In April I noted that there were three possible pathways price could take and assigned percentages to each of them. We can now eliminate one of the pathways.

Pathway #1: Uber Bullish Pathway is now invalidated. That leaves #2 (Bullish Pathway) and #3 (Bearish Pathway).

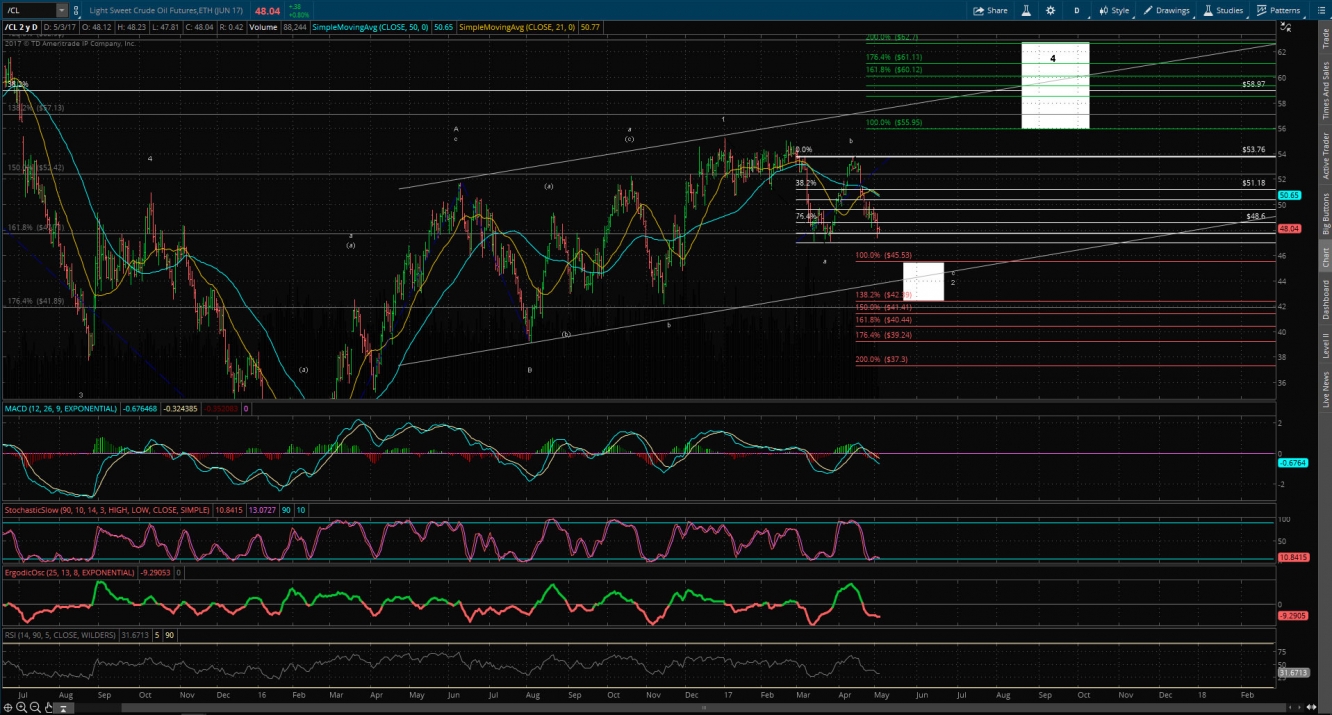

I still favor the bullish thesis for price as we have yet to complete a proper larger wave 4 which would eventually put price in the low $60’s before embarking lower. Let’s look at the updated two pathways remaining.

Bullish Pathway: Ideal Bottoming Range of $45.53 to $42.39

The bullish thesis is throwing everyone a curve ball. Traders who thought price would be propped up due to the upcoming OPEC meeting is finding out their wrong. Bears see the production numbers and think why price still close to the $50 area is. This pathway states they will both continue to be confused. I give this pathway an 75% chance of coming to fruition.

For higher resolution: (Right click on image and select Open Image in New Tab)

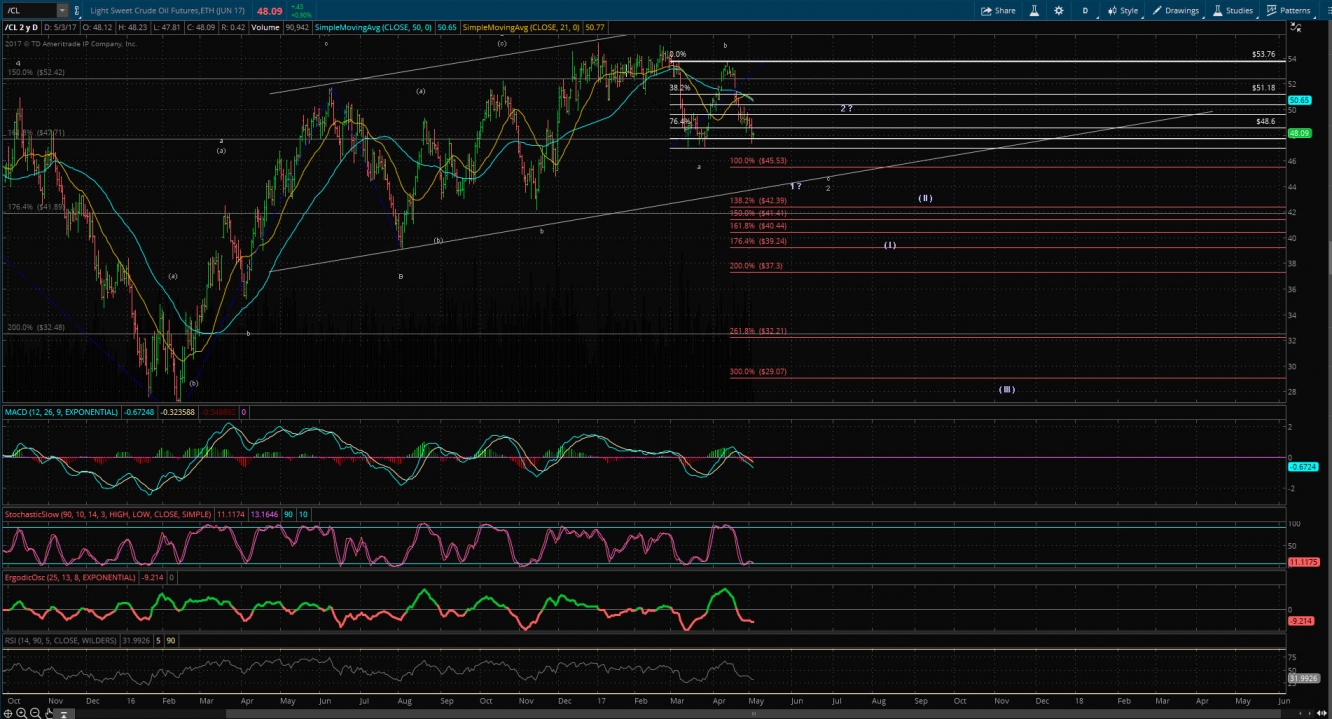

Bearish Pathway: New ATL

Although I think this pathway has a 20% chance of coming to fruition, price’s critical level to hold is $39.19. Below that, this pathway becomes favored and price could descend rapidly into the low $20’s to high teens.

For higher resolution: (Right click on image and select Open Image in New Tab)