- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Kiwi: Is This The End Of The High 80's?

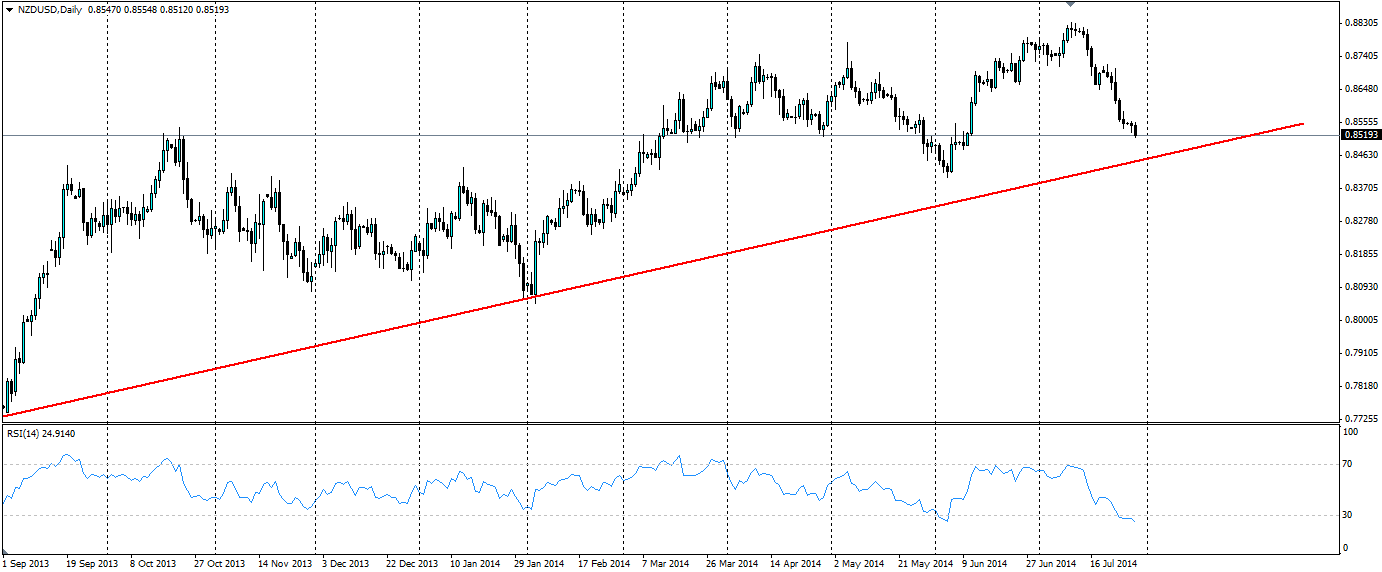

The kiwi dollar has taken a beating in the last few weeks. There are good reasons for this, with dairy products at the top of the list, and now it looks like it has one more level to test before a breakout will spell an end to the high 80’s for a while.

Source: Blackwell Trader

At the last monetary policy statement meeting, the Reserve Bank of New Zealand (RBNZ) said it would pause and asses the economic situation before raising interest rates any more. This is what the bears had been hoping for and the Kiwi took a tumble as a result. Falling commodity prices and an inflation rate that is not really threatening (at just 1.2%) has been the catalyst for the stance of the RBNZ.

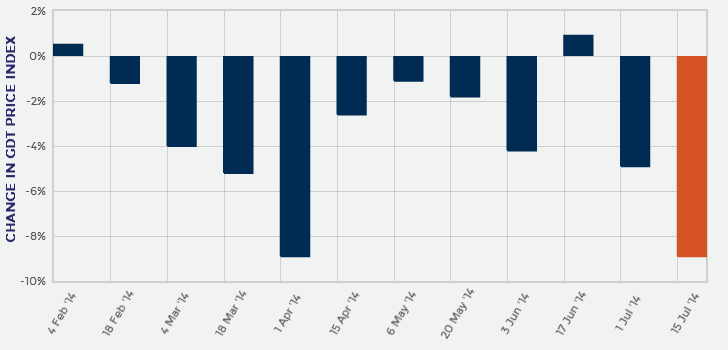

Dairy, New Zealand’s largest export commodity, has come off its highs recently and has brought the Kiwi dollar with it. Since February this year, 10 of the last 11Global Dairy Index auctions have seen a drop, with the latest falling 8.9% (in red below). This has effectively wiped billions of dollars off New Zealand’s export receipts. The latest blow for dairy farmers is that Fonterra, New Zealand’s largest milk processor, will be paying the lower end of expectations at NZ$6.00 per Kg of Milk Solids, down from a peak of $8.65 last season.

Source: Global Dairy Trade

A report of Business Confidence by one of Australia’s largest banks, ANZ, shows a particularly worrying trend. The survey hit a high in February of 70.8 (above zero denotes optimism) and has steadily fallen to the most recent reading last week of 39.7. While this result is still showing optimism, the consistency of the falls are of concern for the Kiwi dollar and the wider New Zealand business community.

So where to now for the Kiwi? The first and most likely target is the bullish trend line, which the current downward sloping channel should intersect within the next few days. This may hold up the bearish price action for a time, however, the outlook for the kiwi is now as bleak as it has been for quite some time. Once the long term bearish trend breaks down, we could see a fairly quick movement down to levels not seen since the beginning of the year.

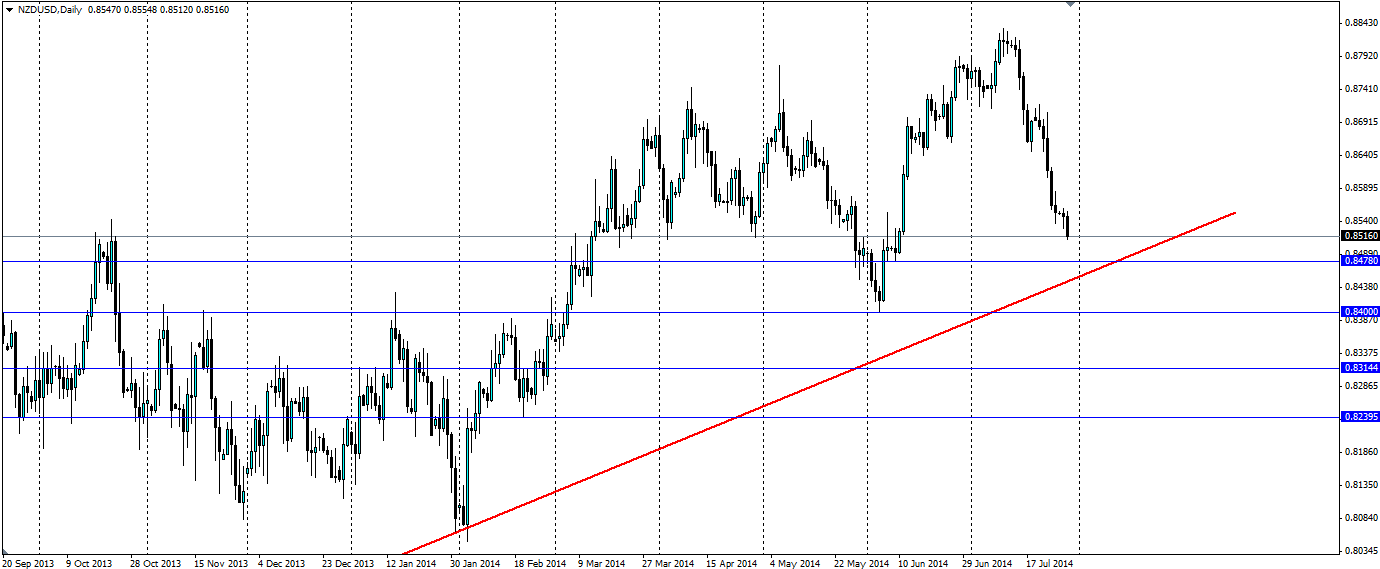

Source: Blackwell Trader

Look for support at 0.8478 to potentially come into play before the bullish trend acts as dynamic support. If the price breaks out of this it is likely to target 0.8400, 0.8314 and 0.8239 as it moves down. These could all act as good exit points for a short taken after a breakout of the trend.

Source: Blackwell Trader

The Kiwi dollar has been on a dream run for the past six years, however, the strong bullish trend that has been in play since last August now looks like it is going to come under pressure. Given the circumstances, it is not likely to hold for long and the Kiwi will be targeting the low 80s after that.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.