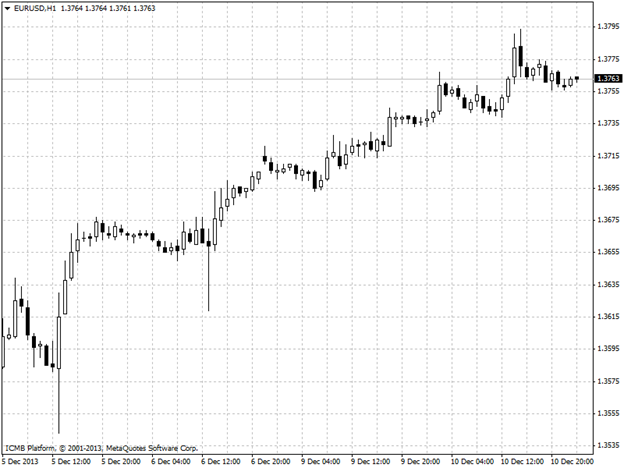

EUR/USD

The euro rose against the dollar on Tuesday after investors locked in gains stemming from Friday's U.S. strong jobs report and sold the greenback for profits, jumping to the sidelines to await the Federal Reserve's decision next week on interest rates and monetary policy. Fed St. Louis President James Bullard said on Monday that the chances of a Fed decision to taper asset purchases is increasing due to improvements taking place in the labor market. The euro, meanwhile, continued to see support due to a surprise European Central Bank decision to hold off on implementing fresh monetary stimulus measures at its December meeting, including negative interest rates, after surprising investors with a rate cut in November. In a speech on Tuesday, ECB President Mario Draghi urged governments to complete a banking union, saying it was crucial at both a national and European level. EUR/USD" border="0" height="468" width="624">

EUR/USD" border="0" height="468" width="624">

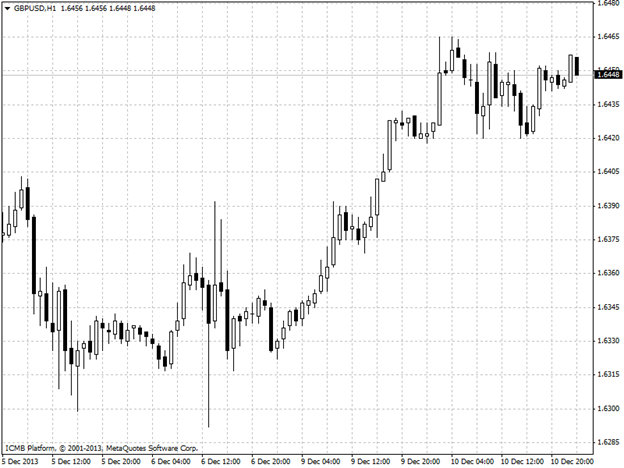

GBP/USD

The pound held steady against the U.S. dollar on Tuesday, hovering near 27-month highs as comments by Bank of England Governor Mark Carney and positive U.K. manufacturing and industrial output data continued to support demand for sterling. The pound remained supported after BoE Governor Mark Carney said Monday the U.K. economy had regained considerable strength in recent months. The comments came during a speech in New York. In addition, data on Tuesday showed that U.K. industrial output rose strongly in October, adding to indications that the recovery is gaining traction and fuelled hopes that the BoE may tighten monetary policy ahead of other central banks. The Office for National Statistics said industrial output increased by 0.4% in October, in line with forecasts and was up 3.2% from a year earlier. It was the largest annual gain in industrial output since January 2011. The ONS said manufacturing production also rose 0.4% in October and was 2.7% higher on a year-over-year basis, the fastest annual growth since May 2011. Economists had forecast a 0.4% monthly increase and 2.9% annual gain. In a separate report, the ONS said the U.K. trade deficit narrowed to GBP9.73 billion in October, from an upwardly revised deficit of GBP10.10 billion in September. Economists had expected the deficit to shrink to GBP9.35 billion. GBP/USD" border="0" height="468" width="624">

GBP/USD" border="0" height="468" width="624">

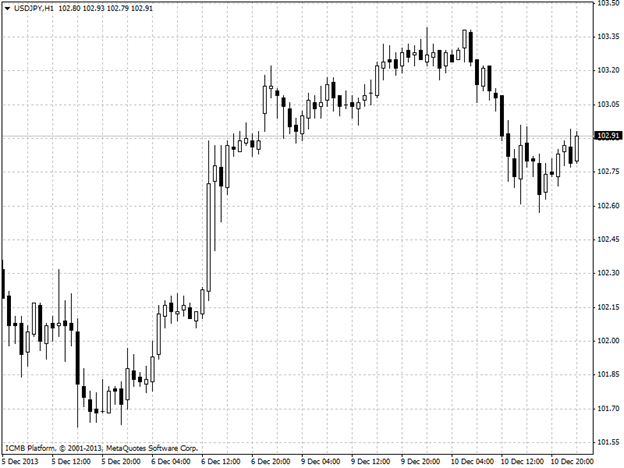

USD/JPY

The dollar fell against the yen on Tuesday amid ongoing uncertainty as to whether or not the Federal Reserve will announce plans to scale back its USD85 billion in monthly bond purchases at its monetary policy meeting next week. A surprisingly strong November jobs report bolstered the dollar in recent sessions by fanning talk the Federal Reserve may announce plans to taper the pace of its USD85 billion in monthly bond purchases at its Dec. 17-18 monetary policy meeting. By Monday, renewed uncertainty as to whether or not the U.S. central bank will wait until early 2014 after reviewing more data before deciding on tapering softened the greenback. USD/JPY" border="0" height="468" width="624">

USD/JPY" border="0" height="468" width="624">

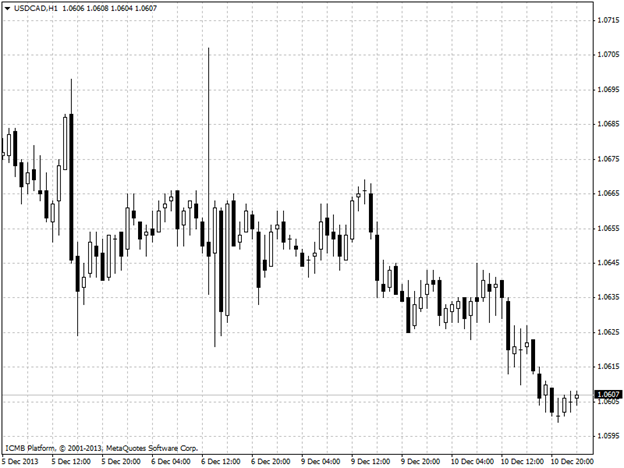

USD/CAD

The Canadian dollar advanced for a fourth day, the longest streak since September, as crude oil climbed to a six-week high to lead gains in commodities. Canada’s currency touched an almost four-year low against the euro as Italy’s economy stopped shrinking and European finance ministers met in an attempt to break a deadlock on a bank-failure bill. The currency strengthened from a three-year low reached versus its U.S. peer last week when the Bank of Canada warned of inflation below its target band, bolstering bets interest rates will stay low. “It’s a combination of crude and other commodities -- copper, as well -- that’s probably giving a bit of a boost to the loonie,” said David Doyle, a strategist at Macquarie Capital Markets, said by phone from Toronto. “The loonie had become a little beaten up and a lot of people had piled onto that trade. That trade has run its course, for now.” USD/CAD" border="0" height="468" width="624">

USD/CAD" border="0" height="468" width="624">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs: Euro Rose Against The Dollar, Pound Holds Steady

Published 12/11/2013, 05:10 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs: Euro Rose Against The Dollar, Pound Holds Steady

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.