- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lilly Gets CRL For Jardiance In Type I Diabetes Indication

Eli Lilly & Company (NYSE:LLY) announced that the FDA issued a complete response letter (“CRL”) for its supplemental new drug application (sNDA) seeking label expansion of its SGLT-2 inhibitor, Jardiance (empagliflozin) 2.5 mg for type I diabetes. Please note that Jardiance is already marketed for treating type II diabetes.

The sNDA filed by Lilly and partner Boehringer Ingelheim sought approval for empagliflozin as an adjunct to insulin for treating type I diabetes patients, under a separate brand name. The FDA stated in its CRL that it was unable to approve empagliflozin’s sNDA in its current form.

Please note that the FDA’s Endocrinologic and Metabolic Drugs Advisory had voted against the label expansion in November last year, suggesting that the benefits of Jardiance 2.5 mg do not outweigh the risks to support approval for the indication.

The sNDA included data from two phase III studies under the EASE program. Data from the EASE studies have shown that empagliflozin 2.5 mg plus insulin led toa statistically significant reduction in A1C versus plus placebo. Meanwhile, empagliflozin treatment led to reduction in weight and decrease in systolic blood pressure, which were the secondary endpoints.

Jardiance is a key top-line driver for Lilly. Its sales surged 43% year over year to $944.2 million in 2019, driven by increased demand trends within the SGLT2 class of diabetes medicines in the United States and higher volume outside the United States.

However, we note that while the diabetes market holds immense commercial potential, it is pretty crowded with the presence of companies like Novo Nordisk (CSE:NOVOb) A/S (NYSE:NVO) , Johnson & Johnson (NYSE:JNJ) and Merck (NYSE:MRK) among others.

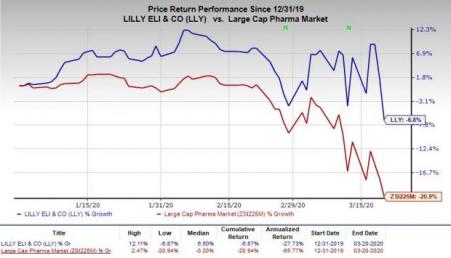

Year to date, Lilly’s shares have declined 6.8% compared with the industry’s decrease of 20.9%.

In a separate press release, Lilly stated that it will provide drive-through testing for COVID-19 infection of health care workers in Indianapolis area. The company is also working with the Indiana State Department of Health for testing COVID-19 samples acquired at local hospitals.

Earlier this month, Lilly collaborated with AbCellera to co-develop antibody products for the treatment and prevention of COVID-19. Along with Lilly, several large pharma companies as well as smaller biotechs are engaged in developing treatment for the coronavirus pandemic,which has infected more than 300,000 people worldwide and taken14,000-plus lives.

Zacks Rank

Lilly currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Johnson & Johnson (JNJ): Free Stock Analysis Report

Novo Nordisk A/S (NVO): Free Stock Analysis Report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Original post

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.