After American International Group, Inc. (NYSE:AIG) completed the sale of its mortgage insurance unit United Guaranty Residential Insurance Company (“UGRIC”) to Arch Capital Group Ltd (NASDAQ:ACGL) , the Moody’s Investor Service jumped into action. The rating agency, which is a wing of Moody’s Corp (NYSE:MCO) , confirmed the insurance financial strength (IFS) rating of “Baa1” on UGRIC. The outlook remains stable.

The deal which was closed earlier during the week was primarily intended to vend off non-core business and generate funds. The company is expected to use the funds generated to deliver $25 billion back to shareholders by the end of 2017, as per its commitment.

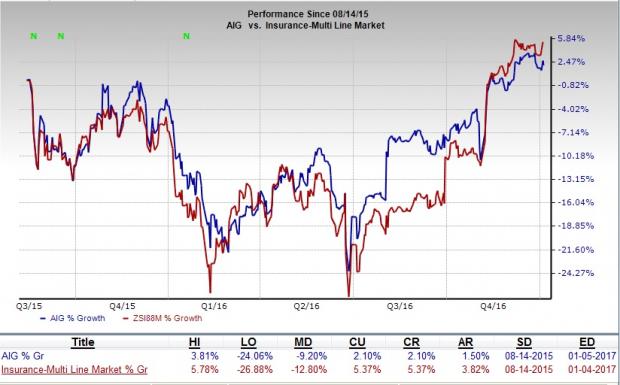

Since the announcement of this spin off, shareholders do not seem to be much optimistic about the stock as the shares of AIG gained 2.1% compared with Zacks categorized Multi Line Insurance industry’s gain of 5.4%. However, AIG has gone through many divestures in 2016 in order to concentrate on its core operation. So, the company expects that with better earnings and financial flexibility, it might regain shareholders’ confidence in the future.

Moody's affirmation of Baa1 IFS rating, with positive outlook, signals at UGRIC's strong core earnings power along with its capabilities as a key subsidiary within the acquirer Arch Capital expanded mortgage insurance operations. Earlier, such operations have helped the company build a leading position in the US private mortgage insurance market. Therefore it can be expected that with this acquisition, Arch Capital is going to enjoy enhanced competitive advantage in its core operations of insurance business, going forward.

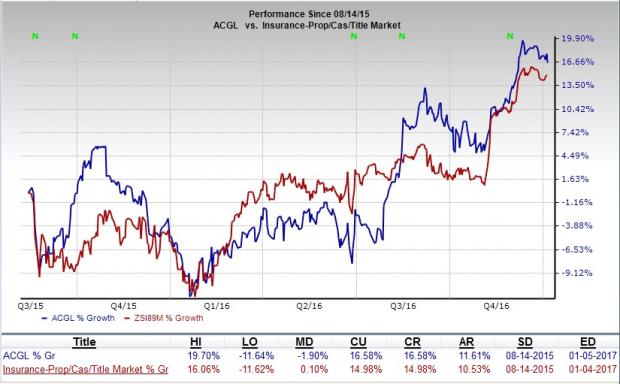

This can also be reflected from the favorable share price movement of Arch Capital since its announcement of acquiring UGRIC. The stock gained 16.6% since then, which is pretty high compared with Zacks categorized Property & Casualty Insurance industry’s gain of 15%. Along with the rating agency, shareholders also seem to be optimistic about Arch Capital.

The solid ground behind this decent IFS rating on UGRIC is supported by its stand-alone credit profile that has witnessed growing market share even at higher pricing levels along with its consistent delivery of strong earnings and impressive management of capital.

UGC and Arch Capital had respectively 18% and 9% of shares in the private mortgage insurance market. The rating agency expects that the acquisition is likely to form a market leader in the concerned market with stronger earnings power and better financial flexibility than its peers. The positive outlook reflects the optimism of Moody's Investors Service regarding this. On a contrary, some loss of market share is also expected to take place because of customer overlap with credit unions, community banks and other lenders.

AIG presently has a Zacks Rank #3 (Hold). Better-ranked stocks from the U.S insurance industry include Axis Capital Holdings Ltd (NYSE:AXS) and State National Companies, Inc. (NASDAQ:SNC) , to name a few. Both of the stocks sport Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 "Strong Buy" stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 "Strong Sells" and other private research. See these stocks free >>

Moody's Corporation (MCO): Free Stock Analysis Report

American International Group, Inc. (AIG): Free Stock Analysis Report

Axis Capital Holdings Limited (AXS): Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL): Free Stock Analysis Report

State National Companies, Inc. (SNC): Free Stock Analysis Report

Original post

Zacks Investment Research