Make no mistake: Jerome Powell’s pain is our chance to set ourselves up for 7%+ dividends, along with serious upside—I’m talking total returns well into the triple digits!

The key? The two stealth dividend-growth picks I have for you today. More on those shortly.

First off, you have to feel sorry for the Fed chief. Not only is he taking a whipping from the president’s Twitter feed for not cutting rates sooner, now he’s being second-guessed for considering a cut at all, given June’s blowout jobs report.

It’s a wonder the poor man doesn’t lock his office door, barricade it with his chair and refuse to come out!

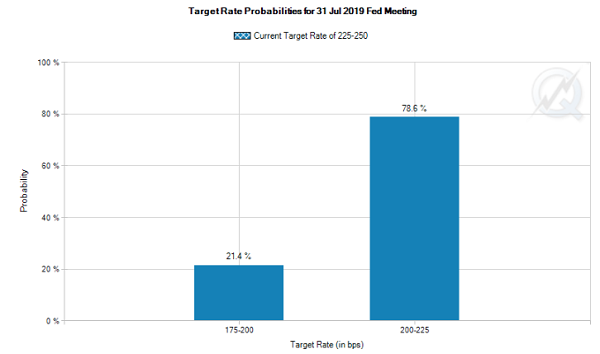

Still, if the smart money (betting through the Fed futures market) is right, we’ll see at least a quarter-point cut at the next Fed meeting on July 31, with two more cuts forecast by year-end—the next one in September:

Smart Money Goes All In On July Rate Cut

You and I both know that trying to guess what the Fed will do in the long run is the ultimate game of Whack-a-Mole.

So today we’re going to leave Powell to his misery and take a “heads-you-win, tails-you-win” approach building our nest egg (and income stream).

We’ll do it by focusing on a group of stocks that outperforms no matter what rates do. I’m talking about companies that pay a steady dividend and regularly drop big (and ideally accelerating) payout hikes on shareholders.

Everyone loves to get a dividend, of course. But dividend hikes never get the credit they deserve. Because a growing dividend pays off in two ways:

- It increases the yield on your initial capital—more on this shortly—and …

- It’s the No. 1 driver of share prices.

I know that second point sounds ridiculous; most people see dividend hikes and share-price gains as separate animals. But they’re far more connected than you probably think.

And we can use the timing and size of dividend increases to profitably “time” our buys and sells. Let me show you how.

“Dividend Barometer” Powered Us to A Fast 43.5% Win

I call this strategy the “dividend barometer.” It couldn’t be simpler to use, and it works no matter what happens with the Fed!

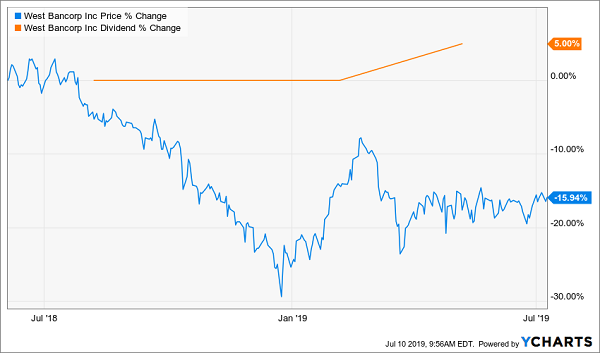

Regional bank West Bancorp (WTBA), a one-time pick in my Hidden Yields advisory, is the poster child for this approach. (And, as I mentioned off the top, my “dividend barometer” points to sunny weather for two other stocks right now, too. More on those below.)

I know I don’t have to tell you that from March 2009, when the market bottomed after the financial crisis, to December 2015, rates were locked at zero—a much lower level than we’ll likely see in this round of rate cuts.

That should have been a profit graveyard for a lender like WTBA. But management didn’t get the memo!

Instead, it kept right on pumping up the dividend, driving a combined 220% payout hike in that time. As you can see below, the share price matched these increases pound for pound.

The correlation is extremely tight—and unmistakable.

Low Rates? WTBA Doesn’t Care

That dead-obvious pattern was enough for me. With rates now on the rise and West’s dividend hikes accelerating, I made the stock a buy in my recently launched Hidden Yields advisory on June 17, 2016.

As if on cue, WTBA soared for a huge 43.5% total return by the time we sold a little less than two years later—and about seven months before Powell famously “pivoted” and indicated that future rate hikes were now on ice.

But the real reason for the sale had nothing to do with rates at all. It was all about our “dividend barometer”:

WTBA’s Share Price Redlines

As I wrote in the May issue of Hidden Yields: “The stock’s price [blue line in the chart above] has run ahead of its payout [orange line above], which has helped our returns to date but puts a damper on future potential.”

What happened after our sale? WTBA’s next dividend hike was ho-hum, and the stock fell back to earth.

WTBA Deflates After Our Sell Call

Let’s move on to the two examples my “dividend barometer” is flashing “buy” today. A little further on, I’ll give you “first-mover” access to my 7 very best dividend-growth picks now, plus the very best buys from my Hidden Yields advisory, the next issue of which is due out this Friday.

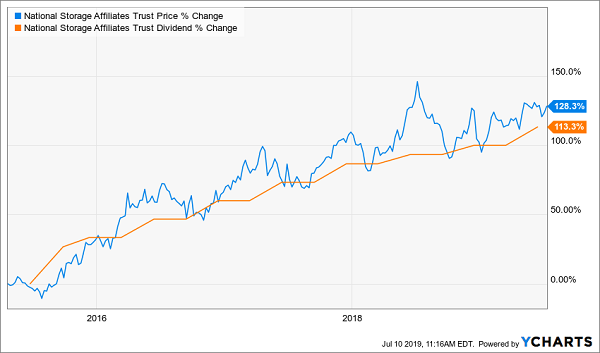

“Powell-Proof” Pick No. 1: National Storage Affiliates (NSA)

NSA’s business couldn’t be more boring. It’s a real estate investment trust (REIT) that operates self-storage facilities (700 rental buildings across 35 states).

But more stuff is piling into its “mini-garages” as consumer spending rises. That, in turn, is driving up the dividend, and the share price right along with it:

Dividend Up, Share Price Up

Two takeaways here: 1) NSA is a serial dividend hiker, often raising its payout more than once a year; 2) Our “dividend barometer” is proving its power: the share price has moved up with the dividend, step for step.

You’ll also notice that the share price has eked out a small lead on the payout in the last few months. But that’s no problem, because NSA can keep its dividend rising.

Consider:

- NSA paid out 82% of its last 12 months of core funds from operations (FFO, the REIT equivalent of EPS) as dividends. That’s very manageable in REIT-land, where payout ratios often go well over 90%.

- Management hiked the dividend 6.7% in May and could hike again before the year is out. Plus …

- Core FFO is rising: in the first quarter, it gained 15.6% from a year ago.

That makes now a great time to move on this low-key REIT, before its next big dividend hike pushes the share price up again.

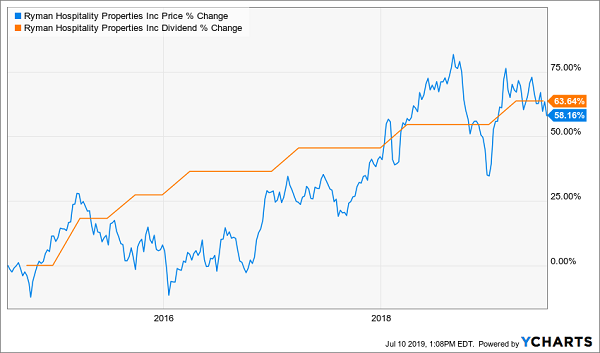

“Powell-Proof” Pick No. 2: Ryman Hospitality Properties (NYSE:RHP)

The other stock my “dividend barometer” is shining a light on is also a REIT: hotel operator Ryman Hospitality Properties (RHP), payer of a nice 4.6% dividend that’s risen 63.6% in the last five years.

In other words, if you’d bought in 2014, you’d already be yielding 7.3% on your original purchase, thanks to Ryman’s steady payout growth. And check out the price gains that rising payout has produced:

Ryman’s Dividend Drives Its Share Price

Like NSA, Ryman is benefiting from the strong economy, in particular its focus on business travel, a market that’s growing fast. And Ryman’s hotels are in conference hotspots like Nashville, Orlando and Washington, DC.

Ryman’s dividend already has solid backup: in the first quarter, adjusted FFO shot up 27.7%, and the company’s dividend payout ratio is even lower than that of NSA: just 56%.

That leaves Ryman with plenty of fuel to keep its dividend—and by extension its share price—moving higher, no matter what Jerome Powell does.

Yours Now: My Dividend Barometer’s Next 7 Breakthrough Picks

Here’s the best news: I just released a new Special Report that reveals the next 7 picks from my powerful “Dividend Barometer.”

These 7 low-key “hidden yield stocks”—so named for their totally disrespected (and surging) payouts—are perfect for today’s uncertain Fed.

And thanks to their bargain valuations and accelerating dividends, these 7 rock-solid businesses are well-positioned for even bigger upside than NSA or RHP: I’m talking about an opportunity for you to DOUBLE your nest egg in short order here!

That’s not all. In addition to your free Special Report, you’ll get the opportunity to sign on for my next issue of Hidden Yields, due out this Friday.

You won’t want to buy another stock until you see this issue! I’m going to take a deep dive into the 17 stocks in the Hidden Yields portfolio and siphon off the very best buys for you to grab today!

This one-two punch—my latest Special Report, with my Dividend Barometer’s 7 top picks now, and the next issue of Hidden Yields (set to drop just 3 days from now!)—gives you more than a dozen strong dividend-growth picks ripe for buying now.

They’re the perfect plays for growing your portfolio’s income stream (and overall value) in these days of Fed confusion and trade-war uncertainty.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."