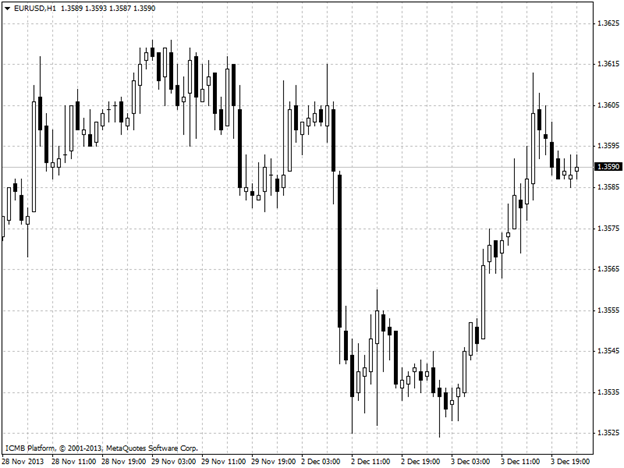

EUR/USD

The dollar fell against the euro and most other currencies on Tuesday after investors locked in gains from Monday's better-than-expected manufacturing report and sold the greenback for profits. The dollar shot up on Monday after the Institute for Supply Management reported that U.S. manufacturing activity in November expanded at its fastest pace since April of 2011, fueling hopes that U.S. recovery is gaining steam. The euro, meanwhile, rose after Spain reported that the number of unemployed individuals in the country declined by 2,500 in November, defying more pessimistic consensus forecasts calling for an increase of 44,300 and much better than October's 87,000 increase. On Wednesday, the euro zone is to release data on retail sales, while Spain and Italy are to publish their services PMIs. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

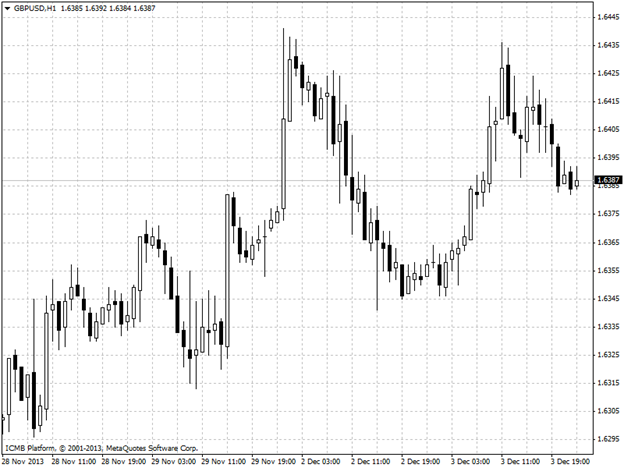

GBP/USD

The pound remained near 27-month highs against the U.S. dollar on Tuesday, as data showing that activity in the U.K. construction sector expanded at the fastest rate in six years November continued to support demand for sterling. The pound found support after the U.K. construction purchasing managers' index rose to 62.6 in November, the highest level since August 2007, from 59.4 in October. Analysts had expected the index to tick down to 59.0. The report said overall activity rose for the seventh month in a row, with "sharp increases” in new orders and employment, while growth in house-building in November was the fastest in 10 years. “Looking ahead, there are a number of positive signs that improvements in activity levels will be maintained, as job creation picked up again in November and confidence about the business outlook reached its highest level since September 2009,” senior economist at survey compiler Markit Tim Moore said. The report came a day after data showed that the manufacturing sector in the U.K. expanded at the fastest rate in 33 months in November. The upbeat fuelled expectations that the Bank of England may tighten monetary policy ahead of other central banks. GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

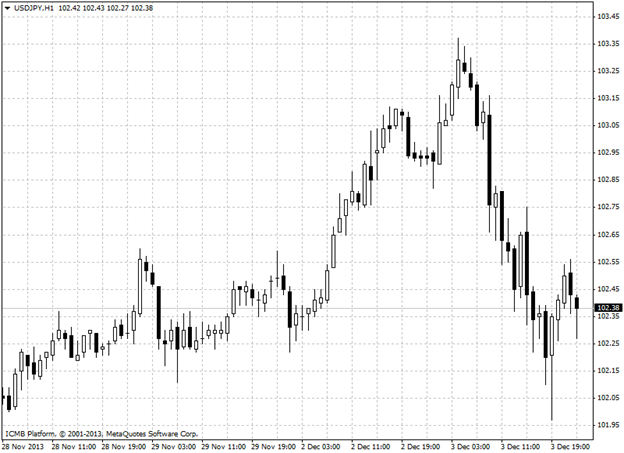

USD/JPY

The dollar dropped against the yen on Tuesday after investors sold the greenback for profits earned on a better-than-expected U.S. factory barometer, while the yen saw demand from bottom fishers looking past dovish comments out of the Bank of Japan. The dollar shot up on Monday after the Institute for Supply Management reported that U.S. manufacturing activity in November expanded at its fastest pace since April of 2011, fueling hopes that U.S. recovery is showing marked improvement. Meanwhile the yen saw demand from bargain hunters after dropping on expectations for the Bank of Japan to beef up stimulus programs to meet its 2% inflation target by 2015. On Monday, BoJ Governor Haruhiko Kuroda pledged to counter any new downside risks to the bank’s inflation goal, saying the BoJ would act by "adjusting monetary policy without hesitation. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

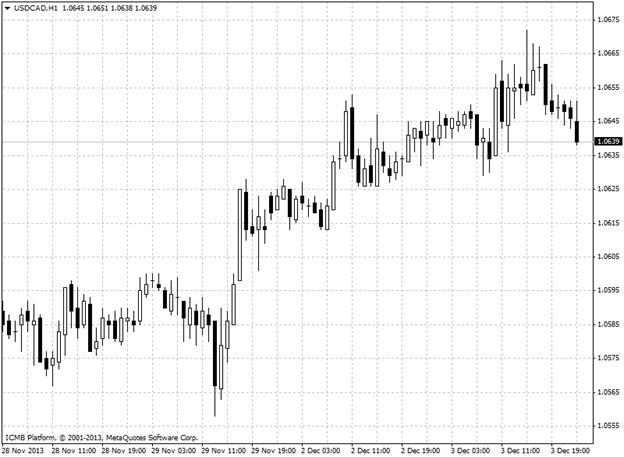

USD/CAD

The Canadian dollar touched the lowest level in more than three years versus its U.S. counterpart on speculation the chances of a cut in the Bank of Canada’s benchmark lending rate are rising. The currency fell against the majority of its most-traded peers before a central-bank meeting tomorrow, when policy makers are projected to leave the benchmark interest rate unchanged. A report last week showed third-quarter economic growth was the fastest in two years even as exports fell, frustrating the Bank of Canada’s expectations for trade to drive growth. U.S. Federal Reserve officials may consider trimming monthly bond purchases at their Dec. 17-18 gathering. The loonie, as the Canadian dollar is known for the image of the waterfowl on the C$1 coin, fell 0.1 percent to C$1.0649 per U.S. dollar at 5 p.m. in Toronto. Earlier it dropped to C$1.0673 per U.S. dollar, the least since August 2010. One loonie buys 93.91 U.S. cents. March 2014 bankers’ acceptances contracts yielded 1.26 percent, matching the lowest since May. The decline in yield suggests investors are pushing back forecasts for higher rates, and may be starting to price in reductions. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">