- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Little To Excite From The Eurozone

Little To Excite From The Eurozone

With a plethora of peripheral pecuniary data out for the Eurozone later today, there is plenty to interest any economist with slight interest in the future of the EU. Looking at the historical trends of these figures makes for difficult reading and leaves little to get excited about.

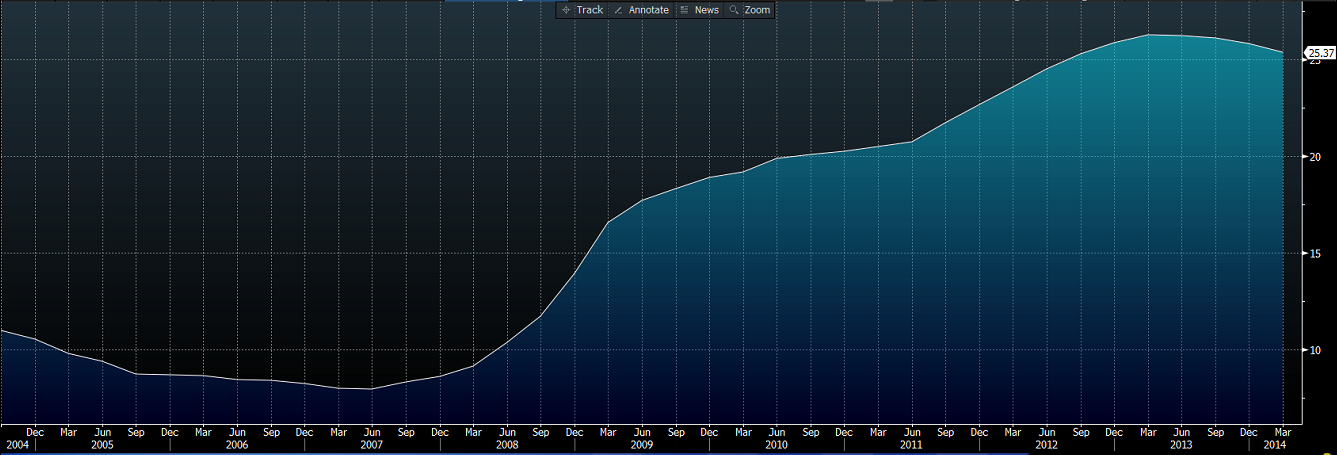

Spain’s unemployment rate, currently at 25.4%, is possibly the worst of all the economic data in the whole EU, so it’s a good thing we are getting that out of the way first, at 07:00 GMT today. To be fair to Spain, this is not the worst it has been. April 2013 saw the rate peak at an eye watering 26.2% after a crippling five year recession. The rate has steadily come down since then and may actually drop further. So this could be one of the only good pieces of news for the EU today.

Spain Unemployment Rate

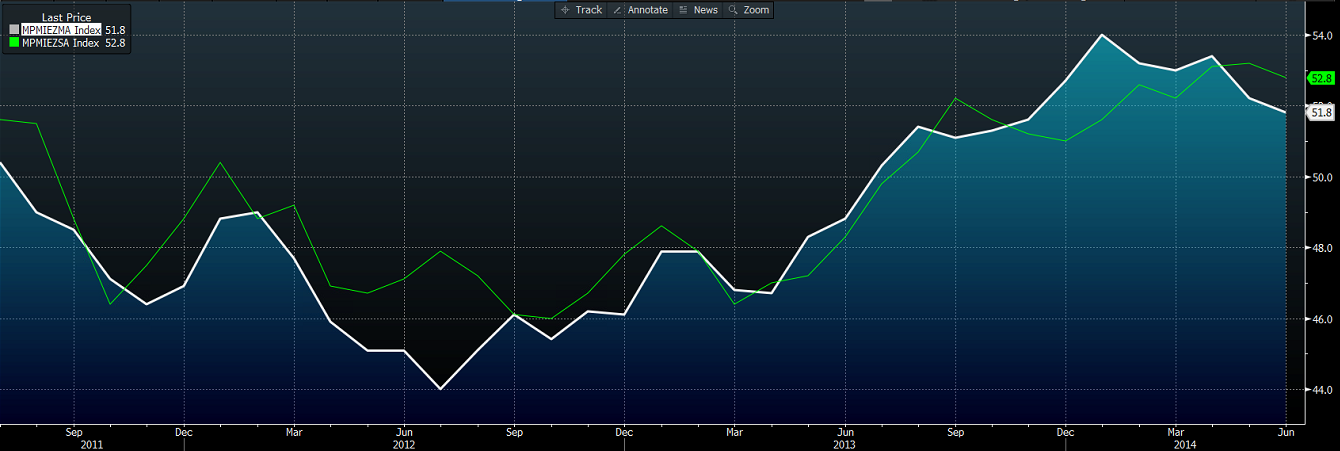

At the same time the Preliminary Manufacturing and Services PMIs for France are released. These reports have had a troubled time over the last three years, with the beginning of 2014 providing a glimmer of hope. This hope was dashed when both PMIs began trending into contractionary territory throughout the current year. The current manufacturing PMI of 48.2 is expected to lift to 48.5, and the services PMI is tipped to lift also from 48.2 to 48.9. However, as we know, below 50 is not a good place to be, so these will not be something to get excited about.

French Manufacturing PMI (White) and Services PMI (Green)

Half an hour later (07.30 GMT) sees Germany release its Manufacturing and Services PMIs. The good news for the Euro is that these are expected to stay above 50, with 52.2 and 54.7 respectively and they arealso expected to rise. Manufacturing figures have followed a similar path to the French figures, with 2014 proving to be discouraging months as well, however, German services haven’t suffered as much. German manufacturing PMI peaked in January at 56.5 with services peaking in May at 56.0. Do not expect these figures to excite either. If they follow the recent trend, they will be disappointing, with the exception of the service. Maybe.

German Manufacturing PMI (White) and Services PMI (Green)

To round off a (potentially) disappointing hour for the Euro, the EU manufacturing and services PMIs are reported at 08:00 GMT. The trend with these two are same as with the German and French data (no surprise really, since Germany and France make up half of the EU). The peak for manufacturing was in January with 54.0 and services peaked in May with 53.2. The market expects manufacturing to lift slightly and services to fall. Again if we look at the last few months, we should not expect too much on the positive side as the trends are worrying.

Eurozone Manufacturing PMI (White) and Services PMI (Green)

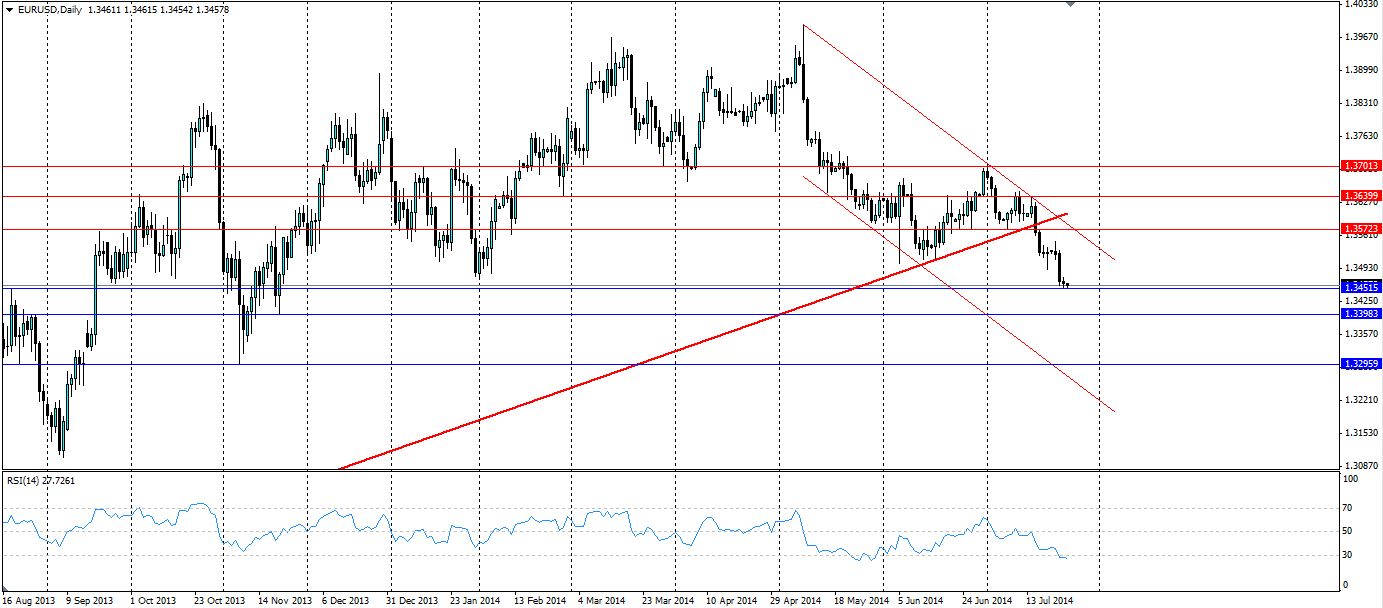

The Euro has certainly felt the effects of these disappointing results over the course of this year, and the bullish trend line was a casualty. With the stimulus package released in June, the European Central Bank (ECB) will be hoping this will filter through to the PMI indicators. If they are on the downside of the markets expectations, the Euro is going to be punished by the markets. This will add to the speculation of further stimulus to come and a subsequent weaker Euro, with the bearish channel likely to hold on for longer.

If the last few months are a sign of things to come, we could see disappointing figures all round and the Euro will feel the heat.

Related Articles

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing...

Trump threatens EU tariffs, creates confusion about Mexico and Canada duties Dollar rebounds but gold slides again Nvidia falls in after-hours trading as earnings fail to set...

Gold Consolidates Ahead of Key US Data Releases The gold (XAU/USD) price was relatively unchanged on Wednesday as markets remained cautious ahead of upcoming inflation data and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.