UK CPI took centre stage earlier in the London session, hitting two-year highs, coming in at 1.2% and 1.4% for headline and core. The pound will be the strongest currency going through the next two sessions.

Considering BoE Governor Carney had earlier mentioned they were not going to tolerate growing inflation, we could see a neutral to slightly hawkish speech on Wednesday, which could further support the pound.

In the long haul, bear in mind that Brexit will return to the spotlight in the first quarter of 2017 as Theresa May is relied upon to trigger Article 50, the official process to commence Britain's EU exit.

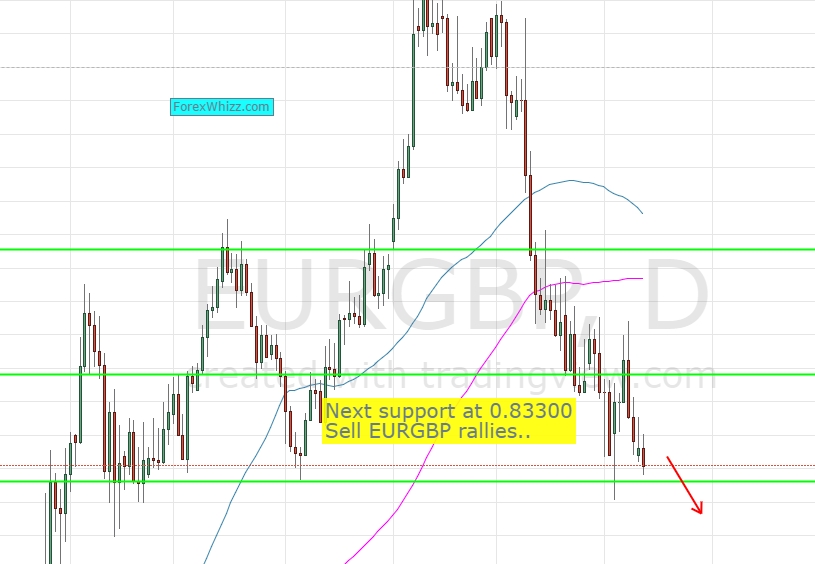

In the short term, look to trade the British pound against an already weak euro (see EUR/GBP chart). Sell any rallies in EUR/GBP, mostly on the lower timeframes (1hr-4hr).

The Fed meeting could also turn out to be a non-event, which would lead to more weakening of the US dollar as traders unwind their long positions, while others continue taking profit from the long US post-election streak. (see GBP/USD chart). I previously did an insight on the US dollar.