged to counter any new downside risks to the bank’s inflation goal, saying the BoJ would act by "adjusting monetary policy without hesitation." On Tuesday, Japan is to publish its BSI manufacturing index and a report on tertiary industry activity. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

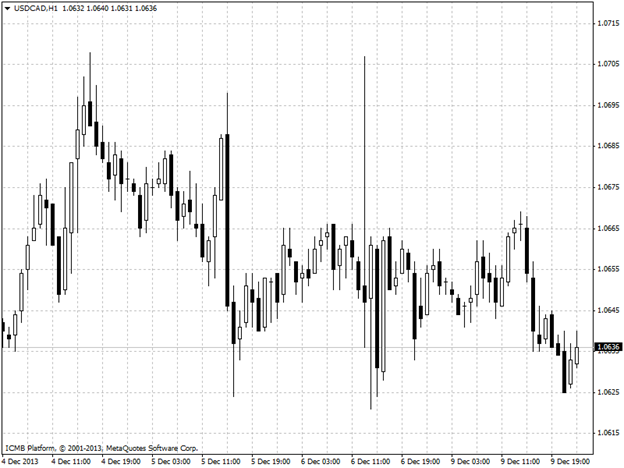

USD/CAD

The U.S. dollar rose to session highs against the Canadian dollar on Monday as Friday’s stronger-than-forecast U.S. jobs report indicated that the economic recovery is gaining traction. In Canada, data on Friday showed that the economy added 21,600 jobs in November, far more than the 12,000 forecast by economists. The unemployment rate was steady at 6.9%. However, the Canadian dollar remained under pressure amid concerns that the subdued inflation outlook may prompt the Bank of Canada to keep interest rates on hold for longer. Data released on Monday showed that Canadian housing starts rose by 192,200 units in November, below expectations for a gain of 195,000. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">