- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AmSurg (AMSG) Lags Q2 Earnings & Sales; Cuts Sales View

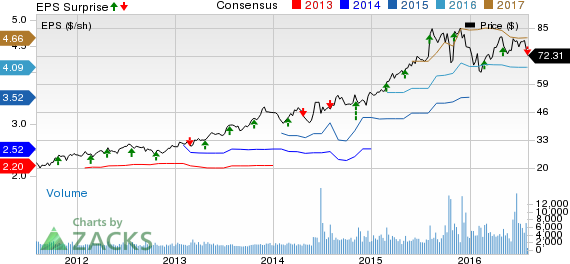

Tennessee-based healthcare provider AmSurg Corp. AMSG reported adjusted earnings per share (EPS) (considering share-based compensation as a regular expense) of $1.01 during the second quarter of 2016. The earnings figure exhibits a 9.8% rise from the year-ago quarter but missed the Zacks Consensus Estimate by a penny.

Strong revenue growth primarily drove this year-over-year improvement in earnings. Further, the adjusted EPS figure was aided by a 12% increase in the company’s diluted shares outstanding, if converted, related to AmSurg’s Dec 2015 equity offering.

Including one-time items, the company reported second-quarter net earnings from continuing operations of $43.8 million or 80 cents per share, displaying an improvement of 39% or 23% from the year-ago quarter equivalent.

Quarter in Details

AmSurg’s net revenue in the second quarter rose 18% year over year to $758.5 million, but missed the Zacks Consensus Estimate of $772 million. Strong same-center and same-contract revenue growth for the Ambulatory and Physician Services divisions primarily drove the top line.

In the reported quarter, net revenue from Ambulatory Services increased 2.8% year over year to $319.7 million with a 4.2% improvement in same-center revenues. Ambulatory Services ended the quarter with 258 centers and one surgical hospital. Ambulatory Services acquired 4 centers and had one center under development, which is scheduled to open in the third quarter of 2016. Moreover, this division had 4 centers under its letter of intent at the end of the second quarter, three of which have been purchased recently.

Physician Services net revenue in the second quarter totaled $438.8 million, up 33% year over year on account of 5.5% growth in same contract revenues, 0.6% rise in new contract revenues and 27.5% improvement in acquisition revenues. Same contract revenue growth of 5.5% in the quarter included a 5.1% increase in patient encounters per day and a 0.4% rise in net revenue per patient.

Adjusted operating expenses spiked 20.5% year over year to $570 million due to increased salaries and benefits (up 26.1% to $404 million), supply cost (up 8.5% to $49.7 million), other operating expenses (up 5.9% to $111.1 million) and 159% surge in transaction costs to $5.1 million. As a result, adjusted operating margin contracted 140 basis points to 24.9% in the quarter.

AmSurg exited the quarter with $74.1 million in cash and cash equivalents versus $85.9 million at the end of the first quarter of 2016. It had $100 million of borrowing capacity available under its revolving credit facility of $500 million at the end of the second quarter of 2016. Net cash flow from operating activities in the quarter was $113.3 million, down from the year-ago quarter’s figure of $152.6 million.

2016 Outlook

For 2016, AmSurg has reduced its revenue guidance. The company currently expects to generate revenues in the range of $3.05–$3.09 billion, compared to earlier guidance of $3.09–$3.13 billion. The current 2016 Zacks Consensus Estimate for revenues stands at $3.09 billion, in line with the upper end of the company's guided range.

However, at the bottom-line front, the company maintained its outlook for 2016. AmSurg continues to expect to deliver adjusted EPS (considering stock-based compensation as a one-time item) of $4.28–$4.35. The current 2016 Zacks Consensus Estimate for adjusted EPS is pegged at $4.09.

Further, the company continues to expect same-center revenue growth of 4–6% for both Ambulatory and Physician Services.

Additionally, AmSurg provided its EPS guidance for the third quarter of 2016. The company expects adjusted EPS in the range of $1.10–$1.13. The current Zacks Consensus Estimate stands at $1.12.

Our Take

AmSurg ended the second quarter of 2016 on a disappointing note, with quarterly numbers missing the Zacks Consensus Estimate on both fronts. However, on a comparable year-over-year basis, the outcome was promising. Strong growth in the second quarter was driven by successful implementation of the company’s organic growth and acquisition strategies in both the Ambulatory and Physicians Services businesses. However, the company’s consistently weak cash balance position raise concern.

Meanwhile, we view the company’s 2016 outlook as a discouraging one with a lowered revenue outlook and unchanged EPS guidance.

Nevertheless, the recent initiatives by government agencies to curtail healthcare expenditures have encouraged a shift towards ambulatory surgery centers instead of admissions to traditional hospitals. This, in turn, should benefit home healthcare providers like AmSurg.

Zacks Rank & Key Picks

AmSurg currently has a Zacks Rank #2 (Buy). Other favorably ranked ranked medical stocks worth a look are Cepheid CPHD, Masimo Corporation MASI and Natus Medical Inc. BABY. All these stocks sport a Zacks Rank #1 (Strong Buy).

CEPHEID INC (CPHD): Free Stock Analysis Report

MASIMO CORP (MASI): Free Stock Analysis Report

NATUS MEDICAL (BABY): Free Stock Analysis Report

AMSURG CORP (AMSG): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.